Strong growth in wafer capacity for image sensors expected

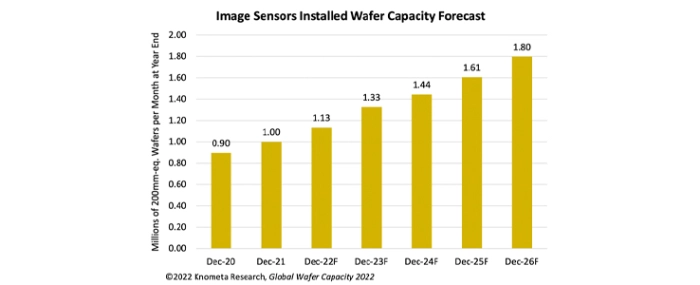

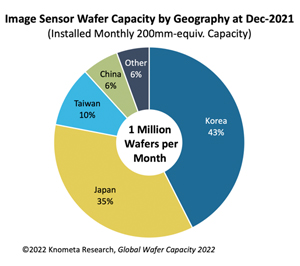

Global installed capacity for image sensors was one million 200mm-equivalent wafers per month at the end of 2021. According to a new Global Wafer Capacity 2022 report from Knometa Research, image sensor capacity is forecasted to increase by 13% in 2022.

Knometa Research says that by the end of 2026, the installed capacity for image sensors is projected to be 1.8 million 200mm-equivalent wafers per month. That would mean an average annual growth rate of 12.5% over the forecasted period; which would make image sensor capacity among the fastest-growing segments.

The researchers at Knometa points out that while the pandemic negatively impacted the image sensor market in 2020, growth did return in 2021. Demand for digital imaging is increasing in virtually all areas, including cellphones, automotive, machine vision, security cameras, webcams, drones, and more.

While Sony in Japan is the industry’s leading CMOS image sensor supplier, the combined CIS capacity of Samsung and SK Hynix made Korea the industry’s biggest source for production of image sensors at the end of 2021.

More than a decade ago, Sony set a goal to become the largest supplier of image sensors for cellphones. After claiming the top spot, in 2014 Sony took aim at becoming the largest supplier of CMOS image sensors for automotive systems and it is pursuing machine vision applications in factory automation and drones as well as image-recognition security cameras. Besides that, the company also sells 3D imaging sensors for depth ranging, face recognition, artificial intelligence, and machine vision.

Sony was the first to manufacture image sensors on 300mm wafers. The company has continued expanding its CIS capacity by converting 300mm fabs from logic to image sensor production and by acquiring 300mm fabs from other companies in Japan looking to exit the business of fabricating ICs, Knometa states. The Japanese company has eight 300mm fab lines at four sites in its native country, with the newest being Fab 5 in Nagasaki. The new fab started mass production in 2021 and the company is already constructing an expansion, the report continues.

Samsung entered the CMOS image sensor business to diversify beyond DRAM and NAND flash business. Since the fabrication technologies and toolsets for CIS devices are like that of DRAM, Samsung repurposed older DRAM fabs to begin making image sensors. The company became the industry’s second-largest supplier of image sensors by serving most of the camera module needs of its huge cellphone business. Samsung’s image sensor production exists primarily at a large 300mm fab facility in Hawseong, South Korea.

SK Hynix has used the same strategy of turning older DRAM fabs into capacity for CMOS image sensors but lacks the benefit of having another related SK Hynix operation to buy its CIS devices. The company has a small but growing share of the global image sensor market.

The industry’s third-largest supplier of image sensors is OmniVision but it relies on external foundries for the fabrication of its CIS wafers. OmniVision’s primary sources of foundry capacity are TSMC in Taiwan and SMIC and HLMC in China.

For more information visit Knometa Research.