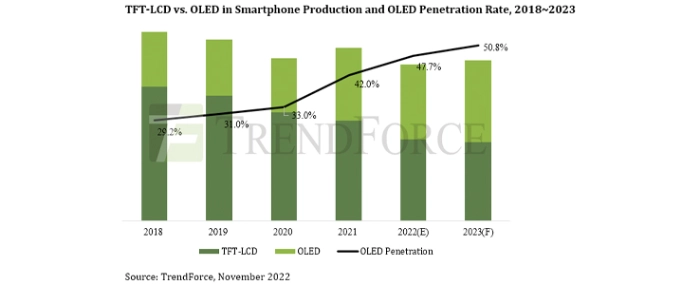

Penetration rate of smartphones with OLED display is rising

According to TrendForce’s latest research, the penetration rate of smartphones that feature an OLED panel (regardless of whether the OLED panel is the rigid, flexible, or foldable type) is projected to climb from around 47.7% in 2022 to 50.8% in 2023. Then, by 2026, the penetration will climb above 60%.

TrendForce says since Apple started to adopt OLED for iPhones with the release of the iPhone 12 series in 2020, other smartphone brands have also steadily increase the use of this display technology for their high-end device models. Currently, all iPhone models under the main series are equipped with an OLED panel. The models under the SE series are the only remaining ones that still have an LCD panel. As for Samsung, half of its smartphone offerings have an OLED panel. Chinese smartphone brands such as Xiaomi, OPPO, and vivo have also raised the share of device models with an OLED panel to 30~40%. In sum, most smartphone brands plan to have OLED incorporated into more of their offerings, though Transsion is a notable exception as it targets Africa with affordable devices and thus has a relatively low adoption rate.

TrendForce points out that Chinese smartphone brands previously did not actively widen the adoption of flexible OLED panels on account of two factors. First, Samsung Display (SDC) had been able to sell rigid OLED panels to Chinese brands at lower prices because it is the sole supplier for this type of panel. And because of favorable prices, Chinese brands preferred rigid OLED panels as they helped bring down the cost of a whole device. Second, concerns about whether consumers can accept higher prices for their devices also affected Chinese brands’ willingness to use flexible OLED panels.

When there was a shortage of rigid OLED panels from SDC during 2021, Chinese brands were unable to mitigate the supply risk as they lacked alternative sources for this component. Taking lessons from this turn of events, Chinese brands have now teamed up with the major panel suppliers based in their home country to develop low-cost “ramless DDI flexible OLED panels”. Prices of flexible OLED panels could drop sharply because of their joint efforts, perhaps even close to the level for prices of rigid counterparts. Such development, in turn, could significantly increase Chinese brands’ willingness to use flexible OLED panels. Besides reducing the potential risk of depending too heavily on SDC as the exclusive supplier, Chinese brands could also support their government’s localization policy and help domestic panel suppliers expand market share. It is reported that Chinese brands are planning to incorporate flexible OLED panels into their midrange devices in the future.

On the subject of foldable smartphones that are also equipped with an OLED panel, TrendForce estimates that unit sales of these devices will total around 12.8 million for 2022. The corresponding market penetration rate will reach around 1.1%. Samsung is significantly ahead of other brands in the development of foldable smartphones, so almost 80% of the foldable smartphones that are now on the market belong to Samsung’s Flip and Fold series. Chinese brands including Huawei, Xiaomi, vivo, and OPPO have also launched new foldable devices this year. Although these devices have been noted for getting consumers’ attention with advances in performance and outward design, they have not achieved significant sales growth outside China this year due to the limitations of their distribution channels. Given that the major smartphone brands will release new and upgraded device models at regular times each year, TrendForce currently forecasts that sales of foldable smartphones will total 18.5 million units for 2023, reflecting a market penetration rate of about 1.5%.

TrendForce adds that the adoption of OLED panels among smartphones will continue to grow steadily in 2023. Both the releases of high-end foldable OLED devices and the uptake of low-priced, low-cost OLED panels will provide the consumption channels for the supporting panel production capacity, which will also expand over the quarters. Conversely, LTPS LCD panels are approaching full maturity, so the demand for this type of panel will fall to a certain extent in the future due to the anticipated contraction of the smartphone market. Under such scenario, the excess production capacity for LTPS LCD panels will be used to provide display solutions for other applications, such as automotive displays, industrial equipment displays, and IT displays. Hence, suppliers for LTPS LCD panels are expected to speed up the development of market segments that are alternative to smartphone displays.

For more information visit TrendForce.

.jpg)