© Trendforce

Analysis |

Quarterly notebook panel shipment sets new high in 3Q21

Owing to persistently strong demand for notebook panels and increased supply of such upstream components as ICs and TCONs, quarterly notebook panel shipment reached yet another historical high in 3Q21, with 72.27 million pcs shipped, representing an increase of 7.1% QoQ, according to TrendForce’s latest investigations.

TrendForce indicates that the proliferation of the stay-at-home economy resulted in record-setting performances from the notebook panel market, in which quarterly shipment reached historical highs for three quarters consecutively across the 1Q21-3Q21 period. Nevertheless, market demand for panels has shown partial signs of weakening. Demand remains strong for commercial notebooks but has begun plummeting for consumer notebooks and Chromebooks. Alongside this drop in Chromebook demand, 11.6-inch panels, which are the mainstream size of Chromebook displays, have also dropped in terms of shipment volumes, reaching only 10.88 million pcs shipped in 3Q21, a 28.3% QoQ decline.

Quarterly shipment of Chromebook panels is expected to undergo a further decrease in 4Q21. In addition, given the aforementioned strong demand for commercial notebooks, panel suppliers have quickly transitioned their focus towards 14-inch and 15.6-inch panels in response, and the combined quarterly shipment of both of these sizes reached 46.45 million pcs in 3Q21, a 20.2% QoQ increase. The bullish performance of these sizes of notebook panels thereby became the key reason behind the historical high in notebook panel shipment in 3Q21.

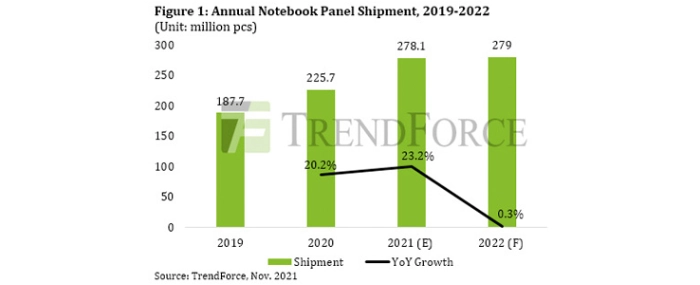

Due to panel suppliers’ swift response to changes in the market, notebook panel shipment for 2H21 is not expected to be overly impacted by the weakening demand for Chromebooks and consumer notebooks. For now, TrendForce projects notebook panel shipment for 4Q21 to reach 71.15 million pcs, while shipment for the entire 2021 is expected to reach 278.1 million pcs, a 23.2% YoY increase.

Looking ahead to 2022 and regarding the supply side of the panel market, most panel suppliers will be aggressive in their shipment plans for notebook panels due to the massive growth in notebook panel shipment across the 2020-2021 period. As such, panel suppliers are planning to ship about 330 million pcs of notebook panels in 2022. However, if a corresponding demand for notebooks fails to emerge next year, the notebook panel market may enter into an oversupply situation, thereby placing downward pressure on panel prices.

Regarding the demand side of the panel market, demand for Chromebooks and consumer notebooks will likely continue to slow down next year, but this slowdown will be accompanied by a corresponding growth in commercial notebook demand due to the persistent growth of the overall economy, along with the global digital transformation also taking place. Taking these factors into account, TrendForce expects annual notebook panel shipment for 2022 to reach 279 million pcs, representing a slight growth of 0.3% YoY.

For more information visit © TrendForce

For more information visit © TrendForce