Slow growth in China NEV market cause battery material price drop

According to TrendForce’s latest research on the Li-ion (lithium ion) battery industry chain in China, there was an across-the-board decline in prices of upstream (raw) materials in January as participants in the industry chain were focusing on inventory consumption.

The decline was especially significant for upstream materials related to cathodes, cathode materials, and battery electrolytes. The average price of lithium carbonate, which is the most costly among the upstream materials related to cathodes, fell by 12% MoM. Lithium hydroxide also suffered a price drop, but the demand for this material was bolstered by orders from regions outside China. Compared with lithium carbonate, lithium hydroxide experienced a more moderate price slide. Nevertheless, the average prices of battery-grade lithium carbonate and lithium hydroxide both dipped below RMB 500,000 per metric tons. Turning to electrolytes and related upstream materials, the average price of LiPF6 (lithium hexafluorophosphate) fell by 11% MoM for January. This, in turn, caused the average price of electrolytes to drop by 11~15% MoM for the same month.

TrendForce points out that China initiated the phase-out of its NEV (new energy vehicle) subsidy at the start of 2023. Other regions of the country have introduced other subsidy policies in the hope of stimulating consumption, and the preferential rate for the purchase tax on NEV purchase has been extended to the end of 2023. However, a significant portion of Chinese consumers’ demand for new vehicles was expended in 4Q22 when the country saw energetic promotional activities that aimed to spur NEV sales. Moving into this first quarter, the Chinese car market has been affected by the low season. On the whole, NEV sales in China has slowed down recently and thereby caused a general decline in prices of upstream materials for Li-ion batteries. On the other hand, the drop in material prices has reduced some of the cost pressure on the manufacturing of Li-ion batteries.

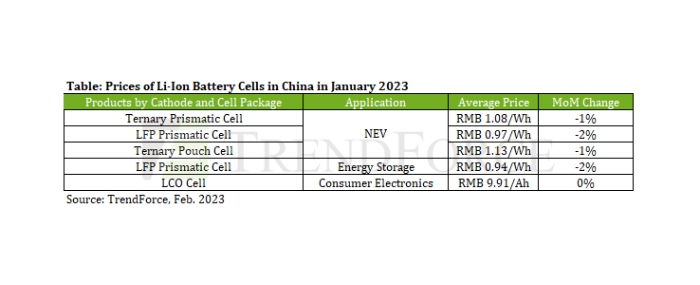

Regarding price trends of NEV power battery products in China, prices of battery cells on the whole fell by about 1% MoM for January. Various cell types including ternary cells and prismatic LFP (lithium iron phosphate) cells experienced a MoM decline of 1~2%. TrendForce projects that their prices will go down further in February. In the market for energy storage battery cells, most products are LFP cells, and their prices fell by 2% MoM for January to reach the average of RMB 0.94 per watt-hour. Also, due to the policy support that the Chinese government has been providing for the development of energy storage technologies, the demand for Li-ion energy storage batteries is expected to rebound slightly going forward. Prices of energy storage battery cells are currently projected to remain mostly flat or drop a bit for 1Q23. Lastly, looking at Li-ion battery cells for consumer electronics, the average price of LCO (lithium cobalt oxide) cells in China came to around RMB 9.9 per amp-hour in January. Transactions were low in the market for consumer batteries due to the slumping demand for electronic devices. Furthermore, prices of the upstream materials for LCO cathodes kept sliding. Looking ahead, the market for LCO materials is expected to remain weak in the short term, it will witness a further price decline in February.

For more information visit TrendForce.