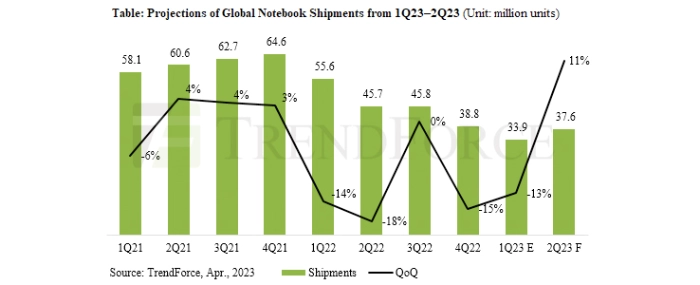

Global notebook demand is projected to grow 11% QoQ in 2Q23

TrendForce research reveals that global notebook shipments reached 33.9 million units in 1Q23 – a 13% QoQ and 39% YoY decline. However, demand is projected to pick up in the current quarter.

This drop is primarily attributed to the continued impact of economic headwinds on consumer market confidence, which has hindered notebook channels as they destock. As a result, notebook brands have reduced ODM orders in an attempt to regulate inventory pressure, with this pressure on notebooks and their components expected to be eased in 2Q23 as channels increase demand MoM. TrendForce predicts this will drive 2Q23 notebook shipments to 37.63 million units, an 11% QoQ increase but a 17.7% YoY decline.

Business markets face pressure, demand for niche products gradually growing

The U.S. Federal Reserve raised the benchmark interest rate a quarter of a percentage point, from 4.75% to 5%—the highest it’s been since the eve of the 2007 financial crisis—in response to weak market demand and a continuous decline in corporate revenue. In the face of high financing and borrowing costs, businesses are strictly controlling financial expenditures, delaying procurement plans, and reducing manpower, all of which, impact the shipment volume of commercial models.

Brands are planning to launch mid-range and entry-level models from the NVIDIA GeForce 40 series. TrendForce believes that more affordable pricing for entry-level customers will encourage them to purchase new graphics cards, thereby driving up demand. Furthermore, as interest in AI grows, high-performance gaming notebooks and models geared towards professional creators are gaining more attention. Even if they are niche products, they can be still be regarded as one of the factors that stimulates demand in the consumer market.

Unfortunately, delayed recovery from the pandemic and the effects of inflation has further widened the consumer gap, despite positive impacts from promotional activities in 2H23. TrendForce predicts that global notebook shipment volumes in 2023 may further decrease 13% YoY as businesses reduce expenditure.

For more information visit TrendForce