Key development period for AI PCs in 2024

Global shipment of notebooks is expected to reach 167 million units in 2023—a YoY decrease of 10.2%, TrendForce reports. However, with inventory pressures easing, the notebook market is anticipated to return to a balanced supply and demand cycle in 2024.

The principal growth drivers are expected to be the gradual release of pent-up demand for business sector upgrades and continuous expansion in certain segments such as Chromebooks and gaming notebooks. Overall shipment volume is forecast to reach 172 million units, marking a YoY increase of 3.2%.

TrendForce reports that the emerging market for AI PCs does not have a clear definition at present but can be examined through the lenses of software and hardware. From a software standpoint, Microsoft has launched its AI assistant, Copilot, which is powered by the GPT LLM, with sales starting in November. This service, requiring Windows 11, is available as a subscription for USD 30 per month, enabling Microsoft 365 business customers to harness the processing power of AI. Currently, the service is highly dependent on cloud-based servers for storage and performance.

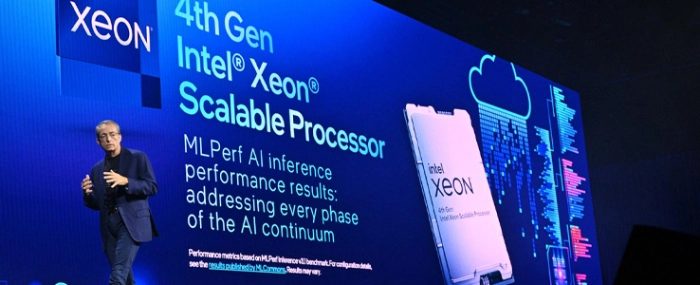

On the hardware side, the focus for CPU manufacturers is to enhance AI processing capabilities in end-user devices to achieve faster performance (instantaneous responses and low latency), increased security (local storage), and cost reduction (less reliance on servers). Whether it’s Intel’s NPU, AMD's Ryzen AI, Apple's Neural Engine, or Qualcomm’s NPU, the integration of neural processing engines forms the basis for client-side AI applications in endpoint devices. This negates the need for cloud operation, enabling offline AI inference for production needs. The launch of new processors in 2024 is set to lay the groundwork for high-performance computing AI PCs.

TrendForce believes that due to the high costs of upgrading both software and hardware associated with AI PCs, early development will be focused on high-end business users and content creators. This group has a strong demand for leveraging AI processing capabilities to improve productivity efficiency and can also benefit immediately from related applications, making them the primary users of the first generation. The emergence of AI PCs is not expected to necessarily stimulate additional PC purchase demand. Instead, most upgrades to AI PC devices will occur naturally as part of the business equipment replacement cycle projected for 2024.

For consumers, current PCs offer a range of cloud AI applications sufficient for daily life and entertainment needs. However, without the emergence of a groundbreaking AI application in the short term to significantly enhance the AI experience, it will be challenging to rapidly boost the adoption of consumer AI PCs. For the average consumer, with disposable income becoming increasingly tight, the prospect of purchasing an expensive, non-essential computer is likely wishful thinking on the part of suppliers.

For more information visit TrendForce.