© Kitron

Electronics Production |

Strong finish to an exceptional year for Kitron

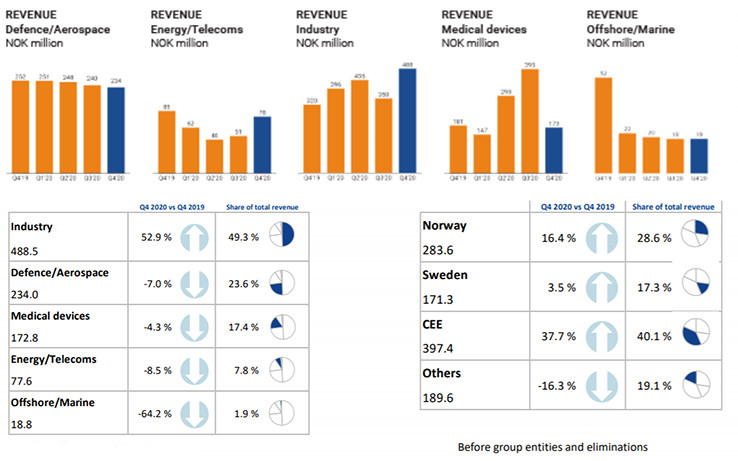

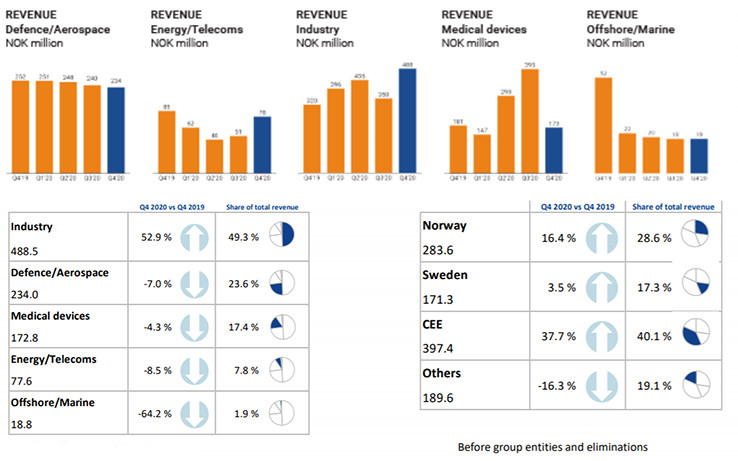

Kitron's revenue for the fourth quarter was NOK 992 million (EUR 96 million), an increase of 12% compared to last year.

Peter Nilsson, Kitron's CEO, comments: "On top of a strong underlying trend for Kitron in 2020, the Covid-19 pandemic created a temporary demand surge within the Medical devices market sector, leading to unusually strong growth and high margins. In 2021, we see a more normalized market and expect to follow our long-term growth and margin trajectory. Looking ahead, we see exciting business opportunities related to megatrends within electrification and connectivity.”

Solid revenue and order backlog

Kitron's revenue in the fourth quarter amounted to NOK 992 million (EUR 96 million), compared to 889 million (EUR 86 million) in the same quarter last year. Revenue growth compared to the same quarter last year was particularly strong in the Industry market sector. As expected, the Medical sector normalised after extraordinarily high activity in the second and third quarter, the latest quarterly report states.

The order backlog ended at NOK 2 006 million (EUR 196 million), compared to 1 884 million (EUR 184 million) last year. The order backlog increased the most within Energy/Telecom and Industry.

© Kitron

Strong profitability

Fourth quarter operating profit (EBIT) was NOK 75.7 million (EUR 7.4 million), compared to 54.2 million (EUR 5.3 million) last year. EBITDA was NOK 102.2 million (EUR 9.9 million), compared to 82.2 million (EUR 8.0 million) last year. Profit after tax amounted to NOK 47.1 million (EUR 4.6 million), compared to 34.0 million (EUR 3.3 million) in the same quarter the previous year.

Strong full-year results

Full-year revenue of NOK 3 964 million (EUR 388 million) gave an overall revenue growth of 20% for the year. Operating profit (EBIT) for the year ended at NOK 312.6 million (EUR 30.6 million), compared to NOK 201.5 million (EUR 19.7 million), resulting in an EBIT margin of 7.9%, compared to 6.1% in 2019. Profit after tax was NOK 213.1 million (EUR 20.8 million), up from NOK 132.5 million (EUR 12.9 million).

Improved operating cash flow

Operating cash flow was NOK 132.2 million (EUR 12.9 million), compared to 97.2 million (EUR 9.5 million) in the fourth quarter of 2019, recovering significantly from being temporarily challenged by the unusually strong growth in the second and third quarter. Net working capital was NOK 1 064 million (EUR 104 million), an increase of 13% compared to the same quarter last year. As a percentage of revenue, net working capital was unchanged. Capital efficiency ratios are expected to improve further.

Outlook

For 2021, Kitron expects revenue between NOK 3 900 and 4 200 million (EUR 381 - 411 million). EBIT margin is expected to be between 6.8 and 7.4%. The outlook for 2021 implies that Kitron is back on its long term trajectory for revenue and profitability after exceptional growth in 2020, largely driven by Corona-related demand within the Medical devices sector. Growth is driven by Defence/Aerospace, Electrification and Connectivity within Energy/Telecom and Industry Sectors. Medical devices is expected to be normalised and in line with previous years.

