© TrendForce

Analysis |

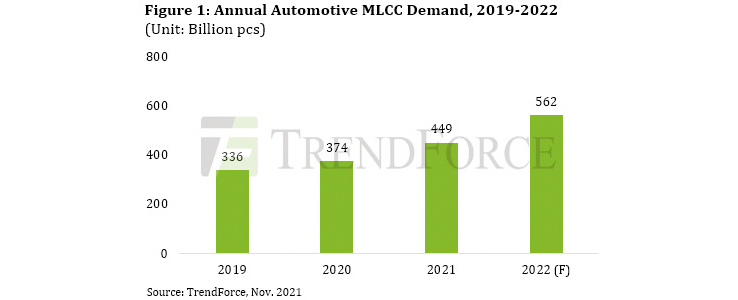

Annual automotive MLCC demand for 2021 to reach 449B Pcs

Various MLCC suppliers’ book-to-bill ratios as well quarterly shipments for 4Q21 now show signs of decline, according to TrendForce’s latest investigations.

Not only has the demand for consumer electronics slowed, but ODMs’ clients have also eased their procurement activities due to issues including the global chip shortage, mismatched component availabilities, and China’s power rationing. Demand in the automotive market, on the other hand, has remained strong since 3Q21. Automotive applications have therefore become an important point of focus in MLCC suppliers’ latest product planning and capacity expansion efforts. Thanks to these in-demand applications, annual MLCC demand from the automotive market for 2021 is expected to reach 449 billion pcs, a 20% YoY increase.

TrendForce further indicates that the growth of the EV market and improvements in ADAS specifications have resulted in a twofold increase in automotive MLCC consumption. While EVs’ electrified drivetrain and high safety requirements represent a high barrier to entry for MLCC suppliers, these hurdles have also in turn raised MLCC products’ ASP and profitability. Hence, the automotive electronics industry has been increasing its annual MLCC demand by double-digits in recent years. In particular, an analysis of different vehicles and their respective MLCC consumption reveals the following: a conventional EV requires 2.2 times the MLCC usage of a conventional gasoline vehicle, an ADAS-equipped EV requires 2.7 times, and an autonomous EV requires as much as 3.3 times.

Regarding MLCC suppliers, Japanese companies including Murata, TDK, and Taiyo Yuden continue to dominate the automotive MLCC market. These suppliers will expand their production capacities for automotive applications in overseas facilities in China, Philippines, and Malaysia next year, with powertrains, ADAS, and connected systems being among the most significant of the aforementioned applications. Korea-based Samsung, on the other hand, specializes in powertrain applications by leveraging its MLCC offerings’ small form factor, high capacitance, and high voltage. Finally, Taiwanese suppliers, such as Yageo and Walsin, are actively invested in developing automotive products and High-Q products for RF applications in an effort to increase their presence in the infotainment system market and EV charging station market.

Looking ahead to 2022, TrendForce expects annual automotive MLCC demand to reach 562 billion pcs, a 25% YoY increase, primarily attributed to the continued electrification of vehicles. While the global implementation of carbon-neutral policies and excellent sales performances of Tesla vehicles bring about widespread adoption of EVs, various countries have successively set concrete dates for the termination of gasoline vehicle sales. Hence, EVs are gradually becoming not only the mainstream option in the automotive market, but also the primary driving force behind the future growth of the MLCC industry.