© batman2000 dreamstime.com

Analysis |

TMC to focus on catching up to Samsung in 3D-NAND production capacity

Toshiba just announced that the company has agreed to sell its memory business, Toshiba Memory Corporation (TMC) to a U.S.-Japanese consortium represented by U.S. private equity firm Bain Capita for JPY 2 trillion (USD 18 billion). Something that will impact on the NAND Flash market in the first half of 2018.

According to DRAMeXchange, a division of TrendForce, the deal will start to have a notable impact on the NAND Flash market in the first half of 2018 as the negotiations took longer than expected. From a medium- to long-term perspective, this deal will inject the necessary capital into TMC so that it can work to become a rival to Samsung in terms of NAND Flash technology and production capacity.

Alan Chen, senior research manager of DRAMeXchange, noted that several members of the acquiring party are government-backed investors and major private investment firms that are not deeply involved in the NAND Flash industry. Generally speaking, this government-supported consortium is not expected to significantly alter the management and operation of TMC after the deal is completed.

“The participation of Innovation Network Corporation of Japan (INCJ), the Development Bank of Japan (DBJ) and Bain Capital shows that TMC’s technologies have enormous strategic value,” said Chen. “At the same time, major technology enterprises such as SK Hynix and Apple have also joined the consortium and provided part of the funding to move the deal forward, thus reflecting a jockeying of both global political and commercial interests.”

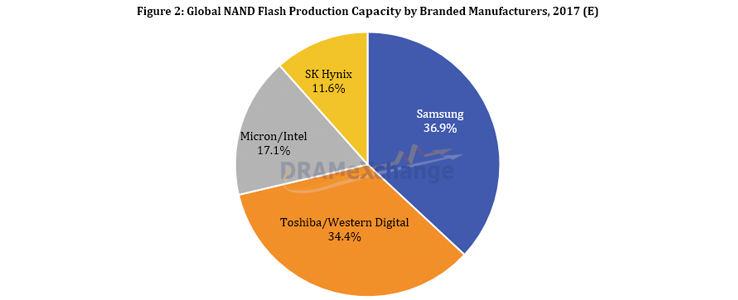

Chen added: “The infusion of capital from the new stakeholders in TMC will be like a shot of adrenaline. Given that the total investment in a new NAND Flash fab (with a monthly capacity of 80,000~100,000 wafers) averages around US$8 billion, neither Toshiba nor Western Digital can alone shoulder the cost of capacity expansions and technology development, especially as they are facing against the industry leader Samsung.”

