© New Venture Research

Electronics Production |

CM service market makes 15% leap

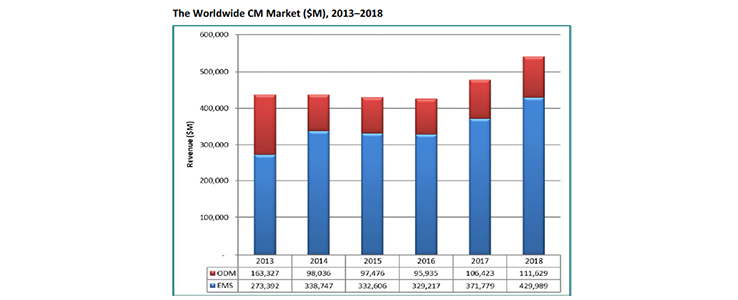

In 2018, the worldwide contract manufacturing (CM) services market increased significantly—by 15 percent in total revenue—resulting in combined EMS and ODM revenue of nearly $542 billion, an expansion of $70.7 billion.

Revenue growth from 2013 to 2016 had been flat, but expanded dramatically in 2017 and 2018.

The CM market has been sustained by the strong demand for smart phones, and the even more powerful demand for infrastructure networking equipment to build out the 5G wireless architecture with products like enterprise storage systems, enterprise LANs, and servers. The need for cloud computing, social media, and real‐time data and video streaming is driving the need for advanced switching, routing, and wireless communication hardware.

For the ninth year in a row, the industry was profitable at $8.4 billion (for 42 EMS public companies and 17 ODM public companies), the same amount achieved in 2017. Foxconn accounted for nearly half of all the money made by the EMS industry in 2018, and EMS companies accounted for approximately 80 percent of the total. Only five EMS companies and one ODM company lost money in 2018, the market researcher writes in its latest report.

Pegatron ranked second in net income for EMS firms ($369 million). Meanwhile, Delta Electronics ($639 million), Quanta Computer ($473 million), and Lite‐On ($264 million) ranked highest in earnings for the ODMs.

Plant closures and openings were rare in 2018, as most companies appear to have right‐sized their operations or closed facilities due to consolidation. New openings are clearly related to new business opportunities, while the closures are being driven by economic decisions such as right‐sizing the company.

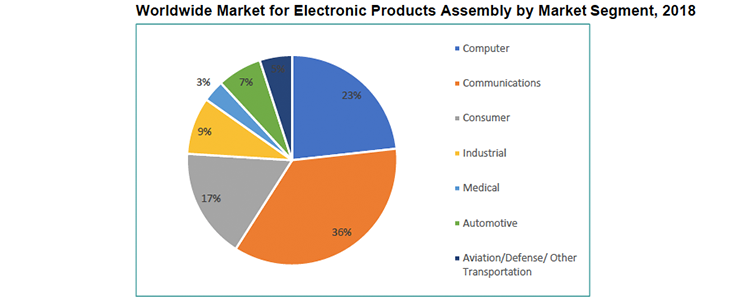

Communications and computer products will continue to be the segments driving the largest growth in the electronics industry. Fuelled by the demand for EMS services, the contract manufacturing industry will grow from $542 billion in 2018 to $777 billion in 2023, at a CAGR of about 7.5 percent. Outsourcing has become a critical element in keeping the electronics assembly industry expanding and driving costs down each year, and is a leading factor in stimulating continuous consumer demand and technology deployment. The trend to move price‐sensitive manufacturing to low‐cost regions has ceased, but will continue to impact the industry for all suppliers in the foreseeable future— at least regionally.

More on the subject can be found at New Venture Research.

More on the subject can be found at New Venture Research.