© icinsights

Analysis |

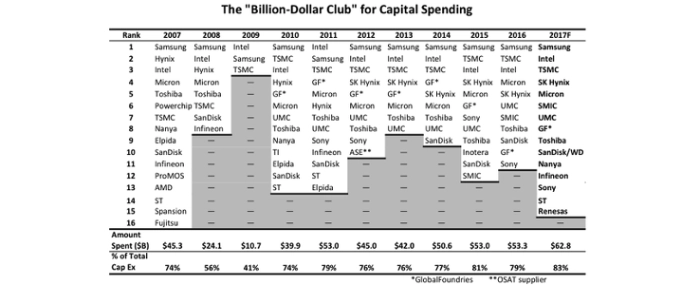

'Billion Dollar Capex Club' accepts new members

Top spenders expected to represent 83 percent of total semiconductor industry spending in 2017.

In total, there are 15 companies that are forecast to have semiconductor capital expenditures of ≥ USD 1.0 billion in 2017, up from 11 in 2016 and only 8 in 2013. Infineon and Renesas are expected to move into the major spending ranking this year as each company is aggressively targeting the fast rising automotive semiconductor market. Other companies expected to be added to the ranking this year include Nanya and ST.

Moreover, IC Insights believes that a few Chinese companies are likely to break into the “major spenders” ranking over the next couple of years as they ramp up their new fabs. The 15 companies listed, which include four pure-play foundries, are forecast to represent 83 percent of total worldwide semiconductor industry capital spending in 2017, the highest percentage over the timeperiod shown.

This year, four companies—Intel, Samsung, GlobalFoundries, and SK Hynix— are expected to represent the bulk of the increase in spending. Samsung is forecast to spend USD 3,200 million more in capital outlays this year than in 2016, Intel USD 2,375 million more, GlobalFoundries USD 865 million more, and SK Hynix an additional USD 812 million. Combined, these four companies are expected to increase their spending by USD 7,252 million in 2017, or about 90 percent of the total USD 8,021 million net jump in total semiconductor industry capital expenditures forecast for this year.

With a 31 percent increase, the DRAM/SRAM segment is expected to display the largest percentage increase in capital expenditures of the major products types listed this year. With DRAM ASPs surging since the third quarter of 2016, DRAM manufacturers are once again stepping up spending for this segment.

Capital spending for flash memory in 2016 (USD 14.6 billion) was significantly higher than spending allocated for DRAM (USD 8.5 billion). Overall, IC Insights believes that essentially all of the spending for flash memory in 2016 and 2017 was and will be dedicated to 3D NAND flash memory process technology as opposed to planar flash memory. A big jump in NAND flash capital spending in 2017 is expected to come from Samsung as it ramps its 3D NAND production in its giant new fab in Pyeongtaek, South Korea.

-----

More information can be found at IC Insights.