China to boost its mature process capacity

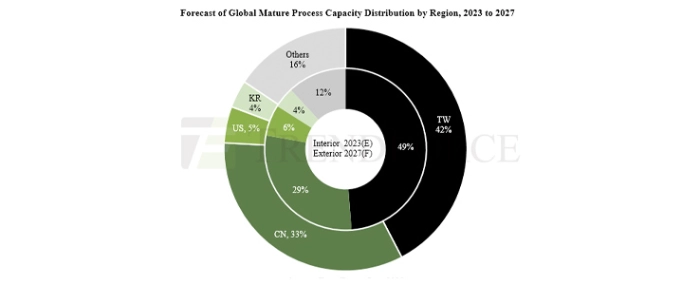

The global ratio of mature (>28nm) to advanced (>16nm) processes is expected to be about 7:3 between 2023 and 2027, according to TrendForce. China's mature process capacity is expected to increase from 29% this year to 33% by 2027.

China's growth is propelled by policies and incentives promoting local production and domestic IC development, and leading the charge are giants like SMIC, HuaHong Group, and Nexchip, while Taiwan’s share is estimated to consolidate from 49% down to 42%.

TrendForce reports that the expansion predominantly targets specialty processes such as Driver ICs, CIS/ISPs, and Power Discretes, with second and third-tier Taiwanese manufacturers at the forefront

Within the Driver IC sector, the spotlight is on high voltage (HV) specialty processes. As companies aggressively pursue the 40/28nm HV process, UMC currently dominates, trailed by GlobalFoundries. Yet, SMIC’s 28HV and Nexchip’s 40HV are gearing up for mass production in 4Q23 and 1H24, respectively – narrowing their technological gap with other foundries. Notably, competitors with similar process capabilities and capacities, such as PSMC, and those without twelve-inch factories like Vanguard and DBHitek, are poised to face challenges head-on in the short term. This trend may also have long-term implications for UMC and GlobalFoundries.

In the realm of CIS/ISP, 3D CIS structure comprises a logic layer ISP and CIS pixel layer. The primary demarcation for mainstream processes is around 45/40nm range for the logic layer ISP, which continues to progress toward more advanced nodes. Meanwhile, the CIS pixel layer, along with FSI/BSI CIS, predominantly uses 65/55nm and above processes. Currently, TSMC, UMC, and Samsung are the frontrunners in this technology. Yet, Chinese players like SMIC and Nexchip are hot on their heels, swiftly closing the gap. Their ascent is further fueled by Chinese smartphone titans OPPO, Vivo, and Xiaomi. Additionally, domestic shifts prompted by governmental policies are positioning Chinese CIS companies like OmniVision, Galaxycore, and SmartSens to rally behind local production.

Power Discretes mainly encompass products like MOSFETs and IGBTs. Vanguard and HHGrace have been deeply involved in Power Discrete processes for some time, boasting a more comprehensive process platform and vehicle certification than many competitors. However, a wave of Chinese contenders, backed by national policies favoring EVs and solar initiatives, are ready to stake their claim, intensifying global competition in this sector. This includes mainstream foundries like HHGrace, SMIC, Nexchip, and CanSemi. Additionally, smaller Chinese IDMs and foundries, such as GTA and CRMicro, are also entering the competitive landscape. If China massively ramps up its production capacity, it will intensify global competition in Power Discrete manufacturing. The impact will not only spark price wars among local Chinese businesses but could also erode the order books and clientele of Taiwanese companies.

In a nutshell, while China actively courts both global and domestic IC designers to bolster its local manufacturing presence, the ensuing massive expansion could flood the global market with mature processes, potentially igniting a price war. TrendForce notes that as China’s mature process capacities continue to emerge, the localisation trends for Driver IC, CIS/ISP, and Power Discretes will become more pronounced. Second and third-tier foundries with similar process platforms and capacities might face risks of client attrition and pricing pressures. Taiwan's industry leaders, renowned for their specialty processes – UMC, PSMC, Vanguard to name a few – will find themselves in the eye of the storm. The battle ahead will hinge on technological prowess and efficient production yields.

For more information visit TrendForce.