© vinnstock dreamstime.com

Analysis |

German components distribution with solid growth in 2015

According to FBDi e.V., German electronics components distribution market grew by 7.7 percent in Q4/15. Persistently positive development of order situation.

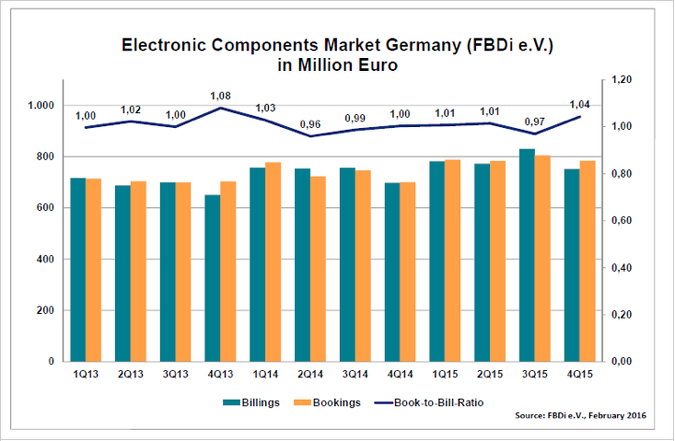

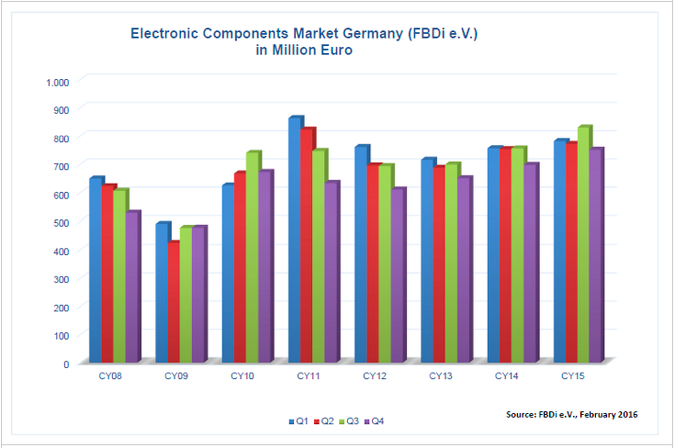

The German component distribution enjoyed a successful year 2015. The turnover of the FBDi member companies in Germany increased by 7.7 percent to 752 million Euro. Orders even showed an increase of 11.9 percent to 784 million Euro, resulting in a book-to-bill rate of 1.04, which paves the way for a good start into 2016. Overall, 2016 the turnover increased by 5.8 percent to a record 3.14 billion Euro – without the weak first half-year (3 percent growth) the result would have been even higher.

The fourth quarter was essentially impacted by a significant double-digit growth in sensors (+64 percent), displays (+30 percent) and power supplies (+16.5 percent), followed by semiconductors (7.4 percent) and passive components (6 percent). Only electromechanical have stagnated at ~1 percent of growth. For the full-year the following picture emerges: Semiconductors increased by 7 percent to 2.18 billion Euro, passives by 2 percent to 443 million Euro whereas electromechanicals decreased by 1.6 percent to 304 million Euro.

Sensors have grown by almost 10 percent to 20 million Euro, displays by 18.8 percent to 101 million Euro and power supplies by 17.3 percent to 76 million Euro. The overall revenue split did hardly change – with semiconductors representing almost 70 percent of the business, passives 14 percent and electromechanicals almost 10 percent. Displays have a share of 3.2 percent of the total market, and the share of power supplies is 2.4 percent.

Georg Steinberger, FBDi Chairman of the board, said: “The German component distribution industry can be satisfied with the result, even if a plus of 5.8 percent is at the lower end of the country results in Europe. This is mainly caused by the exchange rate relations, as countries which are mostly invoicing in Dollars or which have strong currencies compared to the Euro, have grown more strongly. This effect will decline considerably, if the Euro/Dollar relationship remains in a stable corridor.”

In fact, Steinberger is looking forward to an exciting year in 2016. “Up to now the German industry – our customers – remained largely immune to the global downturn, considering the ongoing positive order situation. Apparently, the economic development in China has not yet had an influence on our customers so far. On the other hand, the global components market doesn’t show real leaps in growth (measured in Dollar terms); and the production capacities of most of the manufacturers rather indicate over-capacities than shortages. However, the Internet of Things and Smart Industry (Industry 4.0) may spur growth fantasies already during this year. Both issues are reality today and there is no way anymore to stop this train.”

© FBDi