U.S. chip design market to lose top-dog status

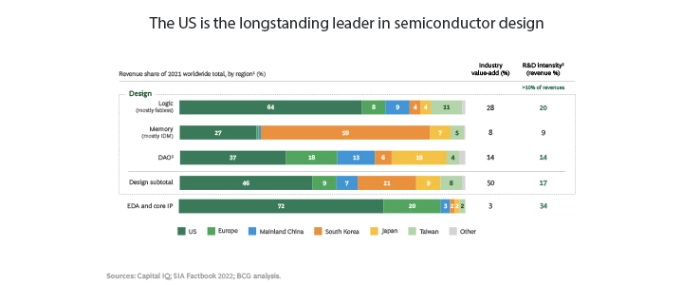

The United States has been a leader in microchip design with dominant companies like Nvidia, Intel and Qualcomm. But failing government support could spell the loss of its top-dog position, warns a SIA report.

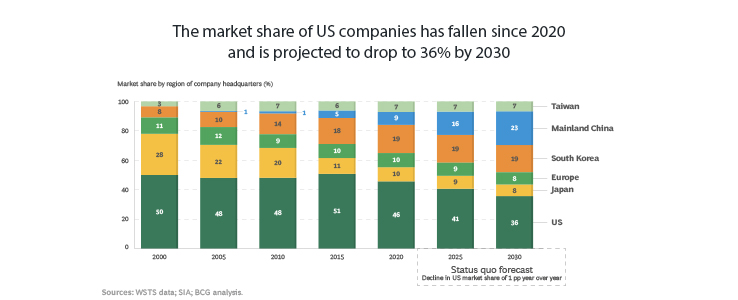

The U.S. overall market share (measured by overall chip sales revenue) has fallen steadily, from about 50% in 2000 to 46% in 2020, and a projected 36% by 2030. The U.S. share of chip design revenue has steadily declined on the same beat: between 2015 (over 50%) and 2021 (46%). Industry association SIA predicts that by 2030 this figure could be as low as 30%.

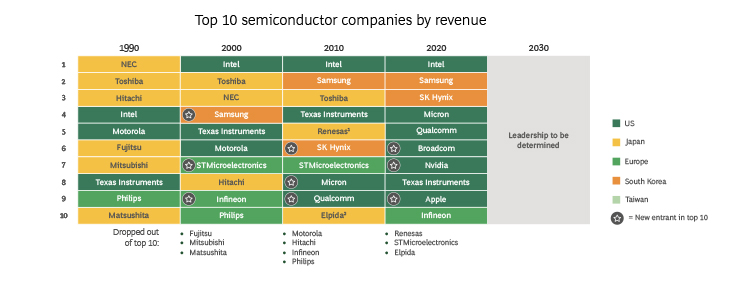

This scenario - as gloomy as it may seem - is not a loose idea either; given that the USA has already lost its lead in chip manufacturing (that has gone to Asia some time ago). Over the past 30 years (between 1990 and 2020 according to SIA), the U.S. share in chip manufacturing capacity had fallen 25% to just 12%.

Reasons are seen in government support; implemented in China and S. Korea for example, but lacking in the US. As a possible solution for the US to keep its leadership role, the report suggests federal investment in semiconductor design and R&D of USD 20 - 30 billion through 2030 (including a USD 15 - 20 billion investment tax credit).

The US, mainland China, Taiwan, South Korea, and the EU have all recently announced plans to fund the expansion of domestic semiconductor capabilities—with a subset of these plans supporting design capabilities.

The plans encompass support for traditional basic research (such as pre-competitive research within a university) and for commercial development (such as equity investments in semiconductor companies). Investments in both areas strengthen the pipelines of talent and innovation that are critical to leadership in design.

Despite these increased investments, however, the overall share of semiconductor-specific design and R&D funding in the US by public investment—comprising direct public R&D funding, tax incentives, and other recent initiatives—is 13%. In contrast, the share of semiconductor-specific design and R&D funded by public investment across Europe, Japan, mainland China, South Korea, and Taiwan is 30%.

Images ©SIA