© targray (illustration purpose only)

Electronics Production |

Global lithium battery anode materials industry concentrated in Asia

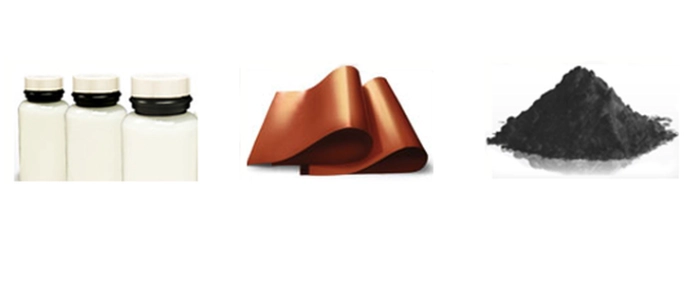

Lithium battery is primarily composed of cathode materials, anode materials, separator, and electrolyte. Anode materials, one of vital raw materials, make up 5-15 percent of lithium battery costs.

Currently, the global lithium battery anode materials industry is concentrated in China and Japan, which combine more than 95 percent of anode materials sales worldwide. Japanese enterprises are in a leading position technologically while China boasts obvious cost advantages in anode materials production, because of abundant graphite mineral resources.

China produced 122.5 kilotons of anode materials in 2016, up 68.3 percent YoY. Driven by new energy vehicle demand, China’s production of anode materials is expected to register a high CAGR of 30-35 percent in upcoming years, and then reach 295 kilotons in 2020.

In 2016, BTR, Hitachi Chemical, Shanshan, Mitsubishi Chemical, Nippon Carbon and JFE Chemical took the top six positions in global anode materials market share ranking (by sales volume), claiming a combined 71.1 percent share, with Hitachi Chemical, Shanshan, Nippon Carbon and JFE Chemical specializing in artificial graphite, BTR and Mitsubishi Chemical in natural graphite.

So far, China has established a relatively complete industrial chain for anode materials, with three regions i.e. Pearl River Delta, Yangtze River Delta, and Central China (Hunan and Henan) formed. With a high regional concentration, the number of anode materials production enterprises in the three regions accounts for over 80 percent of the national total.

As concerns the competitive landscape of key players, Shenzhen BTR New Energy Materials, Shanshan Techology and Jiangxi Zichen Technology still occupy the top three slots despite a gradually narrowing gap in market share, especially in output value between Jiangxi Zichen Technology and Shanshan Technology. Second-tier manufactures such as Shenzhen Sinuo Industrial Development, Huzhou Chuangya Power Battery Materials, Hunan Shinzoom Technology, Jiangxi Zhengtuo New Energy Sc. & Tech. and Fujian XFH New Energy Materials (formerly Shenzhen XFH Technology) driven by the power battery market keep rapid growth in output value, e.g. XFH benefiting from BYD, Guangzhou Great Power Energy & Technology and other power battery companies.