Five companies control the SiC power market

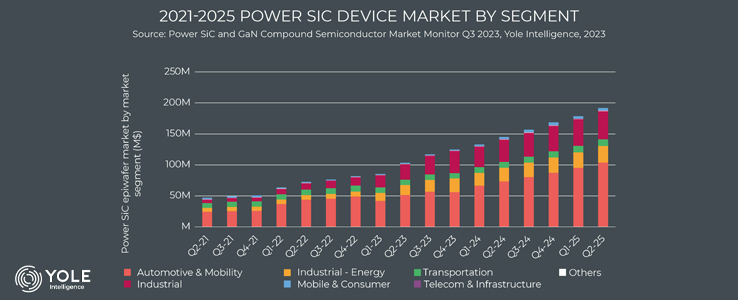

The global power SiC device market is forcasted to grow to about USD 9 billion by 2028, a 31% increase over 2022, according to the 2023 edition of Yole Intelligence's Power SiC Report. While automotive applications dominate the SiC market, other applications such industrial, energy, and rail are adding to its growth momentum.

The pandemic and recent geopolitical upheavals have highlighted the significance of secure access to semiconductors. All regions and major economies – Europe, the US, South Korea, Japan, and India – have launched so-called “Chips Acts” as they look the establish strategic independence in regards to semiconductors.

Although it has been said before, it is worth repeating: wide bandgap semiconductors, like silicon carbide (SiC) and gallium nitride (GaN), will play a crucial role in the semiconductor landscape in the future. In many ways they already do.

Why is that though? Well, as the world moves towards a carbon-free, carbon-neutral society – ergo an emphasis on efficiency – it's hard to argue SiC and GaN’s superior electrical properties. They allow for smaller, lighter, and more efficient high-performance electronic devices and systems, and particularly in applications demanding high power, high frequency, or high-temperature operation.

But how does the market look?

As stated by TrendForce, 6-inch substrates currently hold up to 80% of the market share in the SiC industry, whereas 8-inch substrates only make up 1%. A key strategy to further reduce SiC device costs is to move to larger 8-inch substrates.

Compared to 6-inch substrates, 8-inch SiC substrates offer significant cost improvements. Several major Chinese players – such as SEMISiC, Jingsheng Mechanical & Electrical Co., Ltd. (JSG), Summit Crystal, Synlight Semiconductor, KY Semiconductor, and IV-SemiteC – are currently advancing the development of 8-inch SiC substrates.

“This shift from the approximately 45% of total production costs associated with substrates is expected to facilitate the broader adoption of SiC devices and create a positive cycle for major companies,” TrendForce reported back in November 2023.

However, we’re not only seeing leaps being made by Chinese companies but also major international players. Just look at the recent movement from Infineon Technologies, Onsemi and Wolfspeed.

With mass production applications planned to start before 2030, Infineon has already prepared the first batch of 8-inch wafer samples at its fab and intends to turn them into electronic samples shortly, as pointed out by TrendForce.

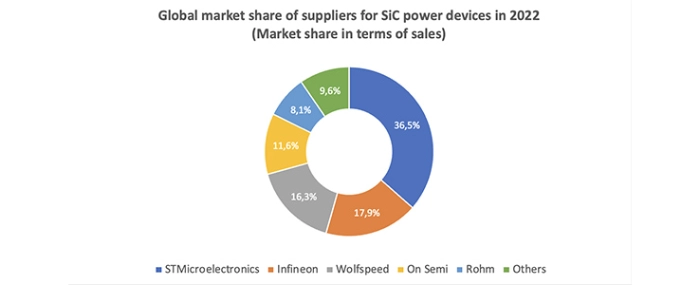

Major players currently control more than 90% of the market, increasing competition. And a slowdown in progress could spell opportunities for followers. According to TrendForce, the top five SiC power semiconductor players in 2022 were dominated by STMicroelectronics (36.5%), Infineon (17.9%), Wolfspeed (16.3%), Onsemi (11.6%), and ROHM (8.1%), with the remaining companies accounting for only 9.6%.

According to research from Yole Intelligence, part of Yole Group, the power SiC device market will grow to USD 8,906 million in 2028, with a 31% CAGR 2022-2028.

The top players mentioned above all achieved record revenues in 2022 – and they are all poised to reach USD 1 billion in SiC revenue within the 2023-2025 timeframe, and that with the overall SiC market expected to reach close to USD 9 billion by 2028. While SiC has garnered the most traction within the automotive sector – much thanks to the current electrification – it is making waves in other sectors as well, such as industrial, energy, and rail applications, adding to its growth momentum.

Recent investments in capacity expansions, business integration, and the creation of new business models – where carmakers and suppliers are spending billions to guarantee material supply – are expected to catapult SiC to new heights in the years ahead.

Given the current market movement and the growing importance of SiC in our industry, Evertiq has invited Jean-Christophe Eloy, CEO and President of Yole Group, to participate as a keynote speaker at the Evertiq Expo in Sophia Antipolis, France on February 8, 2024, to talk about SiC and its impact on Europe.