Trendforce: Panel makers forced to reduce utilisation

Moving into 2H22, terminal brands continue to adjust their inventory, not only weakening panel demand, but also inducing a sustained drop in panel quotations.

The sharp increase in operating pressure affecting panel manufacturers has forced the display industry to restrain production, says Trendforce.

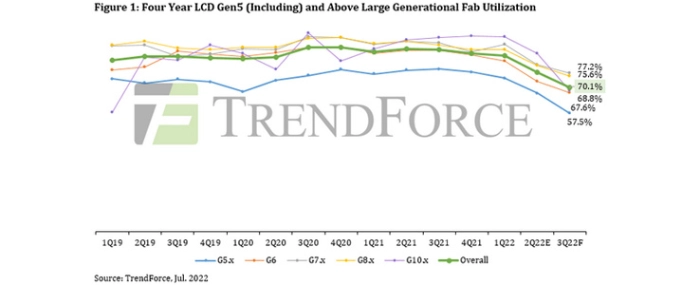

According to TrendForce's "Monthly Panel Supplier Utilization Report," utilization rate (calculated by the volume of glass input) in 3Q22 is expected to fall to 70%, a substantial decrease of nearly 7.3 percentage points from 2Q22.

TrendForce indicates, border controls and lockdowns have led to a disruption of logistics and labor due to the impact of the pandemic in the past two years. In order to avoid production and shipment gridlock, branded manufacturers overstocked from distribution channels to components.

However, as logistics and transportation conditions have improved, previously prepared materials have subsequently arrived in relevant warehouses or ports. As pandemic induced demand subsides, terminal sales have suffered due to rising global inflation and the Russian-Ukrainian war.

As a result, the inventory problem continues to deteriorate and all aspects of the overall supply chain has entered red alert.

Since this type of situation applied not only to a single application, utilization rate is reduced whether it is Gen5, primarily used in producing laptops, or large-size LCD monitors and TVs. None of the large generational fabs were spared.

TrendForce indicates that the utilization rate of Gen5 to Gen7.5 is expected to decrease by 7.7% percentage points to 63.7% and the utilization rate of Gen8 to Gen10.5 will decrease by 7 percentage points to 75% in 3Q22. More than 90% of the Gen10.5 utilization rate used to produce TVs is expected to drop by 17.8 percentage points QoQ, which also highlights the continuing pessimistic demand for TV panels in 3Q22.

As far as panel makers are concerned, depreciation and amortization pressure on Chinese panel makers is more severe than that of other panel makers due to the construction of new factories. In addition, looking at total shipments of larger-sized applications (TVs, monitor panels, and notebooks), Chinese panel makers account for more than half the market, so when the bottom drops out, impact on these companies will be greater than on competitors.

Looking at the three leading Chinese panel manufacturers, although BOE’s capacity allocation is very flexible, a drop of 4 percentage points in overall utilization rate cannot be ruled out in 3Q22. At the same time, China Star Optoelectronics (CSOT) and Huike Optoelectronics (HKC) will not only readjust their older factories in 3Q22 but also slow the rate at which new factories ramp up. The overall operating watermark of these two panel manufacturers is estimated to decrease by 13.3 and 7.4 percentage points, respectively.

Although the pressure of depreciation and amortization on Taiwanese manufacturer AUO is small, in response to changes in market demand, the company had already started production adjustment in 2Q22. It is expected to continue implementing this strategy in 3Q22 with overall utilization rate falling to 50%.

On the other hand, Innolux expects overall utilization to drop by 6.7 percentage points QoQ. Japanese panel manufacturer Sharp is at a relative disadvantage in terms of overhead, and its customer concentration is too high. Its major branded clients have canceled orders, allowing inventory to stack up quickly. Therefore, Sharp has only just announced that it will begin to aggressively scale-down in its Japanese production line in July. In turn, the company’s overall utilization rate decreased by 26.3 percentage points to 59.3% in 3Q22. LG Display, a Korean panel maker, is expected to maintain a similar operating level as in 2Q22 after a sustained contraction in LCD production capacity due to a strategic shift.

TrendForce indicates, if panel makers do not wish to face the risk of high inventories at the beginning of 2023, they should maintain reduced operations in 4Q22 in order to eliminate existing panel inventory. Therefore, it cannot be ruled out that the utilization rate of LCD Gen5 (including) and above large generational fabs will maintain the same level of operation as in 3Q22.

In the past, production cuts were the main response whenever the market was oversupplied. However, with future production capacity still growing, the speed at which brands deplete their inventories and global political and economic trends will be key factors affecting the future display market.

If market conditions continue to deteriorate, it cannot be ruled out that the industry will face another reshuffle, setting off a further wave of mergers and acquisitions.

.jpg)