Four large deals prop up 2022 semiconductor M&A total

Without more megadeals, this year’s value of planned acquisitions will probably fall short of the annual average, says IC Insights in a new report.

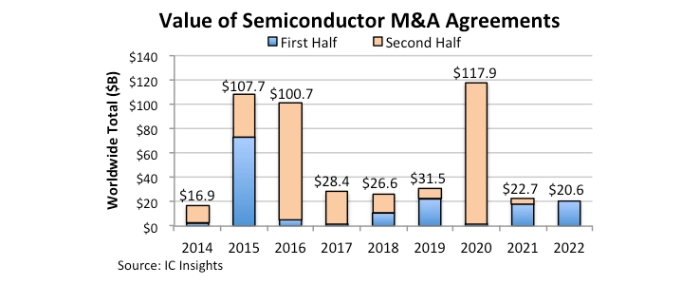

After slowing significantly in the last half of 2021, the pace of megadeals for semiconductor mergers and acquisitions regained momentum in the first six months of 2022, according to M&A data from IC Insights. So far this year, four large agreements have been announced – each valued between USD 1.9 billion and USD 9.4 billion, pushing the combined 1H22 M&A total to USD 20.6 billion.

In comparison, the first-half 2021 total value of M&A agreements for semiconductor companies, assets, product lines, and related business operations totalled USD 18.2 billion, including four that were announced with price tags between USD 1.4 billion and USD 7.1 billion. In the last six months of 2021, the combined value of new semiconductor M&A deals was USD 4.4 billion – the lowest total for the second half of a year since early last decade, according to the 3Q Update.

The total value of semiconductor acquisition agreements in 2022 appears to be on pace to surpass 2021’s full-year M&A value of USD 22.7 billion. However, unless significantly more M&A deals are struck in the remainder of 2022, this year’s total value will probably fall below the recent annual norm of about USD 29 billion (+/- USD 2 billion), excluding 2020, when acquisition agreements hit a record-high USD 117.9 billion. The 2020 peak in semiconductor M&A announcements included Advanced Micro Devices’ acquisition of programmable-logic leader Xilinx for stock (initially valued at USD 35 billion) and Nvidia’s controversial attempt to buy processor-design intellectual property (IP) supplier ARM in the U.K. from Japan’s SoftBank for USD 40 billion in cash and stock. Nvidia dropped its purchase of ARM in February 2022 after facing opposition by government regulators in the U.S., U.K., and European Union over anti-trust concerns.

The four largest semiconductor acquisition agreements in 1H22 accounted for essentially all of the USD 20.6 billion in M&A value during the first half of this year, the new update said. Several other smaller semiconductor acquisition agreements were struck in 1H22, but these deals had values under USD 25 million.

For more information visit IC Insights

.jpg)