© IHS Markit

Electronics Production |

Global smartphone shipments fall - again - in 2Q/2019

The bad news for the global smartphone market is that global shipments fell in the second quarter, marking seven consecutive quarters of year-over-year declines.

The even worse news is that the impact of the United States’ ban on Huawei didn’t yet impact the smartphone market to a large degree during the second quarter—but may still have a negative effect on third-quarter results.

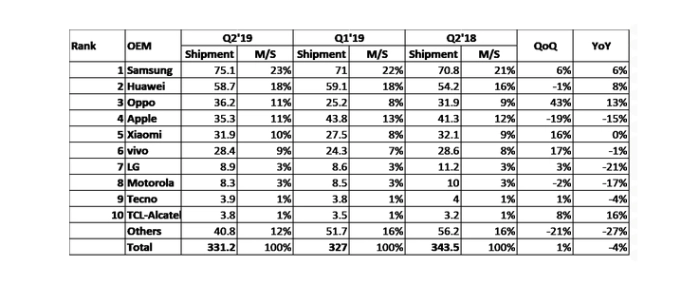

Smartphone shipments declined to 331.2 million units in the second quarter of 2019, down 3.6 percent from the same period last year, according to preliminary data from the IHS Markit Smartphone Intelligence Service. This continued the long losing streak for smartphone shipments, which haven’t increased on a year-over-year basis since the third quarter of 2017. The decline in shipments in the second quarter was widespread, with only four brands among the top-10—Samsung Electronics, Huawei, OPPO and TCL Alcatel—attaining year-over-year growth during the quarter.

The Huawei ban wasn’t in effect for the entire quarter, having been announced right in in the middle of the three-month period on May 15. As a result, the impact of the ban on Huawei was limited. The company shipping 58.7 million smartphones in the second quarter globally, down less than 1 percent from 59.1 million units in the first quarter and up 8 percent from the second quarter of 2018. Huawei’s market share rose to 18 percent in the second quarter, up 2 percentage points from one year earlier.

“In terms of smartphones, Huawei been able to weather the storm so far,” said Jusy Hong, research and analysis director at IHS. “Following a strong first-quarter performance, Huawei was one of the few smartphone makers to buck the overall negative trend in the market in the second quarter. Huawei was able to replace falling international shipments with increased sales in China. However, the full effects of the ban likely will be felt by Huawei’s international business in the third quarter of this year.”

Although a resolution appears to be on the horizon for the company and its US suppliers, the ban is still likely to cause Huawei to experience declining international sales in the third quarter.

Samsung stabilises

Samsung maintained the top rank in the smartphone business. The company was able to increase shipments by 6 percent year-over-year to reach 75.1 million units. It is a little early for Samsung to start realising the benefits from Huawei’s struggles in international markets. However, the tech giant’s market share increased to 23 percent in the second quarter, up 2 percentage points from a year ago.

For Samsung, it will be important to continue focusing on the application of new and innovative technologies to broader parts of its portfolio. Effective competition with Chinese makers will rely on fast execution and agile adjustments. In the latter part of the year, Samsung’s global scale and broad product portfolio should help it pick up share from Huawei in Europe and Latin America, where a prolonged period of uncertainty surrounding the Huawei brand can impact consumer behaviour negatively.

Apple faces smartphone challenges

Apple continues to face challenges in terms of unit shipments—a trend that is unlikely to be fixed soon. Apple shipped 35.3 million iPhones in the second quarter, down 14.6 percent from 41.3 million units one year ago.

Apple continues to be more aggressive with its promotional activities, but still faces two key challenges: super-premium pricing for its latest models and insufficient price elasticity in its older models to drive significant additional shipments of two-to-three-year-old devices.

Apple announced that its iPhone revenue declined 11.8 percent in the second quarter compared to a year earlier, largely due to increasing trade-in promotions in many markets.

Shifting winners and losers

OPPO had a successful quarter, with shipments rising 13 percent to 36.2 million units, up from 31.9 million units during the same period last year. The company has been a key partner to carriers in Europe during the rollout of 5G networks. Even without significant market share in many of European markets, OPPO is demonstrating its value to European carriers and is setting itself up for more growth this year.

Xiaomi cannot shake off the pressure from OPPO and Vivo. In the second quarter, Xiaomi shipped 31.9 million units, almost flat from 32.1 million units a year ago.

India continues to play a central role for Xiaomi’s business outside of China. However, OPPO and Vivo are also expanding in India. In OPPO’s case, a greater focus has been placed on expansion in Europe and India. Like OPPO, Xiaomi is one of the first movers in 5G deployment, partnering with carriers in Europe. As the situation with Huawei has unfolded, Xiaomi and OPPO, along with OnePlus and Samsung, have been the key smartphone makers to support the earliest 5G networks in Europe.

The other maker that showed positive growth in the quarter was TCL Alcatel. The company shipped 3.8 million units, up from 3.2 million in Q2 2018 – an increase of 16 percent.

Tough times continue for most of the market

For many other smartphone brands, business conditions continue to be difficult, with few signs of a silver lining on the horizon.

LG Electronics continues to struggle with its mobile handset business. Its smartphone shipments declined 21 percent in the second quarter compared to a year ago, after a 24 percent year-over-year drop in Q1.

“LG seems to have lost out to Xiaomi, OPPO, OnePlus and Samsung during the 5G rollout in Europe,” Hong said.

Market share concentrate among top brands

The combined market share of the top-six makers exceeded 80 percent of the total shipments during the second quarter. This represents a record high for the global smartphone business.

.jpg)