© yole developpement

Analysis |

Automotive sensing: a mature yet highly dynamic market

How will sensor technology shape the cars of the future? Bosch, Denso, Sensata, NXP and Infineon are still the top players in the automotive space, but changes may occur rapidly.

Despite its age and maturity, the automotive market has witnessed many unexpected developments over the past two years. And as has always been the case, safety drives the market. Automotive OEMs and suppliers are now investing in technologies to develop autonomous and electric vehicles. Automation will spur the development of imaging and detection sensors like cameras, LiDAR, and radar, while electrification will boost the design of current and thermal sensors for battery management. And because sensors are becoming a must-have, other markets are dynamic and growing too.

How will sensor technology shape the tomorrow’s automotive industry? In a global automotive market worth than USD 2.3 trillion, the little world of automotive sensors has recently been shaken up by the emergence of electric and autonomous cars.

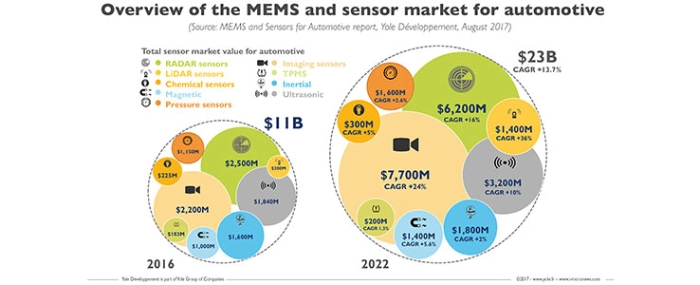

Despite just 3 percent growth in the volume of cars sold expected through to 2022, Yole expects an average growth rate in sensors sales volumes above 8 percent over the next five years, and above 14 percent growth in sales value. This is thanks to the expanding integration of high value sensing modules like RADAR, imaging and LiDAR. The current automotive sensing market groups MEMS and classic active sensors such as pressure, TPMS , chemical, inertial, magnetic, ultrasonic, imaging, RADAR and LiDAR. “This market is worth USD 11 billion in 2016 and is expected to reach USD 23 billion by 2022”, announces Guillaume Girardin, Technology & Market Analyst at Yole. “This is mainly due to the boom in imaging, RADAR and LiDAR sensors, which will respectively be worth USD 7.7 billion, USD 6.2 billion and USD 1.4 billion by 2022,” he adds.

Among classical sensors like pressure, chemical and magnetic sensors, the impact of electric vehicles will remain small in the short term. However, the advent of electrical vehicles will greatly change the amount and the distribution of pressure and magnetic sensors within the car in the longer term. More electric cars will mean fewer pressure sensors and a surge in magnetic sensors for battery monitoring and various positioning and detection of moving pieces. Finally, the automotive world is experiencing one of the fastest-changing eras in its evolution ever. Sensor suppliers are now engaged in a race where they need to be prepared for the golden age of the automotive world.

Among all sensing technologies located in the car, three main sensors will drastically change the landscape: imaging, RADAR and LiDAR sensors.

- Imaging sensors were initially mounted for ADAS purposes in high-end vehicles, with deep learning image analysis techniques promoting early adoption. It is now a well-established fact that vision-based AEB is possible and saves lives. Adoption of forward ADAS cameras will therefore accelerate. Growth of imaging for automotive is also being fuelled by the park assist application, and 360° surround view camera volumes are skyrocketing. While it is becoming mandatory in the US to have a rear view camera, that uptake is dwarfed by 360° surround view cameras, which enable a “bird’s eye view” perspective. This trend is most beneficial to companies like Omnivision at sensor level and Panasonic and Valeo, which have become the main manufacturers of automotive cameras.

- RADAR sensors, which are often wrongly seen as competitors of imaging and LiDAR sensors, are increasingly adopted in high-end vehicles. They are also diffusing into mid-price cars for blind spot detection and adaptive cruise control, pushing Level 2/3 features as a common experience.

- Lastly, LiDAR remains the “Holy Grail” for most automotive players, allowing 3D sensing of the environment. In this report Yole’ analysts highlight the different potential usages of this technology, which will transform the transportation industry completely.