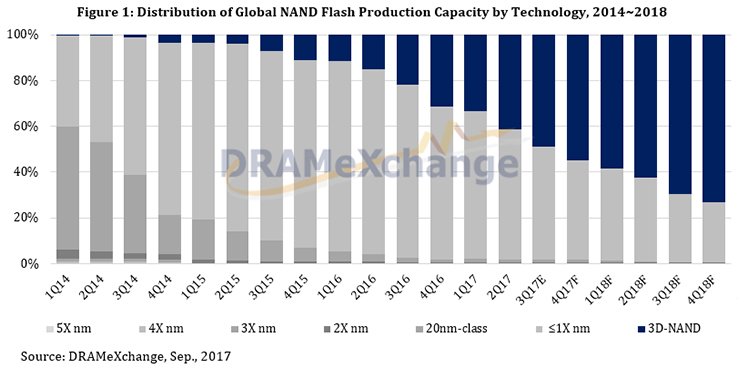

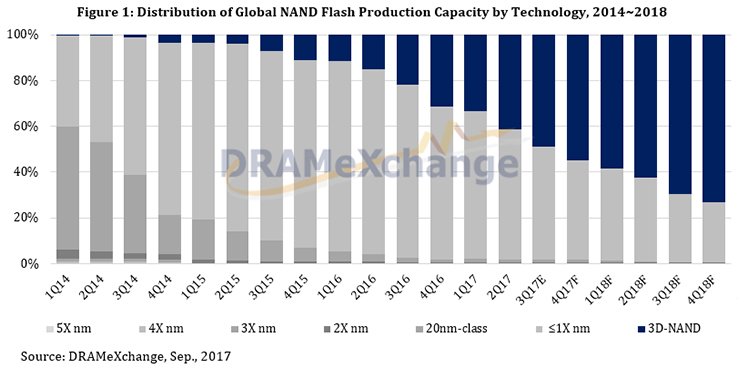

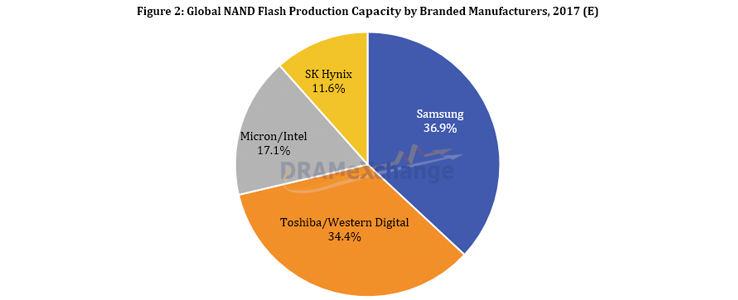

Samsung is still way ahead of the Toshiba-Western Digital alliance in 3D-NAND Flash capacity

Just 10~15% of the total monthly NAND Flash capacity of the Toshiba-Western Digital alliance was based on the 3D-NAND process in the second quarter of 2017. During the same period, 3D-NAND comprised more than 40% of Samsung’s total monthly NAND Flash capacity. Micron and Intel are strategic partners in the NAND Flash market, and they also began mass producing 3D-NAND Flash in the second half of 2016. The representation of 3D-NAND in the total monthly NAND Flash capacity of the Intel-Micron camp is projected to exceed 40% in the third quarter of 2017. Toshiba’s financial problem has been a major reason as to why the Toshiba-Western Digital alliance are behind their competitors in planning 3D-NAND capacity.

In terms of progress, the Toshiba-Western Digital alliance made the 48-layer stacking technology its mainstream 3D-NAND manufacturing process during the first half of 2017. By this fourth quarter, 3D-NAND is expected to represent around 30% of the alliance’s total monthly NAND Flash capacity. With regard to capacity planning, the construction of TMC’s Fab 6 in Yokkaichi, Japan, began this March. This facility is scheduled to mass produce the latest 3D-NAND products in 2019. Nonetheless, the future of Fab 6 is still uncertain because the sale of TMC has also led to disagreements between Toshiba and Western Digital regarding their collaboration.

Samsung is still way ahead of the Toshiba-Western Digital alliance in 3D-NAND Flash capacity

Just 10~15% of the total monthly NAND Flash capacity of the Toshiba-Western Digital alliance was based on the 3D-NAND process in the second quarter of 2017. During the same period, 3D-NAND comprised more than 40% of Samsung’s total monthly NAND Flash capacity. Micron and Intel are strategic partners in the NAND Flash market, and they also began mass producing 3D-NAND Flash in the second half of 2016. The representation of 3D-NAND in the total monthly NAND Flash capacity of the Intel-Micron camp is projected to exceed 40% in the third quarter of 2017. Toshiba’s financial problem has been a major reason as to why the Toshiba-Western Digital alliance are behind their competitors in planning 3D-NAND capacity.

In terms of progress, the Toshiba-Western Digital alliance made the 48-layer stacking technology its mainstream 3D-NAND manufacturing process during the first half of 2017. By this fourth quarter, 3D-NAND is expected to represent around 30% of the alliance’s total monthly NAND Flash capacity. With regard to capacity planning, the construction of TMC’s Fab 6 in Yokkaichi, Japan, began this March. This facility is scheduled to mass produce the latest 3D-NAND products in 2019. Nonetheless, the future of Fab 6 is still uncertain because the sale of TMC has also led to disagreements between Toshiba and Western Digital regarding their collaboration.

The deal may lead to NAND Flash oversupply in the first half of 2018

As the bidding for the majority stake in TMC lasted longer than anticipated, the effect of this deal will become apparent later in the first half of 2018. “After the sale, TMC may be able to raise its 3D-NAND Flash capacity and yield rate to a level higher than initially expected,” said Chen. “Plus, there is a significant degree of uncertainty in NAND Flash demand for the first half of 2018. Hence, the deal in the short term may actually cause supply-driven price decline in the NAND Flash market during the first half of 2018.”

