Total IC unit shipments expected to climb 9% in 2022

Unit growth returns to the long-term growth rate after an enormous 22% surge in 2021.

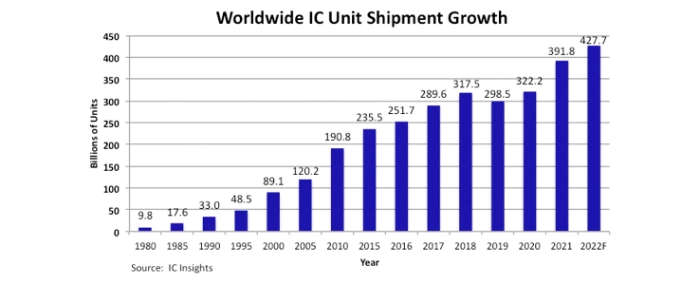

IC Insights forecasts that worldwide IC unit shipments will increase 9.2% this year to 427.7 billion units and resume tracking with the long-term IC unit compound annual growth rate (CAGR) of 9.4%. The 9.2% gain anticipated this year follows the large, 22% increase experienced during the economic recovery of 2021– the largest increase in IC unit growth since the boom year of 2010.

IC unit shipments in 2022 are forecast to reach a record-high level of 427.7 billion, almost 5x more units than were shipped in the year 2000 and nearly 44x more than were shipped in 1980.

In the graph above, you can see a falloff in shipments in 2019, which was only the fifth time in the history of the IC market that there was a year-over-year decline in IC unit volume. The previous four years with a drop in units were 1985, 2001, 2009, and 2012. Never have there been two consecutive years with a decline in IC unit shipments.

Of the 33 major IC product categories defined by the World Semiconductor Trade Statistics (WSTS) organisation, 30 are forecast to show positive unit growth in 2022 and three (SRAM, DSP, and Gate Array) are forecast to have unit shipment declines. Twelve product segments are forecast to match or grow more than the expected 9.2% growth rate for total IC units this year.

From 2021-2026, IC Insights forecasts the IC unit CAGR will be 7%. Ignoring the 5-year CAGR timeperiods with abnormally high or low endpoints, IC Insights believes that the long-term CAGR for IC unit growth will be 7%-8%, moderately lower than the historical 42-year rate of 9.4%.