MLCC shipments to dip 7% in 1Q24 amid slowing demand

The global economic deceleration is taking its toll on the tech sector’s growth, with heavyweights like Intel and Texas Instruments signaling a downturn in their recent financial forecasts.

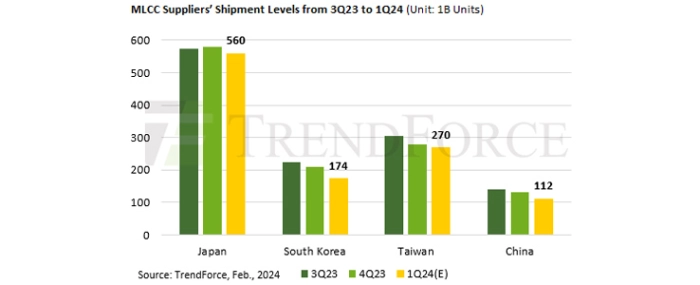

This trend reflects a broader industry pattern of subdued order placements and shipments. TrendForce reports that the first quarter of 2024 will see a 7% quarterly reduction in MLCC shipments to 1.1103 trillion units.

Improvement in AI chip supply spurs rebound in order demand; Smartphone, PC, and server demand remains flat

Despite the general slowdown, there has been a resurgence in order demand for AI chips due to improvements in supply from companies like Nvidia and AMD. This has led to an increase in procurement activities for AI servers by ODM such as Quanta, Compal, and Inventec, benefiting major manufacturers like Murata, Taiyo Yuden, Samsung, and Yageo. Conversely, demand for smartphones, PCs, notebooks, and general-purpose servers remains weak. While the Chinese smartphone market has maintained its procurement momentum from 4Q23, Apple’s smartphone orders have seen a nearly 20% decline in the first quarter.

The supply of notebooks and general-purpose servers has been steady, and despite disruptions in major shipping lanes leading to longer shipping times, there has been no significant increase in OEMs placing early orders with ODMs. The lack of noticeable pre-holiday procurement and an overall tepid market demand reflect a subdued outlook for the first quarter. TrendForce predicts if orders do not improve in March, the average BB ratio for MLCC suppliers may fall to 0.89—a 3.3% decrease from the previous quarter.

Growth in order demand slows as suppliers tighten control over production and inventory levels

Against a backdrop of slowing growth in the ICT sector, industry giants like Murata and Samsung are feeling the squeeze, with their latest quarterly reports showing dips in both revenue and profit. This overstocked market scenario is prompting suppliers to double down on managing production and inventory levels carefully to navigate through persistent pricing pressures. Despite steady orders from certain sectors like AI servers and select Chinese smartphone brands, the outlook for notebooks and general-purpose servers for the upcoming second quarter appears tepid, with expectations of only marginal or flat growth.

Intel is set to infuse some excitement into the market with its 2024 Meteor Lake platform, which boasts enhanced AI capabilities thanks to additional NPUs. These upgrades are not just about boosting computational performance; it’s also expected to significantly increase demand for MLCCs due to higher power consumption and operational temperatures.

Each device will need around 90–100 additional capacitors, especially in key specifications like 2.2u 0201, 10u 0402, and 4u 0603. With the gradual introduction of new platform models in the second half of the year, even if overall notebook orders remain constant or slightly increase, demand for MLCCs is expected to grow.

For more information visit TrendForce.