The spun-off entity will manage its capital expenditure without interference from the former parent company and attain higher operational efficiency

This deal, which also puts TMC outside of Toshiba’s ownership, will also create medium- to long-term changes on the NAND Flash industry. The expenditure of this independently managed company will not be influenced by the financial problem of its former parent company, and it does not have to share resources with other group companies. The spun-off NAND Flash maker therefore can totally concentrate on developing technologies and building up production capacity. On the whole, the newly independent memory business is likely to achieve greater operational efficiency and become more proactive in making strategic decisions.

Though the winner of the bid for Toshiba’s memory business has been announced, the finalization of the deal will still need the consent of Western Digital. Toshiba and Western Digital have jointly invested in the Yokkaichi Operations. In terms of the ownership of the joint venture, Toshiba has around 55% of the share of the total investment versus Western Digital’s 45%. How Toshiba and Western Digital resolve their issues and share the production capacity of the new Fab 6 will be crucial to the completion of the deal and TMC’s future development.

The deal may lead to NAND Flash oversupply in the first half of 2018

As the bidding for the majority stake in TMC lasted longer than anticipated, the effect of this deal will become apparent later in the first half of 2018. “After the sale, TMC may be able to raise its 3D-NAND Flash capacity and yield rate to a level higher than initially expected,” said Chen. “Plus, there is a significant degree of uncertainty in NAND Flash demand for the first half of 2018. Hence, the deal in the short term may actually cause supply-driven price decline in the NAND Flash market during the first half of 2018.”

The spun-off entity will manage its capital expenditure without interference from the former parent company and attain higher operational efficiency

This deal, which also puts TMC outside of Toshiba’s ownership, will also create medium- to long-term changes on the NAND Flash industry. The expenditure of this independently managed company will not be influenced by the financial problem of its former parent company, and it does not have to share resources with other group companies. The spun-off NAND Flash maker therefore can totally concentrate on developing technologies and building up production capacity. On the whole, the newly independent memory business is likely to achieve greater operational efficiency and become more proactive in making strategic decisions.

Though the winner of the bid for Toshiba’s memory business has been announced, the finalization of the deal will still need the consent of Western Digital. Toshiba and Western Digital have jointly invested in the Yokkaichi Operations. In terms of the ownership of the joint venture, Toshiba has around 55% of the share of the total investment versus Western Digital’s 45%. How Toshiba and Western Digital resolve their issues and share the production capacity of the new Fab 6 will be crucial to the completion of the deal and TMC’s future development.

Images: © DRAMeXchange / Trendforce

Samsung is still way ahead of the Toshiba-Western Digital alliance in 3D-NAND Flash capacity

Just 10~15% of the total monthly NAND Flash capacity of the Toshiba-Western Digital alliance was based on the 3D-NAND process in the second quarter of 2017. During the same period, 3D-NAND comprised more than 40% of Samsung’s total monthly NAND Flash capacity. Micron and Intel are strategic partners in the NAND Flash market, and they also began mass producing 3D-NAND Flash in the second half of 2016. The representation of 3D-NAND in the total monthly NAND Flash capacity of the Intel-Micron camp is projected to exceed 40% in the third quarter of 2017. Toshiba’s financial problem has been a major reason as to why the Toshiba-Western Digital alliance are behind their competitors in planning 3D-NAND capacity.

In terms of progress, the Toshiba-Western Digital alliance made the 48-layer stacking technology its mainstream 3D-NAND manufacturing process during the first half of 2017. By this fourth quarter, 3D-NAND is expected to represent around 30% of the alliance’s total monthly NAND Flash capacity. With regard to capacity planning, the construction of TMC’s Fab 6 in Yokkaichi, Japan, began this March. This facility is scheduled to mass produce the latest 3D-NAND products in 2019. Nonetheless, the future of Fab 6 is still uncertain because the sale of TMC has also led to disagreements between Toshiba and Western Digital regarding their collaboration.

