© TrendForce

Analysis |

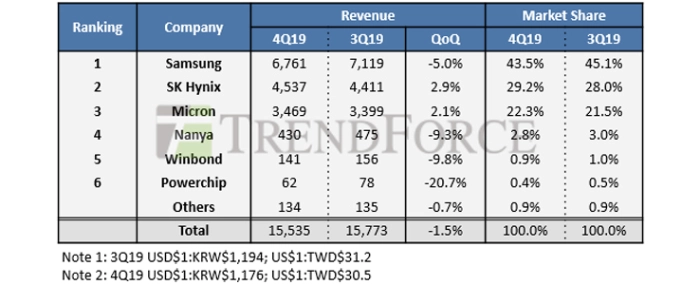

Global DRAM revenue holds steady in 4Q19

The DRAM inventory finally returned to a relatively normal level for most OEMs in 4Q19 after nearly three consecutive quarters of adjustments, says the DRAMeXchange research division of TrendForce.

As the growth in the industry’s overall DRAM supply will be fairly limited in 2020, buyers have been raising procurement ahead of time. Therefore, despite the relatively strong base period in 3Q19, DRAM suppliers increased their sales bits in 4Q19. This increase was able to largely offset the declines in their quotes. All in all, 4Q19 global DRAM revenue registered a minor decrease of 1.5% QoQ, showing a relatively flat trend compared to the previous quarter.

Now, in the first quarter of this year (1Q20), contract prices of PC DRAM and server DRAM products have rallied as PC OEMs and cloud service providers remain fairly proactive in building up their inventories. However, DRAM suppliers’ shipment performances in 1Q20 will be affected by the usual seasonal headwinds of Lunar New Year break in Asia. The three dominant DRAM suppliers are expected to post a QoQ decline in their sales bits for the period.

From the revenue angle in 4Q19, the QoQ growth of Samsung’s server DRAM shipments was lower than that of its chief competitors; its sales bits for the period increased by just 2-3% QoQ, while its ASP saw a QoQ drop. Samsung’s revenue retreated by 5% QoQ to USD 6.76 billion. SK Hynix’s sales bits grew by around 8% QoQ, which more than offset the QoQ drop of its ASP. The company’s revenue increased by 2.9% QoQ to USD 4.54 billion. Micron’s sales bits increased by nearly 10% QoQ, with revenue reaching USD 3.47 billion – a 2.1% increase QoQ.

From the profitability standpoint, almost all suppliers with the sole exception of Samsung failed to achieve a turnaround in 4Q19 mainly because their ASPs fell again by magnitudes of 7-8% versus the previous quarter. Samsung managed to increase its operating margin against headwinds to 36% from 33% in the third quarter due to the cost reduction associated with its transition to the 1Y-nm production. Additionally, Samsung managed to recover some of the write-off in connection with the quality issue of its 1X-nm process. Conversely, SK Hynix has seen its profitability negatively affected by the cost incurred during the course of its transition to the 1Y-nm production. For this supplier, the yield rate has been low during the early phase of the technology migration. SK Hynix posted the largest decline in operating margin among the top three suppliers, dropping to 19% from 24% of the previous quarter. Micron’s operating margin for its fiscal 1Q20 (September to November) was 20%, down from 24% in the previous fiscal quarter. The decline in Micron’s ASP was similar in magnitude to the declines experienced by the two Korean suppliers in their fiscal 4Q19 (October-December 2019).

Moving to 1Q20, there is now a possibility that rising quotes could improve suppliers’ profitability. However, the uptick in prices is expected to be marginal, so improvements in suppliers’ operating margins will unlikely be significant.

On the matters of technology and production, Samsung will be scaling back DRAM production at Line 13 by allocating more of the facility’s wafer capacity to CMOS image sensors (i.e., the same policy for Line 11). However, the second fab of the Pyeongtaek base (P2L) will begin volume production in 2H20 to offset the production cut at Line 13. Around that same time, Samsung will also start the migration to the 1Z-nm technology. Samsung’s total DRAM production capacity by the end of this year will not change much from the end of last year. Since Samsung still has a cautious outlook, the share of the 1Z-nm production in its overall output will not expand significantly this year. SK Hynix’s production plan for 2020 involves shifting the wafer capacity of M10 from DRAM to CMOS image sensors and raising DRAM wafer starts at M14. SK Hynix will probably maintain a conservative approach for the two new fabs in Wuxi because of the ongoing US-China trade dispute as well as the recent COVID-19 epidemic. On the technology front, SK Hynix will be focusing on advancing to the 1Y-nm technology this year. With respect to Micron’s plans for 2020, its subsidiary Micron Memory Taiwan (formerly Rexchip) is mainly producing on the 1X-nm process, but it will be upgrading to the 1Z-nm technology, thus skipping the 1Y-nm stage altogether. Micron’s other subsidiary Micron Technology Taiwan (formerly Inotera) now has more than 50% of its output based on the 1X-nm production. It is also in the midst of advancing to the 1Y-nm technology, which now makes up about 30% of its output.

Turning to the performances of Taiwan-based suppliers in 4Q19, in comparison with a relatively strong base period in 3Q19, Nanya’s sales bits suffered a QoQ decreased in 4Q19. Moreover, the company’s ASP registered a decline. Nanya posted a QoQ decline of 9.3% in revenue. Nevertheless, Nanya has a positive outlook for 1Q20 and expects a turnaround in its revenue result for the period. Nanya believes it will be able to achieve a QoQ growth for both ASP and sales bits in the first quarter. Winbond’s DRAM revenue also fell by 9.8% QoQ owing to weaker-than-expected sales of its new 25nm products and sliding ASP. Powerchip’s DRAM revenue (from own branded, in-house manufactured PC DRAM, excluding foundry DRAM orders) registered a QoQ decline of around 20%. Powerchip continues to transfer wafer capacity from DRAM to CMOS image sensors as the demand for the latter products are stronger. This strategy squeezes its DRAM output and shipments.