Global LCD monitor shipments see 7.4% QoQ decline in 1Q23

TrendForce reports that in the first quarter of 2023, global shipments of LCD monitors fell 7.4% QoQ to 28.8 million units, marking a YoY decline of 20.5%.

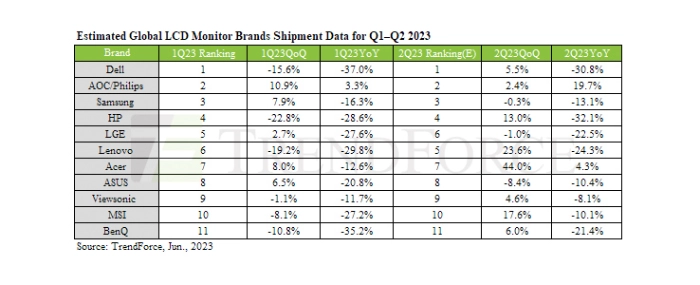

Major brands, including Dell, HP, and Lenovo, experienced significant drops in shipment levels, falling by 15.6%, 22.8%, and 19.2% respectively.

On the other hand, several consumer brands saw quarterly growth in their shipments in the first quarter, primarily due to channels replenishing their inventories in March. Among these brands, AOC/Philips stood out, benefiting greatly from demand in the Chinese consumer market. Their shipments not only grew 10.9% QoQ but also increased 3.3% compared to the first quarter of 2022.

Looking ahead, TrendForce predicts a rebound in LCD monitor shipments in the second quarter. This anticipated recovery is largely driven by Chinese market channels stocking up for the 618 shopping day, coupled with growing demand for gaming monitors, and the successful introduction of new 100 Hz products in the consumer market. TrendForce estimates that 31.4 million LCD monitors will be shipped in 2Q23, a QoQ increase of 9.3%, while the YoY decrease is expected to narrow down to 13%.

Acer is currently leading the pack in the adoption of new 16:9/100 Hz products and is set to reap the benefits in Q2, with a more than 40% projected QoQ growth in LCD monitor shipments. Furthermore, in 2023, MSI joined the ranks of the top ten brands in LCD monitor sales. In addition to continuing to launch high-resolution, high refresh-rate, and other high-end products, MSI has also been gradually introducing high-end QD-OLED products to the market. With the concurrent expansion of its lineup of business products, MSI’s LCD monitor shipments are expected to grow by nearly 20% in the second quarter.

For more information visit TrendForce.