German components distribution remains on record course

Continuing shortage and price increases from manufacturers provide lead to more than 50% sales growth for German components distribution, reports the FBDi. The order situation is relaxing slightly.

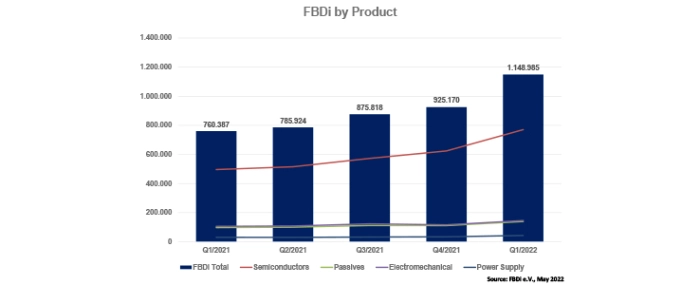

The German components distribution sector started 2022 with sales growth of 51.1% to EUR 1.15 billion in the first quarter of the year. With shortages and a huge order booms throughout 2021, the increase is not really surprising. However, new incoming orders slowed down but remained at a very high level of EUR 1.4 billion, resulting in a book-to-bill rate of 1.21.

The performance of individual product group were varied in the first quarter. While Semiconductors grew by more than 55% to EUR 770 million, Passive Components ‘only’ increased by 43% to EUR 140 million. Sales of Electromechanics, including connectors, rose by 37.5% to EUR 146 million, and of Power Supplies by 42% to EUR 44 million. Other products such as displays and sensors grew at an over-proportional rate, but have taken up a smaller share of the market. Semiconductors accounted for 67% of total sales, passives and electromechanics for 12% and 13% respectively, power supplies for 4%, with sensors, displays, assemblies & systems sharing the remaining 4%.

"Last year's extreme order situation is now manifesting itself in sales, partly due to volume growth and partly to price increases. The fact that incoming orders are still very high indicates that many customers expect structural shortages to continue and attempt to cover themselves in the longer term. At present, it looks as if sales growth will continue at a high level into the second half of the year and possibly beyond. It seems mathematically almost impossible to grow less than 20% in 2022. The boom in electromobility alone is creating an unparalleled pull of demand. The big unknown at the moment is the impact of the Russian war against Ukraine, which could lead to a rough awakening for the economy as a whole and thus also for our industry," says FBDi Chairman of the Board Georg Steinberger in a press release.

In the longer term, Steinberger sees considerable growth opportunities, but also new risks. He says that digitization, 5G, renewable energies and investments in the entire public and private infrastructure continue to spell high demand for electronics and thus also for components. He believes that a doubling of the market throughout Europe in just a few years could be possible.

"But there are also challenges: the drastic shortage of skilled workers, the increasing shortage of raw materials and, last but not least, the new bloc formation around the core conflict USA versus China, which could lead to a complete reassessment of technology supply chains and access to Intellectual Property. Europe has a massive problem in all three aspects, which cannot be solved in the short term, and the lack of consensus that is already visible again now does not help at all."