© head off dreamstime.com

Analysis |

Leading China OEM suppliers, 2020 - the top 10 list

The emergence of the new coronavirus in late 2019 and the still-ongoing pandemic it caused led to an unprecedented global economic downturn. Virtually every nation on the globe felt its effect, but some appear to be recovering faster than others, reports New Venture Research.

China, where the pandemic began, has proven to be one of the more resilient nations, and has bounced back strongly. After seeing its economy shrink by nearly 7% in the first quarter of 2020—the first contraction of China’s economy since records began in 1992—the centrally controlled economy almost immediately began to rebound, and the country ended the year by growing its real GDP by 2.3%, the highest among the Group of 20 major and emerging economies (G20), according to the OECD. This has meant that the China electronics assembly value reached a new high of nearly USD 346.3 billion in 2020, nearly half of the entire Asia/Pacific (APAC) market according to NVR’s latest report, “OEM Electronics Manufacturing in China, 2021 Edition”.

The focus of this report is primarily on the original equipment manufacturer (OEM) market in China. These companies are often, but not always, large corporations that perform electronics assembly of products using their own brand or label. While they often outsource the actual assembly of their products, OEMs design and ultimately own the intellectual property rights to their products. The forecast of assembly value (or electronics cost of goods sold, COGS) of this category of manufacturing supplier is shown in Table 1. In 2020, the total market for OEM suppliers was about USD 201.1 billion, accounting for more than 58% of the total China electronics market. OEMs will grow through 2025 at a CAGR of 3.6%, to a total of USD 240.5 billion. However, its percent of the total market will decline slightly as more suppliers rely on contract manufacturing, and especially EMS, firms.

China OEM Electronics Assembly Value, 2020–2025 - Assembly Value (USD millions)

China holds a unique position in the global electronics industry sector. It possesses, simultaneously, the largest manufacturing capacity for every type of electronics product made, and nearly the largest consumer market of those products. Also, as a partner for electronics corporations from around the world, the country is, at once, the best location for establishing manufacturing and assembly facilities and a very difficult place for foreign-based corporations to do business. On the plus side, China has a seemingly infinite supply of engineering and design talent available at relatively low wages (although that advantage has nearly disappeared in recent years), and a low-cost supply base for components and well-organized infrastructure for providing a supply chain to assemble component parts into finished goods, and for shipping those goods to anywhere in the world. The downside, however, of basing one’s manufacturing in China means partnering with the centrally controlled government, known for negotiating contracts favorable to its domestic competitors and which is regularly accused of conducting unfair trade practices and outright theft of intellectual property.

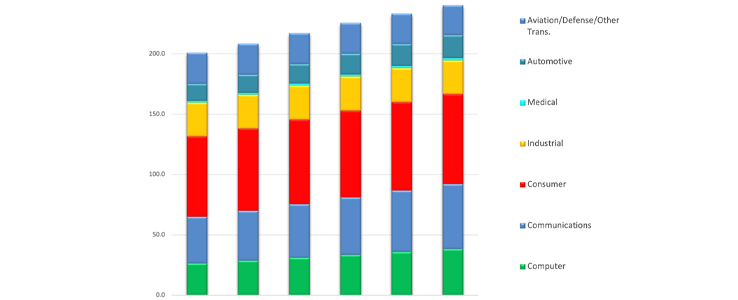

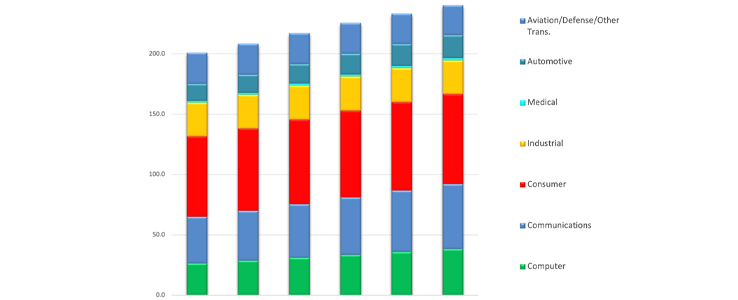

The figure below shows the forecast of China’s OEM assembly value by industry segment for 2020 through 2025. The total China OEM market was nearly USD 201.1 billion in 2020 and will grow to USD 240.5 billion by 2025, a CAGR of 3.6%, more than three times the rate of growth of COGS outside China.

