© Eurobattery Minerals

Analysis |

“Europe needs to move faster to meet the demand”

In a new report from Eurobattery Minerals, covering raw materials supply and demand for e-mobility, it becomes clear that the mining production and the sourcing of raw materials within the EU need to scale up - and that is sooner rather than later.

The report, “Critical raw materials and e-mobility” produced on behalf of the company by the London-based corporate risk advisory firm, Aperio Intelligence, provides an overview of the supply and demand for critical raw materials within the European Union, based on the EU’s goal of developing its self-sufficiency for raw materials in the context of the electric car revolution. The report also analyses current and future market volumes of electric and plug-in hybrid vehicles and e-bikes – with a focus on Europe and China – and their associated demand for copper, nickel and cobalt.

“The report clearly shows the need to scale up mining production and the sourcing of raw materials within the EU. We need to act quickly to enable the electric car revolution and ultimately reach the Agenda 2030 targets outlined by the UN. From the report it is clear that Europe needs to move faster to meet the demand for these materials. A sustainable car industry cannot continue to rely on unsustainable mining”, says Roberto García Martínez, CEO of Eurobattery Minerals, in a press release.

Global copper production

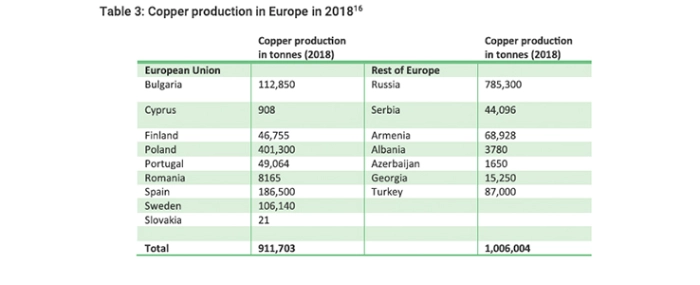

According to the International Copper Study Group (ICSG) and the US Geological Survey (USGS), in 2020, global copper mine production declined slightly to 20 million tonnes, from approximately 20.4/20.5 million tonnes in 2019. In 2018 the EU produced 911'703 tonnes of mined copper, which amounted. to 4.3% of total global production of 21 million tonnes. The largest EU producers were Poland, Spain, Bulgaria and Sweden.

In recent years, global copper mine production has been dominated by Latin America (43%), with Chile (5.8 million tonnes in 2019) and Peru (2.46 million tonnes in 2019) the other largest producers. In 2019, China (1 .6 million tonnes) was the third largest producing country behind Chile and Peru, followed by the US (1 .3 million tonnes) and the DRC 1.3 million tonnes.

Some conclusions from the report:

Global annual copper demand was around 28 million tonnes in 2020, and consumption is expected to grow by approximately 38% by 2030 to about 38 million tonnes annually. In 2019 Europe’s mined production represented 13% of total world production.

The Democratic Republic of Congo dominates global mine production of cobalt, with the EU producing just 0,9% - or 1,377 tonnes – of the world’s total annual production. According to the European Commission, cobalt demand within the EU will increase by five times by 2030.

A recent study commissioned by the European Commission from the consultancy Roskill indicates that automotive electrification is expected to represent the single largest growth sector for nickel demand globally over the next 20 years. In the EU, specifically, annual demand is expected to increase by 5'430'000 tonnes by 2040, from the present 17,000 tonnes (2020).