QoQ decline in NAND Flash ASP will narrow to around 10~15%

TrendForce’s latest analysis of the NAND Flash market finds that most suppliers have already started to scale back production. Due to this development, the vicious cycle of suppliers undercutting each other has been brought under control to some degree as well.

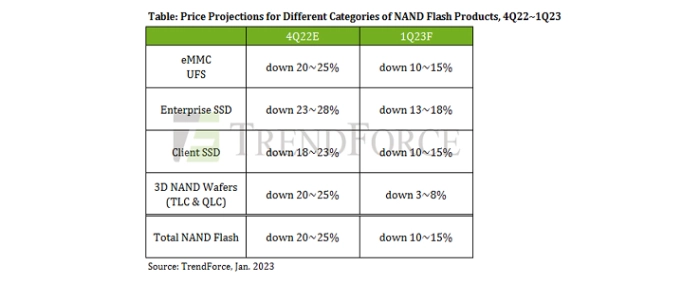

Therefore, the QoQ decline in the overall NAND Flash ASP for 1Q23 is currently projected to reach 10~15%, which is smaller than the QoQ decline for 4Q22. Regarding price trends of different NAND Flash products in 1Q23, prices of NAND Flash wafers are already at the cash cost level, so their decline will moderate sooner compared with other kinds of NAND Flash products. Conversely, prices of enterprise SSDs will suffer the sharpest drop compared with other kinds of NAND Flash products because they represent a major source of inventory consumption and offer a relatively high-profit margin.

NAND Flash suppliers have been aggressively cutting production because the whole NAND Flash market witnessed a price collapse during 2H22. Also, compared with DRAM, NAND Flash has more price elasticity of demand. Therefore, the price slump will end sooner for NAND Flash than for DRAM.

With regard to the client SSD segment, brands for notebook (laptop) computers have been passive in stocking up on SSDs because the demand for their devices is expected to remain fairly weak through 2023. Furthermore, the growth of the demand bits related to client SSDs will decelerate further moving into 2023, so the effect of suppliers’ production cuts on this segment is not expected to become immediately noticeable. Therefore, supply will continue to outstrip demand for client SSDs. In the aspect of product development, the mainstream products in the client SSD segment during 2023 are still going to be 512GB in capacity and based on the 176L 3D NAND technology. Turning to cell architecture, QLC products have undergone some improvements in performance. However, this also has the effect of exacerbating the decline in prices of 512GB SSDs. Going forward, prices of client SSDs on the whole will keep falling as more suppliers offer higher-layer QLC products. On the other hand, TrendForce has observed that some suppliers that have initiated production cuts are able to hold firm on prices of client SSDs. Hence, the QoQ decline in prices of client SSDs will shrink to around 10~15% for 1Q23.

In the enterprise SSD segment, buyers have repeatedly corrected down their orders since 4Q22 because server shipments have been sliding. Furthermore, the build-out of data centers in China slowed down noticeably in 2022 due to the interferences caused by local COVID-19 outbreaks and government policies. As a result, China’s demand for enterprise SSDs in 2022 was weaker compared with 2021. To alleviate the problem of excess inventory, suppliers made larger price concessions for 4Q22 enterprise SSD contracts in exchange for larger procurement quantities from North American buyers. However, this move has taken away a portion of the demand that is reserved for 1Q23. Since the ASP of enterprise SSDs is still higher than the ASPs of various consumer NAND Flash products, suppliers still want to ramp up shipments of the former in order to maintain profitability. There is now fierce price competition in the enterprise SSD market as suppliers seek to capture more market share. As a result, enterprise SSDs will also suffer the steepest price drop among NAND Flash products for 1Q23, with the QoQ decline coming to around 13~18%.

Looking at the eMMC segment, the main sources of demand there are Chromebooks, TVs and networking devices. Presently, these applications are not providing sufficient growth momentum to prop up eMMC prices. In view of the persistently high inventory level for this kind of storage product, NAND Flash suppliers are willing to slash prices as long as there is still some room for profit. TrendForce also points out that some module houses are undercutting eMMC prices in China with products made from low-priced wafers. This kind of competition is exerting a certain amount of pressure on NAND Flash suppliers as well. On the other hand, prices of low-capacity eMMC solutions are near the cost level, so there is not much room for further drops. Going forward, the downward price pressure will concentrate on solutions that are 64GB or higher in capacity. TrendForce projects that eMMC prices on the whole will drop by 10~15% QoQ for 1Q23.

Turning to the UFS segment, the demand for smartphones is still in a slump, so most smartphone brands intend to keep their procurements of UFS solutions for the whole of 2023 around the same amount as for 2022. Thus, the demand outlook of this segment for 2023 is lackluster. Looking ahead, NAND Flash suppliers will continue to vigorously promote UFS solutions since the steady increase in the average NAND Flash content of smartphones has contributed significantly to the bit consumption of the entire NAND Flash market. In particular, suppliers hope that there is sufficient price incentive to encourage Chinese smartphone brands to upgrade the storage capacity of their devices. TrendForce has observed that the number of smartphone models featuring a 256GB storage capacity has risen, but these mostly belong to the high-end and flagship segments. This trend will probably become more noticeable later on as smartphone brands launch new devices for 2H23. In general, the UFS segment will remain in oversupply during 1H23. TrendForce projects that prices of UFS solutions will drop by 10~15% QoQ for 1Q23.

Lastly, in the NAND Flash wafer segment, module houses presently exhibit weak procurement momentum. At the same time, sales have been depressed for retail SSDs and memory cards. The effect of suppliers’ production cuts is expected to become more apparent in 1Q23, but strong inventory pressure is going to keep wafer prices low in the short term. On the other hand, prices are now at the cash cost level for wafers that are mainstream in density. NAND Flash suppliers are also selling at a loss for some large wafer transactions. Going forward, suppliers will be more reluctant to accept deals that entail a loss as the overall supply-demand dynamics gradually returns to a balance. TrendForce projects that contract prices of NAND Flash wafers will drop by about 3~8% QoQ for 1Q23. Compared with other categories of NAND Flash products, wafers will experience the smallest decline in 1Q23.

For more information visit TrendForce.