© stockfotocz dreamstime.com

Analysis |

Traditional automotive force combined with 'new frontier' power

The merger would represent the union of the traditional automotive world with the “new frontier," driven by connectivity and needs for high processing power.

NXP’s strength (also through acquisition of FSL) is the reliability and quality standards required in automotive. On the other hand Qualcomm brings its expertise in the connectivity and artificial intelligence applications, writes market researcher IHS.

© IHS

© IHS

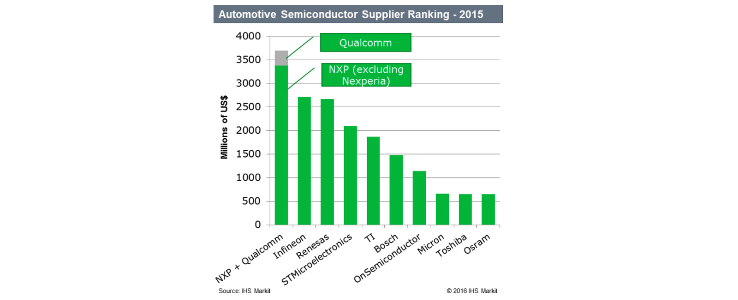

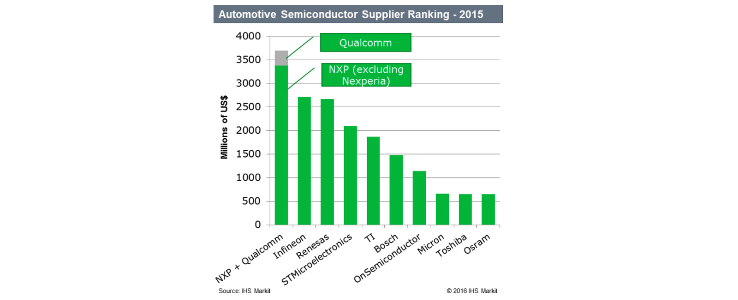

- Qualcomm would take best advantage of NXP’s dominant position in the automotive supply chain. Its combined automotive revenue for 2015 is estimated at USD 3.7B (USD 1B more than Infineon, the second largest).

- Qualcomm would bring itself to the pinnacle of the automotive semiconductor market in only two years (primarily by buying market shares): Ranked 41 in 2014; Climbed to 20th in 2015 through acquisition of CSR; Would be number one by 2016 through the acquisition of NXP.

- From a cost perspective, the merged entity would allow to share the cost of advanced technology nodes (less than 16nm), sharing cost with various other industry segments. Today, traditional automotive suppliers are compelled to scale down the technology nodes because of high-performance processing at low power consumption. However, the ROI is too low in automotive. Through the merger, NXP can leverage Qualcomm’s ROI from other industries to invest in new mask sets.

- Silicon solutions from both the suppliers strongly complement each other, mainly focused on Infotainment and ADAS segments. Other domains are only of NXP competence.

- The merger would fit especially well with future automotive applications, which are driving high double-digit growth for semiconductor components.

- NXP: Software defined radio (SDR), NFC, cyber security, CMOS radar, processors, automotive functional safety, etc.

- Qualcomm: 5G, Artificial Intelligence, V2X, Wireless Charging

© IHS

© IHS