© TrendForce

Analysis |

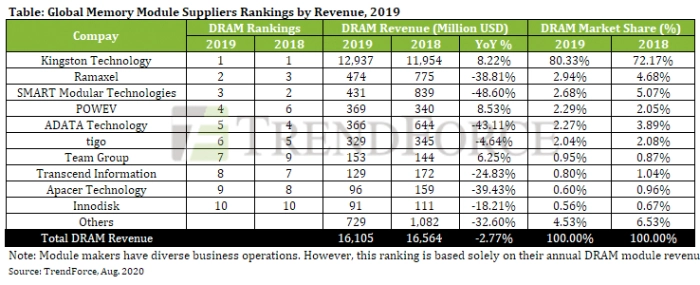

DRAM module revenue decreases by 3% YoY in 2019

The massive drop-off in DRAM quotes in 2019 culminated in a total yearly decline of more than 50%, which led to revenue losses for most module makers in 2019, according to TrendForce’s latest investigations.

However, Kingston’s growth against the downtrend served as the saving grace for the module industry, which registered yearly revenue of USD 16.1 billion in 2019, a mere 3% decrease YoY.

According to TrendForce, an analysis of 2019 price trends shows that the rapid decline of DRAM prices in 1H19 took place because DRAM inventory levels on both the client side and the supply side had reached a relative peak by the end of 2018, with the overall momentum of DRAM procurement gradually weakening, as first shown by server manufacturers. Furthermore, the client side’s yearlong effort in inventory reduction resulted in a constant downward pressure on DRAM prices and frequent reports of price drops, in turn damaging the revenue performances of many module makers. Even so, a few select module makers emerged from these dire circumstances and increased their revenues against the downtrend via developing new commercial opportunities.

Kingston took the crown once again, with China-based POWEV surging to fourth place

TrendForce estimates that the top five module makers accounted for about 90% of industry revenue in 2019, while the top 10 accounted for 95%. In particular, Kingston alone captured more than 80% market share, thanks to a newly developed business model last year which involved a supply chain optimization service provided by Kingston to its major international OEM clients. This service allowed Kingston’s clients to ship a more versatile product offering and do so on a more flexible schedule. Kingston’s DRAM module revenue grew despite the overall decrease in DRAM quotes. The company topped the list of module makers again by scoring an 8% revenue increase YoY.

On the other hand, the nosedive of DRAM prices in 2019 was considerably more detrimental for major Chinese module maker Ramaxel, whose revenue fell by almost 40%. Smart Modular Technologies, the runner-up in 2018, also saw its revenue fall by nearly 50%, thus swapping its position on the revenue ranking list with Ramaxel in 2019. Shenzhen-based POWEV obtained a new batch of orders from Chinese clients in 2019, ensuring that its shipment growth was able to resist the downward pressure on quote levels and driving its revenue to an 8.5% increase YoY. As such, POWEV leapfrogged to fourth place on the list.

Taiwan-based ADATA was similarly affected by the bearish DRAM market due to its high allocation of PC DRAM products. ADATA’s revenue decreased by 43% YoY, and its rank fell to fifth place. ADATA is currently looking to lower its allocation of PC DRAM and raise its overall profitability by expanding its business in emerging sectors, including gaming, industrial automation, and automotive applications. Shenzhen-based DRAM module veteran tigo, ranked sixth on the list, saw improvements in both shipment volume and ASP via its business transformation from B2C to B2B in 2019, during which it posted a mere 4.6% YoY decrease in DRAM revenue. Also worth mentioning is the fact that tigo’s revenue from its NAND Flash business consistently scored YoY growths, in turn contributing to the upward momentum of tigo’s overall revenue.

Team Group expanded its reach in both gaming and e-commerce, while Transcend continued its business transformation despite a minor decline in revenue

In addition to its continued expansion in the global e-commerce industry, Team Group’s increased efforts in the gaming sector, combined with its aggressive marketing and promotional efforts, led to growths in sell-in performance and ASP. Aided by the growing demand from gaming and e-commerce, Team Group’s revenue grew by 6.3% YoY, moving its rank up from ninth to seventh place.

Transcend’s revenue dropped by 25% YoY, while its rank fell to eighth place, as the company struggled to deal with falling quotes and its ongoing business transformation. Transcend’s strategy in response to fluctuations in the memory market remained focused on industrial automation projects, which yielded relatively higher gross profits, and strategic products. Transcend aimed to improve its competitiveness through strengthening its distribution channels and industrial automation businesses.

As Apacer proactively focused on specialty products for industrial automation and automotive markets, Innodisk excelled against the industry-wide decline thanks to its rock-solid core competency

In spite of the relatively large declines in revenue from its DRAM business, ninth-ranked Apacer recorded a YoY growth in overall profit in 2019, as its core business gradually shifted towards specialty products for industrial automation, medical, and automotive markets. By shifting its focus to specialty memories, which are products with higher gross profits, Apacer’s PC DRAM offerings accounted for less than half of its overall memory revenue last year. This realignment of core business is expected to stabilize Apacer’s profit structure going forward.

Tenth-ranked Innodisk made its appearance in the top 10 for two years in a row, registering an 18% decline in DRAM revenue in 2019. In addition to undergoing a narrower DRAM revenue decline compared to the rest of the industry, Innodisk’s overall profitability grew against the downtrend, reflecting the long-term stability of its core competency in industrial automation products, which have relatively high ASP. Innodisk will continue to develop memory products for industrial automation, servers, and medical applications in the future, on top of seizing the diverse commercial opportunities from the rise of AI technologies.