German components distribution sees market slowdown

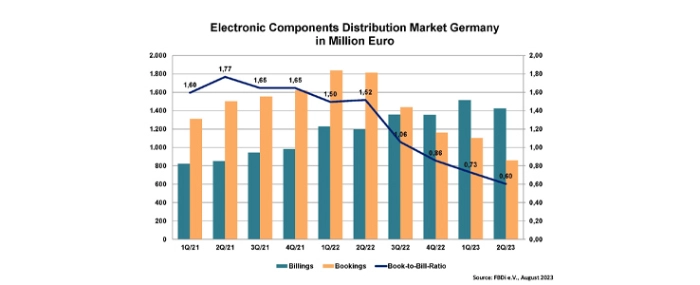

For the German components’ distribution (according to FBDi e.V.), the second quarter 2023 shows a mixed picture in terms of sales and a significant decline in incoming orders (bookings).

Not entirely unexpectedly, the second quarter ended with both good and bad news for the German components’ distribution. On the one hand, the turnover of FBDi's member distributors increased by 19% to EUR 1.42 billion, compared to the second quarter of last year, but on the other hand, bookings fell by almost 53% to EUR 859 million, compared to the record bookings of Q2/2022. The book-to-bill ratio fell from 1.52 a year ago to 0.6, the lowest level since FBDi was founded (in 2003).

Once again, semiconductors were the main driver. At EUR 1 billion, sales were only slightly below the record level of the first quarter of 2002, but 31.5% higher than in the same period a year earlier. Orders, however, fell by a staggering 62%.

Other product areas continued to live in normalization mode: Sales of passive components fell by 1.6% to EUR 173 million and electromechanics by 4.8% to EUR 159 million. Power supplies still grew by 3.5% to EUR 43 million, while sales in the remaining product groups (sensors, displays, assemblies) weakened slightly. Market share by product area shifted towards semiconductors (70%), passives and electromechanics both decreased by 1% (to 12% each), the rest remained approximately the same.

"Almost nothing was a surprise in this quarter, except for the fact that after last year's surge things have slowed down a little. In fact, not all products are out of allocation, SiC and GaN components, for example, are likely to remain in short supply until well into next year. Otherwise, customer inventories are filled to the brim, and a resurgence in component demand is likely to be a long time coming - how long, that’s the key question," says FBDi chairman Georg Steinberger.

The outlook for 2023 remains mixed, says Steinberger: "As has happened several times in the past, we will have to deal with two different halves of the year, a good first half and a less good second half. In total, it will be an almost balanced year, at least for distribution. We hope that once the overstocking has been reduced, the market will return to normal and there will be no cyclical overreactions. However, economic outlook is bleak and do not support expectation for a strong demand of components. We have caught up with past demand and brought forward future demand, which, together with the weak economy, will lead to a significant cool down of our market.”

Steinberger makes one fundamental point, saying that the market conditions have changed, both geopolitical challenges and the market power of individual large global customers can disrupt entire supply chains.

"We have noticed that. And what could prove to be another problem are the subsidy scenarios, with billions and billions of taxpayers' money currently flowing into semiconductor production around the world. Even if the attractiveness of semiconductors continues to grow, it can't be healthy if, as Knometa Research suggests, there will be a whopping 230 fully operational 300mm wafer fabs by 2027. This could lead to massive overcapacity.”