Prices have started to drop in PV industry chain

According to TrendForce’s latest analysis of the industry chain for photovoltaic (PV) products, buyers of PV wafers have become less willing to stock up.

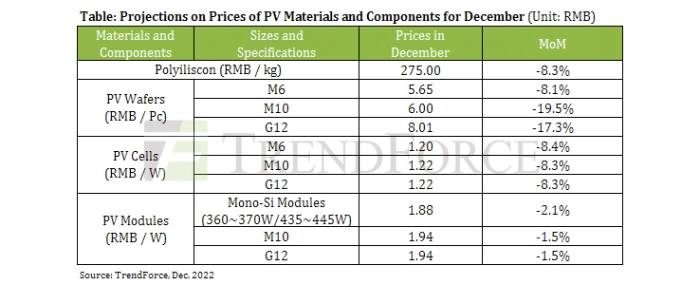

Furthermore, with the arrival of the year-end holidays in the overseas markets (i.e., the regional markets outside China) and the approaching Lunar New Year holiday at the start of next year, the downstream sections of the industry chain are now heading into the traditional slow season. Polysilicon prices have started to drop. At the same time, wafer suppliers are also accelerating inventory reduction in order to limit the corresponding decline in wafer prices. However, even as wafer suppliers plan to lower their capacity utilization rates ahead of the slow season, new entrants are joining the market and are rapidly adding more production capacity. Due to the combination of mounting inventory pressure and intensifying competition, wafer prices have begun to fall noticeably since the start of this December. Based on recent wafer transactions, TrendForce estimates that prices (in RMB per piece) of M10 wafers have fallen by 19.5% MoM for December. Among different wafer sizes, M10 appears to have suffered the largest price drop.

TrendForce further points out that prices of polysilicon materials, PV cells, and PV modules will be on a slide going into 1Q23. Regarding the polysilicon market, prices kept climbing for the most part of this year. By November, Tier-1 polysilicon suppliers were still seeing production capacity being fully booked. However, Tier-2 suppliers began to noticeably lower their quotes in the same month. Moving into December, the growth of new orders is starting to decelerate, and Tier-1 suppliers are seeing inventory piling up after they have completed the orders for the earlier periods. Just as demand is slowing down, the growth of polysilicon production capacity has been picking up over the months. In view that supply is no longer tight, TrendForce estimates that polysilicon prices (in RMB per kilogram) have fallen by 8.3% MoM for December. The average price is also estimated to reach around RMB 275 per kilogram.

Facing declining prices in the upstream sections and cooling demand in the downstream sections, module suppliers have also become less keen on procuring more cells. The cell market was in tight supply for almost a year, but this situation has eased as cell suppliers maintain a high capacity utilization rate. Hence, cell prices (in RMB per watt) have been showing signs of wobbling this December. Prices of large-sized cells are estimated to have dropped by more than 8% MoM. However, TrendForce believes cells on the whole will still be the most profitable compared with other sections of the industry chain in 2023. This has to do with the significant degree of differentiation and specificity among cells in terms of production-related technologies.

Turning to the module market, it has slowed down since the middle of December as the latest wave of installations in China has come to an end. Also, the year-end holiday season has dampened demand in the overseas markets. With the decline in wafer prices resulting in a corresponding drop in prices of both polysilicon and cells, module suppliers have also lowered their capacity utilization rates. The magnitudes of price declines in the upstream sections are within module suppliers’ expectations. Therefore, prices (in RMB per watt) of modules that are to be deployed for next year’s projects are starting to fluctuate as well. Some of the winning bid prices for next year’s tenders are now below RMB 1.9 per watt.

Regarding the state of the PV market in 2023, many factors come into play. The development of large-scale projects will continue in China. European countries will also proceed with their energy transition strategies. In the US, the country’s Commerce Department has made the preliminary determination that four Chinese manufacturers for PV products are evading existing tariffs. However, installations in the US will accelerate in pace as project developers want to take advantage of the two-year tariff exemption period that has just been granted by the government. Taken altogether, these factors will help expand the scale of the PV market next year. On other hand, TrendForce warns that the main sections of the industry chain (e.g., polysilicon, wafers, and cells) are showing signs of excess capacity. Significant declines in prices of PV components and materials will thus occur in market segments where demand has been suppressed during 2022, especially large-scale projects that are sensitive to price fluctuations. Furthermore, large-scale projects are going to be the portion of demand that is difficult to gauge. They will be a major variable to the growth of the PV market in 2023.

For more information visit TrendForce.