© Kitron

Strong profitability

Fourth quarter operating profit (EBIT) was NOK 75.7 million (EUR 7.4 million), compared to 54.2 million (EUR 5.3 million) last year. EBITDA was NOK 102.2 million (EUR 9.9 million), compared to 82.2 million (EUR 8.0 million) last year. Profit after tax amounted to NOK 47.1 million (EUR 4.6 million), compared to 34.0 million (EUR 3.3 million) in the same quarter the previous year.

Strong full-year results

Full-year revenue of NOK 3 964 million (EUR 388 million) gave an overall revenue growth of 20% for the year. Operating profit (EBIT) for the year ended at NOK 312.6 million (EUR 30.6 million), compared to NOK 201.5 million (EUR 19.7 million), resulting in an EBIT margin of 7.9%, compared to 6.1% in 2019. Profit after tax was NOK 213.1 million (EUR 20.8 million), up from NOK 132.5 million (EUR 12.9 million).

Improved operating cash flow

Operating cash flow was NOK 132.2 million (EUR 12.9 million), compared to 97.2 million (EUR 9.5 million) in the fourth quarter of 2019, recovering significantly from being temporarily challenged by the unusually strong growth in the second and third quarter. Net working capital was NOK 1 064 million (EUR 104 million), an increase of 13% compared to the same quarter last year. As a percentage of revenue, net working capital was unchanged. Capital efficiency ratios are expected to improve further.

Outlook

For 2021, Kitron expects revenue between NOK 3 900 and 4 200 million (EUR 381 - 411 million). EBIT margin is expected to be between 6.8 and 7.4%. The outlook for 2021 implies that Kitron is back on its long term trajectory for revenue and profitability after exceptional growth in 2020, largely driven by Corona-related demand within the Medical devices sector. Growth is driven by Defence/Aerospace, Electrification and Connectivity within Energy/Telecom and Industry Sectors. Medical devices is expected to be normalised and in line with previous years.

© Kitron

Strong profitability

Fourth quarter operating profit (EBIT) was NOK 75.7 million (EUR 7.4 million), compared to 54.2 million (EUR 5.3 million) last year. EBITDA was NOK 102.2 million (EUR 9.9 million), compared to 82.2 million (EUR 8.0 million) last year. Profit after tax amounted to NOK 47.1 million (EUR 4.6 million), compared to 34.0 million (EUR 3.3 million) in the same quarter the previous year.

Strong full-year results

Full-year revenue of NOK 3 964 million (EUR 388 million) gave an overall revenue growth of 20% for the year. Operating profit (EBIT) for the year ended at NOK 312.6 million (EUR 30.6 million), compared to NOK 201.5 million (EUR 19.7 million), resulting in an EBIT margin of 7.9%, compared to 6.1% in 2019. Profit after tax was NOK 213.1 million (EUR 20.8 million), up from NOK 132.5 million (EUR 12.9 million).

Improved operating cash flow

Operating cash flow was NOK 132.2 million (EUR 12.9 million), compared to 97.2 million (EUR 9.5 million) in the fourth quarter of 2019, recovering significantly from being temporarily challenged by the unusually strong growth in the second and third quarter. Net working capital was NOK 1 064 million (EUR 104 million), an increase of 13% compared to the same quarter last year. As a percentage of revenue, net working capital was unchanged. Capital efficiency ratios are expected to improve further.

Outlook

For 2021, Kitron expects revenue between NOK 3 900 and 4 200 million (EUR 381 - 411 million). EBIT margin is expected to be between 6.8 and 7.4%. The outlook for 2021 implies that Kitron is back on its long term trajectory for revenue and profitability after exceptional growth in 2020, largely driven by Corona-related demand within the Medical devices sector. Growth is driven by Defence/Aerospace, Electrification and Connectivity within Energy/Telecom and Industry Sectors. Medical devices is expected to be normalised and in line with previous years.

© Kitron

Strong profitability

Fourth quarter operating profit (EBIT) was NOK 75.7 million (EUR 7.4 million), compared to 54.2 million (EUR 5.3 million) last year. EBITDA was NOK 102.2 million (EUR 9.9 million), compared to 82.2 million (EUR 8.0 million) last year. Profit after tax amounted to NOK 47.1 million (EUR 4.6 million), compared to 34.0 million (EUR 3.3 million) in the same quarter the previous year.

Strong full-year results

Full-year revenue of NOK 3 964 million (EUR 388 million) gave an overall revenue growth of 20% for the year. Operating profit (EBIT) for the year ended at NOK 312.6 million (EUR 30.6 million), compared to NOK 201.5 million (EUR 19.7 million), resulting in an EBIT margin of 7.9%, compared to 6.1% in 2019. Profit after tax was NOK 213.1 million (EUR 20.8 million), up from NOK 132.5 million (EUR 12.9 million).

Improved operating cash flow

Operating cash flow was NOK 132.2 million (EUR 12.9 million), compared to 97.2 million (EUR 9.5 million) in the fourth quarter of 2019, recovering significantly from being temporarily challenged by the unusually strong growth in the second and third quarter. Net working capital was NOK 1 064 million (EUR 104 million), an increase of 13% compared to the same quarter last year. As a percentage of revenue, net working capital was unchanged. Capital efficiency ratios are expected to improve further.

Outlook

For 2021, Kitron expects revenue between NOK 3 900 and 4 200 million (EUR 381 - 411 million). EBIT margin is expected to be between 6.8 and 7.4%. The outlook for 2021 implies that Kitron is back on its long term trajectory for revenue and profitability after exceptional growth in 2020, largely driven by Corona-related demand within the Medical devices sector. Growth is driven by Defence/Aerospace, Electrification and Connectivity within Energy/Telecom and Industry Sectors. Medical devices is expected to be normalised and in line with previous years.