© farang dreamstime.com

Electronics Production |

2014 - a year review for EMS

With 2014 in the rear-view mirror, we at evertiq thought this might be a good time to contact our friends at Reed Electronics Research to take a look at what actually happened during the year.

The EMS industry has gone through a lot during the last couple of years. We've seen everything from pure success to complete nose dives over the years, but how was 2014?

When we reached Peter Brent at Reed Electronics Research we came to talk about how the European landscape for the EMS industry is looking at the moment. He told me that; EMS companies, particularly those in Group 2 and 3 such as éolane, Partnertech, Kitron, and others are all searching for growth in a competitive European market, which, is really at a standstill. Larger EMS companies are looking to gain positions in the bigger and growing EMS markets.

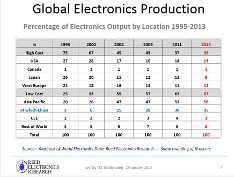

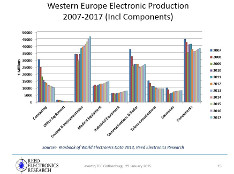

“The background for the changes is that the economy in Europe did not really get going in the Eurozone. Whilst the UK has shown strong growth and Scandinavia is growing reasonably well, Finland and Italy are both forecast to be still in negative GDP territory. France is at around 0.4% growth for 2014 and Germany is starting to grow, but modestly, at 1.4%,” says Peter Brent. If we break it down bit by bit – or rather segment by segment – how did it go for Europe? Mr. Brent explained that the European EMS manufactures of 3C sector products (Computers, Consumer goods, Communications) are almost wholly made in Central and Eastern Europe (CEE) and to some extent in Russia and Ukraine. However, during 2012-2014 the Big 6 have moved a considerable volume of 3C manufacture out of CEE and into their plants in Asia to take advantage of economies of scale. The recent fall in the oil price may encourage the Big 6 to bring some production back to CEE. Very briefly; most of the 3C products are made in low labour cost countries mainly in CEE. There are still some 3C products made in Western Europe, but they are mainly specialist products, such as rugged laptops or PC’s for industrial or military use, or highly priced consumer items such as audio systems, specialist visual media and so on. The 3C products are mainly manufactured by the 6 largest companies in group 1, with the exception of Zollner, which does not ‘play’ in the 3C sectors. So Foxconn, Flextronics, Jabil, Sanmina and Celestica are the main 3C players, but some of these companies are also trying to establish greater sales in the Medical, Automotive, Control & Industrial and Aerospace/Defence sectors which dominate the EMS production in Western Europe.

“By far the largest, and fastest growing areas for EMS in Europe is the business in Control, including Instrumentation, and Industrial electronics area. This strength comes from the large number of sophisticated electronic, and electro-mechanical manufacturers all over Western Europe plus the emphasis that nations in Western Europe are putting on enhancements in alternative energy generation, environmental controls for automotive sector, growing rail transportation and sophisticated on-board systems,” Mr. Brent explains. Another high growth area for the European EMS is that of Medical electronics, mainly driven by the rising and long-living population and the monitoring of chronic medical conditions. “Whilst spending on defence related electronics is reducing, and has dropped sharply in 2014 in some countries there are signs that this may slow in the near future as the West views Russia and the conflicts in the Middle East with increasing concern. With the upward growth of air travel, and the increased competitiveness of Airbus in the world aircraft manufacturing markets, companies supply this sector are looking at good prospects. So in short, we expect good growth for EMS in the Control & industrial, Automotive and Medical sectors and also for Aircraft and Aerospace,” Mr Brent adds. So with all this said, and with 2014 behind us, how should one approach 2015, what can we expect? “A cautious start to the year with limited visibility in the short term on the back of the continued uncertainties in the Eurozone, slower growth in the emerging markets, geopolitical tensions and so on.” According to Peter Brent, we can also expect further consolidation of the European EMS companies as some are unable to react to the pressure of static prices and the need to offer a broader line of services. We will also see the continual transfer of more EMS manufacturing to satellite plants in lower cost countries in Europe. On the other hand, Peter mentions the emergence of indigenous EMS companies from CEE such as Videoton and Fideltronik and others, which leverage their low cost manufacturing base with increasing in-house skills and expertise. “The EMS-providers we believe will be entering into closer cooperation with their OEM customers to reduce further the ‘time to market’ of finished products and this partnership will be further extended as EMS increasingly follow their customers into new geographical markets. The main battleground for EMS in Europe will be increasingly in the sectors of Medical, Control and Industrial and Automotive,” Mr Brent concludes. ---- Images and Data © Reed Electronics Research. For further information visit Reed Electronics Research site.