Russia / Ukraine conflict likely to affect raw nickel prices

The conflict between Russia and Ukraine has escalated in recent days. In addition to the surge in natural gas and crude oil prices, the conflict may also impact the supply of non-ferrous metals including aluminum, nickel, and copper, says TrendForce

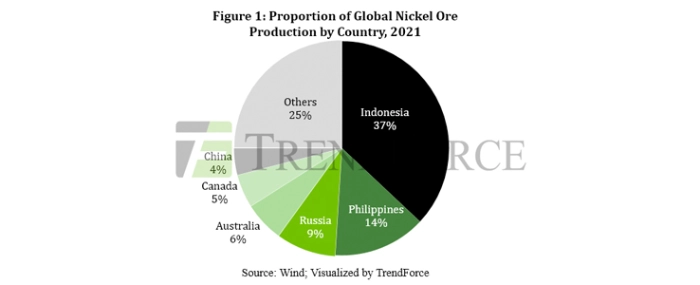

As pointed out by TrendForce, nickel is a key upstream raw material for the manufacture of electric vehicle power batteries and mainly used in the production of ternary cathode materials. In 2021, global nickel mine production was approximately 2.7 million tons, originating primarily from Indonesia, the Philippines, and Russia. Russian nickel production accounts for approximately 9% of the world's total (including low, medium, and high-grade nickel), ranking third globally. At present, the market penetration rate of new energy vehicles is accelerating and ternary power batteries account for nearly half of power battery market share, which signals strengthening demand for upstream raw material nickel for automotive power batteries. Although Russian nickel exports remain unaffected for the time being, if the situation on the ground between Russia and Ukraine continues to deteriorate, global nickel supply may be impacted in the short term, pushing up nickel prices, and further increase cost pressures on end product markets such as the electric vehicle industry.

TrendForce states that in the medium to long term, since the lion’s share of new nickel ore smelting and processing projects have been located in Indonesia in recent years and Indonesia's nickel ore production accounted for approximately 37% of the world's total production in 2021, Indonesia’s concentrated production of nickel is expected to improve supply and demand in 2H22. TrendForce also emphasizes, regarding the export ban on mines announced by Indonesia last year, this ban only prohibits the export of raw ore and does not prohibit Chinese companies such as Zhejian Huayou Cobalt, Tsingshan Holding Group, Lygend Resources, and GEM from investing in the processing end of nickel mines in Indonesia. Therefore, smelting nickel ore and highly processed products are not affected by the export ban.

For more information visit TrendForce.