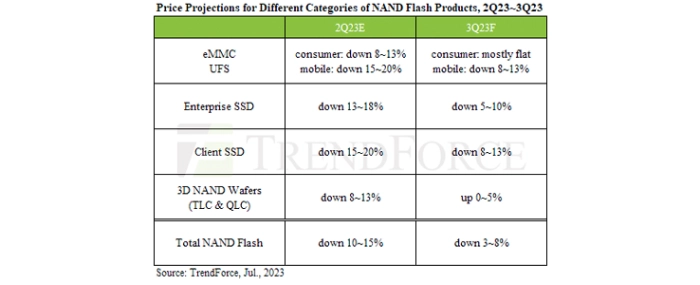

ASP of NAND Flash to continue falling 3~8% in 3Q23

TrendForce reports that OEMs have continued making concerted efforts to scale back production. However, given that the trajectory of market demand is still unclear, it’s expected that the NAND Flash market will continue to be in a state of oversupply in 3Q23.

Cautious inventory management by buyers is preventing a stabilisation in NAND Flash prices even with an anticipated seasonal surge in demand for 2H23. TrendForce predicts that NAND Flash wafers will be the first to see a price hike in 3Q23 as prices for module products such as SSDs, eMMCs, and UFS will likely continue to fall due to tepid downstream demand. Consequently, the overall ASP of NAND Flash is forecast to continue dropping by about 3~8% in 3Q23, though a possibility exists prices may recover in 4Q23.

Client SSD: Although notebook shipments are expected to gradually recover in 3Q23, reversing an oversupply of SSD will continue to be challenging. Furthermore, a portion of suppliers have implemented aggressive promotions to secure customer orders and hit shipping targets in light of weakened demand and less-than-satisfactory order volumes from major clients, putting pressure on other suppliers. TrendForce estimates that the ASP of client SSDs will fall by 8~13% in the third quarter.

Enterprise SSD: An influx of orders from Chinese government agencies and telecom operators, combined with improved stockpiling momentum from second-tier e-commerce and internet service providers, may stimulate 3Q23 shipments of enterprise SSDs for new server platforms. This is likely to lead to increased buyer demand. However, bargaining margins are progressively shrinking given that various suppliers are currently operating at a loss for NAND Flash products, with prices falling below cash costs. The positive effects of reduced production are expected to become gradually evident in 2H23. Consequently, the decline in ASP of enterprise SSDs in 3Q23 is forecast to converge to 5~10%.

eMMC: Currently, demand remains sluggish. For small-capacity eMMCs, suppliers have aggressively slashed prices in 2Q23 to the point where there’s almost no further room for prices to continue falling. As such, suppliers have ceased price-cutting, and it’s predicted that the price of small-capacity eMMCs will remain stable in 3Q23. As for large-capacity eMMCs, suppliers have strong bargaining power and prices are more likely to remain stable for eMMCs used in industrial equipment and Chromebooks, given less customer demand. However, since the majority of large-capacity eMMC purchases are still made by smartphone OEMs, the price trend will likely be roughly the same as that of same-capacity UFS, meaning the potential for further price declines.

UFS: The third quarter sees smartphone OEMs leveraging relatively lower prices to boost their component stock to healthy levels. This is anticipated to gradually strengthen procurement activity for UFS. Nevertheless, in the second half of the year, UFS demand may only experience a modest boost from seasonal demand and the release of new products, with overall shipments potentially not meeting expectations. Owing to an inability to significantly ramp up buyer demand and coupled with the need to attribute some of the price decline moving from Q2 to Q3, TrendForce predicts that the average contract price for UFS will continue to fall 8~13% in the third quarter.

NAND Flash Wafer: Suppliers are expected to experience an easing of inventory pressure in the third quarter, leading to a more assertive pricing stance. There exists a high probability that third-quarter contract prices will hit a low and rebound, stimulating purchasing interest among buyers. This growth could potentially expedite the balancing of supply and demand, sustaining an upward pricing trend. TrendForce anticipates that the ASP of NAND Flash wafers is expected to see a quarterly increase of 0~5% given suppliers’ assertive pricing stance.

For more information visit TrendForce.

.png)