CM market show lowest growth seen over the last five-year period – but still reached a new all-time

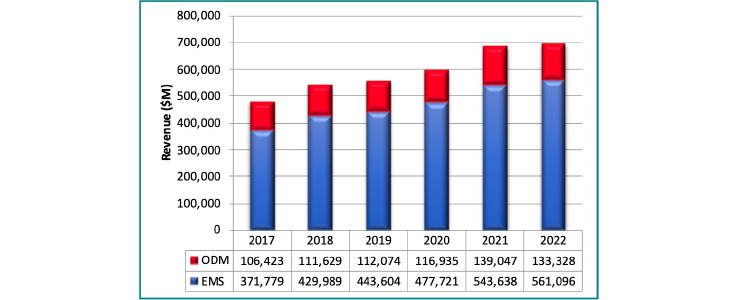

The worldwide contract manufacturing (CM) market expanded at a rapid pace of percent CAGR over the last five years, averaging a 7.7% CAGR, according to New Venture Research's (NVR) latest electronics manufacturing services report.

However, in 2022 the year-over-year growth rate went flat from the previous year and decreased from 14.8% to 1.7% — the lowest growth seen over the last five-year period. Nevertheless, the industry reached a new all-time high of USD 694.4 billion in 2022, mostly led by top-tier EMS companies. EMS companies averaged the highest growth over the last five years, exhibiting an 8.6% CAGR, whereas ODMs experienced a somewhat lower growth of 4.6%. Both suppliers were hurt by a slump in PCs and smartphones which experienced an overstock situation from the surge of the previous year.

The worldwide market for electronics assembly by supplier (USD million), 2027 – 2022

New Venture Research states in the report that the CM market was sustained by the strong demand in the automotive, aerospace/military, and medical markets.

Orders for tablets, desktop and notebook computers, and servers, once strong, weakened in 2022 as demand for replacement sales had peaked in the previous year. Desktop revenue is now expected to be in decline for the next five years, while notebook orders should remain strong. The forecast is that the computer industry as a whole (which includes servers and workstations) will see good growth over the next five years.

Some of the highest growth rates for electronics assembly products were found in the medical and industrial markets. The pandemic negatively affected the transportation sector (automotive and aerospace), as well as certain consumer electronics products, due to a decline in disposable income but transportation has since recovered. Nearly all the high-mix/high-complexity products (medical, industrial, transportation) experienced higher than average growth, except for defense/military projects, which were flat, according to our surveys, as contractors attempted to determine if any new investment upgrades would be forthcoming from the US government.

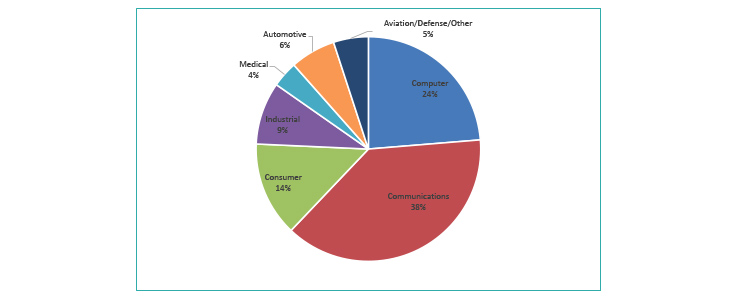

The largest market in size is the communications segment, with its dominance by smartphones that have begun to overshadow the computer market. The computer market will always see growth driven by upgrades and new developments such as generative AI that will be demanding more computing power and storage. The consumer market ranks third and is sustained by strong demand for digital TVs. The industrial market ranks fourth in size, followed by the automotive and aviation/defense/other transportation segments, and lastly by the medical equipment market. Together these market segments for electronics product assembly totaled approximately USD 1.4 trillion in assembly revenue.

The worldwide market for electronics assembly by market segment (USD 1.4 trillion), 2022

The analysts at New Venture Research believe that communications and automotive products will continue to be the segments driving the largest growth in the electronics industry.

In 2027, the total industry is expected to reach nearly USD 1.8 trillion in annual assembly value (COGS), as consumption and replacement of electronics products continue and new products fuel demand. Outsourcing has become a critical element in keeping the electronics assembly industry expanding and driving costs to the margin each year –a leading factor in stimulating continuous consumer demand. Therefore, the trend to move price-sensitive manufacturing to low-cost regions will impact the industry for all suppliers in the foreseeable future.

For more information visit New Venture Research.