© SEMI

Analysis |

Record growth projected for semiconductor equipment market

Global sales of semiconductor manufacturing equipment by OEM’s are projected to increase 16% from USD 59.6 billion in 2019 and register a new industry record of USD 68.9 billion in 2020, SEMI reports.

The growth is expected to continue with the global semiconductor manufacturing equipment market reaching USD 71.9 billion in 2021 and USD 76.1 billion in 2022.

Both the front end and the back end semiconductor equipment segments are expected to power the expansion. The wafer fab equipment segment – which includes wafer processing, fab facilities, and mask/reticle equipment – is projected to rise 15% to reach USD 59.4 billion in 2020, followed by 4% and 6% growth in 2021 and 2022, respectively.

The foundry and logic segments, which account for about half of total wafer fab equipment sales, will see a mid-teens percentage increase this year to reach USD 30 billion in spending driven by investments in leading-edge technologies. Spending on NAND flash manufacturing equipment will surge 30% this year, surpassing USD 14 billion, while DRAM is expected to lead the expansion in 2021 and 2022.

The assembly and packaging equipment segment is forecast to grow 20% to USD 3.5 billion in 2020, followed by 8% and 5% increases in 2021 and 2022, respectively, driven by advanced packaging applications. The semiconductor test equipment market is expected to rise 20% in 2020, reaching USD 6 billion, and continue to expand in 2021 and 2022 on demand for 5G and high-performance computing (HPC) applications.

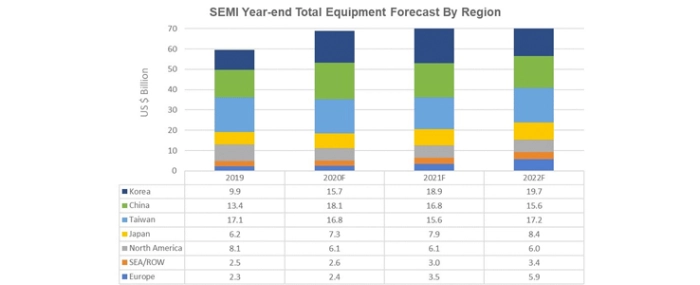

According to SEMI, China, Taiwan and Korea are projected to be the leading regions in spending in 2020. Robust foundry and memory investment in China is expected to propel the region to the top of the total semiconductor equipment market for the first time this year. In 2021 and 2022, Korea is forecast to lead the world in semiconductor equipment investments on the back of a memory recovery and increases in logic investment. Equipment spending in Taiwan will remain robust, powered by leading-edge foundry investment. Most other regions tracked will also see growth during the forecast period.

.jpg)