NAND and DRAM are poised to hit new revenue records

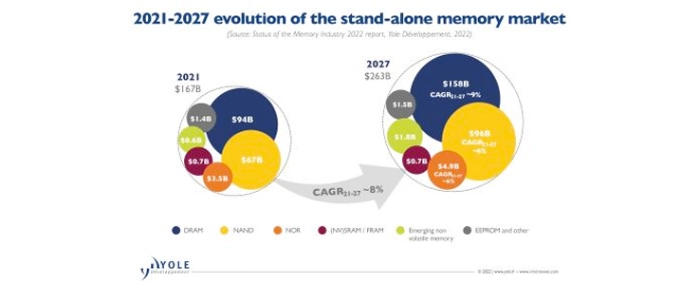

Market research and strategy consulting company, Yole Développement, says that despite the numerous global challenges, the memory market will grow to over USD 260 billion in 2027.

“Amid trade-war tensions and the COVID-19 pandemic, the stand-alone memory market has been expanding throughout the last two years. Revenue was up 15% and 32% in 2020 and 2021, respectively. Such remarkable growth was made possible by a combination of constrained production and strong demand growth across most market segments,” says Simone Bertolazzi, Ph.D., Senior Market & Technology Analyst, Memory at Yole, in a press release.

Yole has recently released its annual Status of the Memory Industry report, in which the company says that the outlook for the memory business appears bright – just read the following.

Yole expects DRAM to grow to USD 118 billion, up 25%. NAND flash memory will reach USD 83 billion, up 24%, in 2022. These are – as the research company points out – historic records. In the long term, the stand-alone memory market is expected to continue expanding, with a CAGR during 2021-2027 of 8% and is poised to grow to over USD 260 billion in 2027. However, seasonality will remain.

Noticeably, the NOR flash market has seen a strong resurgence in 2021. Revenue grew to USD 3.5 billion, up 43%. According to Yole, this is due to tight market conditions putting upward pressure on prices. Significant demand growth was driven by multiple applications, including consumer and the IoT , automotive, telecom, and infrastructure.

The year 2022 marks the 35th anniversary of NAND flash’s invention. Since 1987, the bit density and cost-per-bit of NAND devices have progressed relentlessly. To sustain such scaling, new technical solutions are being intensely researched, including CBA architectures such as YMTC’s Xtacking approach. Nowadays, all memory manufacturers are carrying out R&D using hybrid bonding equipment. Major suppliers like Kioxia and Samsung are putting wafer-to-wafer bonding on their NAND roadmaps.

In the DRAM business, Yole points to a current consensus that planar scaling – even through lithography EUV processes – will not be sufficient to provide the required bit-density improvement for the entire next decade. Hence, monolithic 3D DRAM – the DRAM equivalent of 3D NAND – is being considered by major equipment suppliers and by leading DRAM manufacturers as a potential solution for long-term scaling. Yole’s analysts believe that this novel 3D technology could make its entry into the market in the 2029-2030 time frame.

High-end smartphones are equipped with superior LPDDR5 memory to support ultra-high-performance camera applications and AI, providing consumers with high-quality images and videos. LPDDR5 memories have increased transfer speed compared to the previous generation of low-power DRAM memory. LPDDR5 characteristics empower devices to match both consumer needs and technological innovations.

For more information please visit Yole Développement.

.png)