Samsung is still way ahead of the Toshiba-Western Digital alliance in 3D-NAND Flash capacity

Just 10~15% of the total monthly NAND Flash capacity of the Toshiba-Western Digital alliance was based on the 3D-NAND process in the second quarter of 2017. During the same period, 3D-NAND comprised more than 40% of Samsung’s total monthly NAND Flash capacity. Micron and Intel are strategic partners in the NAND Flash market, and they also began mass producing 3D-NAND Flash in the second half of 2016. The representation of 3D-NAND in the total monthly NAND Flash capacity of the Intel-Micron camp is projected to exceed 40% in the third quarter of 2017. Toshiba’s financial problem has been a major reason as to why the Toshiba-Western Digital alliance are behind their competitors in planning 3D-NAND capacity.

In terms of progress, the Toshiba-Western Digital alliance made the 48-layer stacking technology its mainstream 3D-NAND manufacturing process during the first half of 2017. By this fourth quarter, 3D-NAND is expected to represent around 30% of the alliance’s total monthly NAND Flash capacity. With regard to capacity planning, the construction of TMC’s Fab 6 in Yokkaichi, Japan, began this March. This facility is scheduled to mass produce the latest 3D-NAND products in 2019. Nonetheless, the future of Fab 6 is still uncertain because the sale of TMC has also led to disagreements between Toshiba and Western Digital regarding their collaboration.

The deal may lead to NAND Flash oversupply in the first half of 2018

As the bidding for the majority stake in TMC lasted longer than anticipated, the effect of this deal will become apparent later in the first half of 2018. “After the sale, TMC may be able to raise its 3D-NAND Flash capacity and yield rate to a level higher than initially expected,” said Chen. “Plus, there is a significant degree of uncertainty in NAND Flash demand for the first half of 2018. Hence, the deal in the short term may actually cause supply-driven price decline in the NAND Flash market during the first half of 2018.”

The spun-off entity will manage its capital expenditure without interference from the former parent company and attain higher operational efficiency

This deal, which also puts TMC outside of Toshiba’s ownership, will also create medium- to long-term changes on the NAND Flash industry. The expenditure of this independently managed company will not be influenced by the financial problem of its former parent company, and it does not have to share resources with other group companies. The spun-off NAND Flash maker therefore can totally concentrate on developing technologies and building up production capacity. On the whole, the newly independent memory business is likely to achieve greater operational efficiency and become more proactive in making strategic decisions.

Though the winner of the bid for Toshiba’s memory business has been announced, the finalization of the deal will still need the consent of Western Digital. Toshiba and Western Digital have jointly invested in the Yokkaichi Operations. In terms of the ownership of the joint venture, Toshiba has around 55% of the share of the total investment versus Western Digital’s 45%. How Toshiba and Western Digital resolve their issues and share the production capacity of the new Fab 6 will be crucial to the completion of the deal and TMC’s future development.

The deal may lead to NAND Flash oversupply in the first half of 2018

As the bidding for the majority stake in TMC lasted longer than anticipated, the effect of this deal will become apparent later in the first half of 2018. “After the sale, TMC may be able to raise its 3D-NAND Flash capacity and yield rate to a level higher than initially expected,” said Chen. “Plus, there is a significant degree of uncertainty in NAND Flash demand for the first half of 2018. Hence, the deal in the short term may actually cause supply-driven price decline in the NAND Flash market during the first half of 2018.”

The spun-off entity will manage its capital expenditure without interference from the former parent company and attain higher operational efficiency

This deal, which also puts TMC outside of Toshiba’s ownership, will also create medium- to long-term changes on the NAND Flash industry. The expenditure of this independently managed company will not be influenced by the financial problem of its former parent company, and it does not have to share resources with other group companies. The spun-off NAND Flash maker therefore can totally concentrate on developing technologies and building up production capacity. On the whole, the newly independent memory business is likely to achieve greater operational efficiency and become more proactive in making strategic decisions.

Though the winner of the bid for Toshiba’s memory business has been announced, the finalization of the deal will still need the consent of Western Digital. Toshiba and Western Digital have jointly invested in the Yokkaichi Operations. In terms of the ownership of the joint venture, Toshiba has around 55% of the share of the total investment versus Western Digital’s 45%. How Toshiba and Western Digital resolve their issues and share the production capacity of the new Fab 6 will be crucial to the completion of the deal and TMC’s future development.Images: © DRAMeXchange / Trendforce