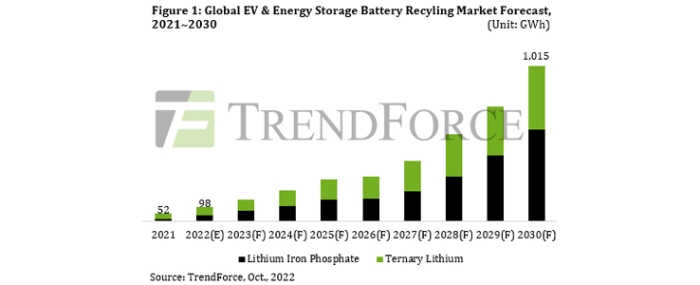

EV and energy storage battery recycling market forecast

TrendForce indicates that the rapid rise in the penetration rate of the global new energy vehicle (NEV) market has stimulated an increase in the installed capacity of power batteries on a yearly basis.

At the same time, the technological path of lithium iron phosphate batteries in the field of electrochemical energy storage has become the mainstream solution for new installed capacity in recent years and its market share is rising rapidly. As EV and energy storage batteries are retired on a large-scale in the future, TrendForce estimates that the global market for EV and energy storage battery recycling will exceed 1TWh by 2030, of which the scope of lithium iron phosphate battery recycling will account for more than a 58% share.

A plethora of competitors, but actual scale of retired power battery recycling is limited

However, several major problems remain to be solved in the battery recycling industry at this stage. First, it is still early in the development of the lithium-ion battery recycling industry and approximately 70% of used batteries come from defective products and waste from battery factories. The actual scale of recycling remains small. Second, the number of participants in the battery recycling industry continues to rise and overall industry standardisation still needs to be improved.

Taking the Chinese market as an example, China has continued to introduce power battery recycling policies since 2020. More than 10,000 new battery recycling-related companies were registered in just the year 2021, an approximate 4-fold increase compared to 2020. However, there were only 45 companies (hereinafter referred to as white-listed companies) meeting the “Industry Standard Conditions for Comprehensive Utilisation of Waste Power Batteries for New Energy Vehicles” issued by the Ministry of Industry and Information Technology of the PRC as of the end of 2021. It is worth noting, according to TrendForce research, the current annual production capacity of comprehensive waste battery treatment originating from white-listed companies has exceeded 1.01 million tons and the planned processing capacity of these companies exceeds 4.25 million tons. However, the actual recycled volume of lithium-ion batteries in China in 2021 was less than 300,000 tons, demonstrating the obvious idling capacity of the battery recycling industry.

Cascade utilization and recycling go hand in hand to create a recycling economy for the battery industry

From the perspective of China, one of the world's largest NEV markets, installed capacity in the global power battery market will exceed 3TWh by 2030 and China’s power battery installed capacity is expected to account for approximately 45% of the world's total. Therefore, the effective use of a battery’s full life cycle will be an important way to create an eventual low-carbon economy and battery recycling not only makes up for a shortage of resources, but also reduces stress on the environment and resources compared with the exploitation, production, and use of primary mine materials.

According to TrendForce research, the current recycling of waste lithium-ion batteries in China is mainly divided into cascade utilisation and recycling and reconstruction. Cascade utilisation is employed in fields such as backup power, small-scale energy storage, and micro vehicles (such as low-speed electric vehicles) when power battery storage capacity is attenuated to less than 80% but most cascade utilisation in the energy storage field remains at an experimental demonstration stage and is excluded from large-scale energy storage projects by the National Energy Administration of the PRC. Recycling and reconstruction mainly involves dismantling retired power batteries to recover valuable metals such as lithium, cobalt, and nickel, and reuse them in the regenerative manufacturing of battery materials.

For more information visit TrendForce