Soitec blames inventory issues for 13% 4Q revenue fall

French semiconductor materials provider Soitec has announced a fall in revenue for 4Q 2023, with sales down by 13% to EUR 240m.

The firm said the performance was in line with expectations, and attributed the decline to "the correction of RF-SOI inventories by our customers." It expects the flat results to continue for the next few quarters before a rebound in Q4 2024.

As such, Soitec is adjusting its revenue guidance for the full-year, with an organic decline of around 10% year-on-year and an EBITDA margin forecast of around 34%.

Pierre Barnabé, Soitec’s CEO, said: “After the very strong sequential rebound achieved in the second quarter, we maintained our third-quarter revenue at a similar level, in line with our expectations. As we indicated during our last communication, the correction of RF-SOI inventories by our customers continues to weigh on revenue, offsetting the continued strong performance of FD-SOI, POI and Power-SOI, strong growth in automotive and industrial, and a solid level of revenue in smart devices."

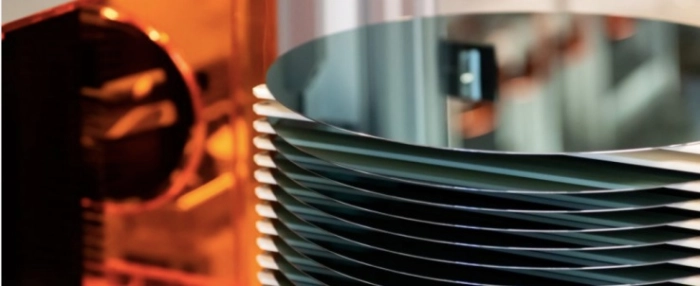

Soitec says new product lines are a key pillar of its future strategy. At the centre of this is its SmartSiC technology. It says the EV-focused tech can reduce energy losses, boost thermal management and improve power density. Through the application of SmartCut technology, each SiC substrate can be used 10 times. As a result, SmartSiC enables electric vehicles to achieve ranges above 500 km, compared with an average of 350 km for vehicles using silicon IGBT alternatives.