© stevanovicigor dreamstime.com

Analysis |

EMS in 2014: Cautious optimism

What happened with the EMS industry in 2013? And where can we expect the industry to go from here?

Electronics components and systems are important for the industrial landscape of the region. Despite the strategic benefit of establishing a production facility in Central and Eastern Europe as an access point to the rest of Europe, the European Electronics industry faces fierce global competition, high research costs and fast technological development. This encourages companies to seek strategic partnerships in order to pool resources and remain competitive.

The decline for EMS in the final quarter of 2012 was more significant than predicted, as OEMs stalled order into 2013, or even cancelled orders on top of a weak economy. The 2013 followed a similar path to the of 2012 as as we look forward to 2014 and beyond, the EMS industry continues to face a period of uncertainty with limited visibility. OEMs are therefore reassessing their manufacturing strategies, which encourages some to increase their level of outsourcing or even exit manufacturing entirely. This is good news for EMS providers due to increased demand for their services and despite the volatility that is typical for the EMS market, developments in recent months have been positive.

The uncertainty regarding the extent and timing of the global economic recovering still affects the industry. For 2014, total European revenues for the EMS market are forecasted to show modest decline. Western European is forecasted to grow 0.8%, which is not offset by the 1.4% decline in Central Eastern Europe.

© MPCF

Although at a reduced level of production, major EMS providers retain a regional manufacturing presence in Western Europe; the majority of European manufacturing is now located in CEE. As global EMS companies often acquired these facilities through acquisition of major European OEMs, they offer the same capabilities as regional players but can rely on global resources to support growth.

Some end markets, in particular Healthcare/LIfe Sciences and Commercial Aerospace, have shown strong growth recently. Outsourcing of product development, manufacturing and after-market services is expected to continue growing in these sectors.

The positive trend of the industry is also reflected in sustainable EBITDA margins of above 4%. After the dip in the second quarter of 2013, margins have been increasing, reaching the highest level of the year at 5.12% in Q4.

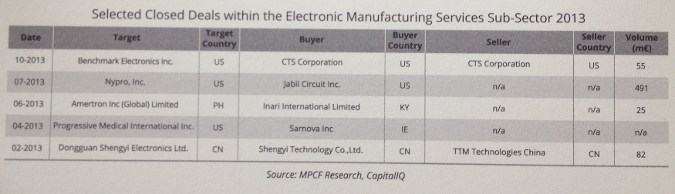

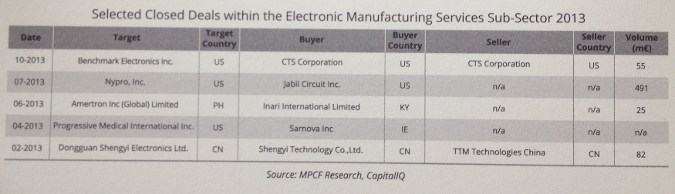

The industry as a whole has experienced changes in the landscape due to acquisitions and exits. One of the largest transactions was the acquisition of CTS Corporation’s EMS segment by Benchmark Electronics, with a transaction value of EUR 55 million. Despite recent positive industry developments, electronics manufacturers still exhibit cautious optimism.

-----

Roman Göd, Managing Partner at MP Corporate Finance, will talk about the EMS industry and underlying M&A trends during TEC Munich in January 2015. More information about TEC Munich can be found here.

© MPCF

Although at a reduced level of production, major EMS providers retain a regional manufacturing presence in Western Europe; the majority of European manufacturing is now located in CEE. As global EMS companies often acquired these facilities through acquisition of major European OEMs, they offer the same capabilities as regional players but can rely on global resources to support growth.

Some end markets, in particular Healthcare/LIfe Sciences and Commercial Aerospace, have shown strong growth recently. Outsourcing of product development, manufacturing and after-market services is expected to continue growing in these sectors.

The positive trend of the industry is also reflected in sustainable EBITDA margins of above 4%. After the dip in the second quarter of 2013, margins have been increasing, reaching the highest level of the year at 5.12% in Q4.

The industry as a whole has experienced changes in the landscape due to acquisitions and exits. One of the largest transactions was the acquisition of CTS Corporation’s EMS segment by Benchmark Electronics, with a transaction value of EUR 55 million. Despite recent positive industry developments, electronics manufacturers still exhibit cautious optimism.

-----

Roman Göd, Managing Partner at MP Corporate Finance, will talk about the EMS industry and underlying M&A trends during TEC Munich in January 2015. More information about TEC Munich can be found here.

© MPCF

Although at a reduced level of production, major EMS providers retain a regional manufacturing presence in Western Europe; the majority of European manufacturing is now located in CEE. As global EMS companies often acquired these facilities through acquisition of major European OEMs, they offer the same capabilities as regional players but can rely on global resources to support growth.

Some end markets, in particular Healthcare/LIfe Sciences and Commercial Aerospace, have shown strong growth recently. Outsourcing of product development, manufacturing and after-market services is expected to continue growing in these sectors.

The positive trend of the industry is also reflected in sustainable EBITDA margins of above 4%. After the dip in the second quarter of 2013, margins have been increasing, reaching the highest level of the year at 5.12% in Q4.

The industry as a whole has experienced changes in the landscape due to acquisitions and exits. One of the largest transactions was the acquisition of CTS Corporation’s EMS segment by Benchmark Electronics, with a transaction value of EUR 55 million. Despite recent positive industry developments, electronics manufacturers still exhibit cautious optimism.

-----

Roman Göd, Managing Partner at MP Corporate Finance, will talk about the EMS industry and underlying M&A trends during TEC Munich in January 2015. More information about TEC Munich can be found here.

© MPCF

Although at a reduced level of production, major EMS providers retain a regional manufacturing presence in Western Europe; the majority of European manufacturing is now located in CEE. As global EMS companies often acquired these facilities through acquisition of major European OEMs, they offer the same capabilities as regional players but can rely on global resources to support growth.

Some end markets, in particular Healthcare/LIfe Sciences and Commercial Aerospace, have shown strong growth recently. Outsourcing of product development, manufacturing and after-market services is expected to continue growing in these sectors.

The positive trend of the industry is also reflected in sustainable EBITDA margins of above 4%. After the dip in the second quarter of 2013, margins have been increasing, reaching the highest level of the year at 5.12% in Q4.

The industry as a whole has experienced changes in the landscape due to acquisitions and exits. One of the largest transactions was the acquisition of CTS Corporation’s EMS segment by Benchmark Electronics, with a transaction value of EUR 55 million. Despite recent positive industry developments, electronics manufacturers still exhibit cautious optimism.

-----

Roman Göd, Managing Partner at MP Corporate Finance, will talk about the EMS industry and underlying M&A trends during TEC Munich in January 2015. More information about TEC Munich can be found here.