Computers will be the fastest growing industry segment as the industry recovers from a shortage of semiconductor components, caused by the pandemic, and a gradual shift away from consumer electronics products. Thus, computer products will grow fastest with a CAGR of 7.6%. The communications sector will also grow sharply, though slightly less quickly, at a CAGR of 6.9%. Medical and automotive products will also grow at a CAGR of 6.7% and 6.0%, respectively. Consumer products are by far the largest industry segment for China OEMs in 2020. However, in part because of increasing outsourcing among consumer OEMs to large EMS firms, the growth of this industry segment will be much slower—just 2.3% CAGR.

Leading China OEM Suppliers, 2020

Computers will be the fastest growing industry segment as the industry recovers from a shortage of semiconductor components, caused by the pandemic, and a gradual shift away from consumer electronics products. Thus, computer products will grow fastest with a CAGR of 7.6%. The communications sector will also grow sharply, though slightly less quickly, at a CAGR of 6.9%. Medical and automotive products will also grow at a CAGR of 6.7% and 6.0%, respectively. Consumer products are by far the largest industry segment for China OEMs in 2020. However, in part because of increasing outsourcing among consumer OEMs to large EMS firms, the growth of this industry segment will be much slower—just 2.3% CAGR.

Leading China OEM Suppliers, 2020

For more information please visit © New Venture Research

| 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | CAGR | |

| Total China Market | 346,255.8 | 361,432.9 | 378,037.6 | 394,004.9 | 409,105.9 | 423,302.3 | 4.1% |

| OEM Assembly Value | 201,066.5 | 208,506.0 | 217,263.3 | 225,737.6 | 233,512.9 | 240,460.7 | 3.6% |

| Percent of Total Market (%) | 58.1% | 57.7% | 57.5% | 57.3% | 57.1% | 56.8% |

Computers will be the fastest growing industry segment as the industry recovers from a shortage of semiconductor components, caused by the pandemic, and a gradual shift away from consumer electronics products. Thus, computer products will grow fastest with a CAGR of 7.6%. The communications sector will also grow sharply, though slightly less quickly, at a CAGR of 6.9%. Medical and automotive products will also grow at a CAGR of 6.7% and 6.0%, respectively. Consumer products are by far the largest industry segment for China OEMs in 2020. However, in part because of increasing outsourcing among consumer OEMs to large EMS firms, the growth of this industry segment will be much slower—just 2.3% CAGR.

Leading China OEM Suppliers, 2020

Computers will be the fastest growing industry segment as the industry recovers from a shortage of semiconductor components, caused by the pandemic, and a gradual shift away from consumer electronics products. Thus, computer products will grow fastest with a CAGR of 7.6%. The communications sector will also grow sharply, though slightly less quickly, at a CAGR of 6.9%. Medical and automotive products will also grow at a CAGR of 6.7% and 6.0%, respectively. Consumer products are by far the largest industry segment for China OEMs in 2020. However, in part because of increasing outsourcing among consumer OEMs to large EMS firms, the growth of this industry segment will be much slower—just 2.3% CAGR.

Leading China OEM Suppliers, 2020

| Company | Headquarters | China Rev. ($M) | Market Share (%) |

| Huawei Investment & Holding Co., Ltd. | Shenzhen, Guangdong, China | 84,718.0 | 16.5% |

| China Aerospace Science and Technology Corp. (CASC) | Beijing, China | 34,328.9 | 6.7% |

| China Electronics Technology Group Corp. (CETC) | Beijing, China | 32,679.3 | 6.4% |

| Samsung Electronics Co., Ltd. | Suwan, South Korea | 32,024.3 | 6.3% |

| Midea Group Co., Ltd. | Foshan, Guangdong, China | 23,174.3 | 4.5% |

| Haier Smart Home Co., Ltd. | Qingdao, Shandong, China | 15,596.0 | 3.0% |

| Gree Electric Appliances, Inc. of Zhuhai | Zhuhai, Guangdong, China | 14,816.8 | 2.9% |

| Robert Bosch GmbH | Gerlingen, Germany | 12,402.3 | 2.4% |

| Lenovo Group Limited | Hong Kong, China | 10,858.0 | 2.1% |

| ZTE Corporation | Shenzhen, Guangdong, China | 9,856.5 | 1.9% |

| Others | 241,573.9 | 47.2% | |

| Total | 512,028.4 | 100.0% |

For more information please visit © New Venture Research