© yury-asotov / dreamstime.com

Electronics Production |

Developing trends – Part 1: Clusters old and new

This article is the first in a series of three that investigates current and future electronics manufacturing clusters and the predictors to their development. It examines China’s cluster landscape and the catalysts of cluster development.

It is important to keep in mind that perhaps the single greatest driver of cluster development is the presence of other electronics suppliers. Close proximity of suppliers of different capabilities to one another boosts their mutual productivity by reducing inbound transportation costs and transit times, increasing communication and cooperation, and facilitating “technology spillover”. For the purpose of this examination, however, we want to understand what motivates the pioneers of new clusters that begin the snowball of cluster growth.

Clusters initially develop from specific catalysts and different combinations of factors that include:

• Labor cost

• Labor supply (skilled and unskilled)

• Location and logistics infrastructure

• Proximity to market

• Government intervention, i.e. investment incentives, state planning

Early Clusters

The Pearl River Delta, China’s first and largest electronics manufacturing services cluster, not only was originally characterized by low wages, but also by a large and dense population.

Although similar to much of China at the time, the area’s logistical advantage was unmatched. River access to the sea and western consumers combined with proximity to Hong Kong and its existing supplier-base and investment capacity made the Pearl River Delta in Guangdong province an ideal choice.

Government intervention in the form of investment incentives and government infrastructure investment allowed Shenzhen, a port in Guangdong province, to become the center of the first major Electronics Manufacturing Services cluster in China and now the largest and most developed cluster of its kind in the world.

The second largest cluster in Jiangsu province, surrounding Shanghai, developed for some of the same reasons, but it was partially due to wage inflation and labor shortages back in Guangdong. In Jiangsu, suppliers could also benefit from an existing logistics infrastructure even as the government continued to make large development investments in the region.

Despite the presence of lower wages and a large labor supply in China’s interior, poor logistics infrastructure originally precluded a cost-effective model for inland cluster development.

Inland Cluster Development

In the last five years the situation in China has evolved considerably. Rising labor costs, low unemployment and increasing worker expectations in existing clusters, combined with inland areas’ rapidly developing infrastructure and growing consumer market, have led to fledgling clusters in the areas of Sichuan, Chongqing and Henan.

Suppliers are not only struggling to cope with rapidly growing wages in traditional clusters, but also challenges to ramping up and maintaining production due to labor shortages and the increasing demands of a more industrially evolved workforce .

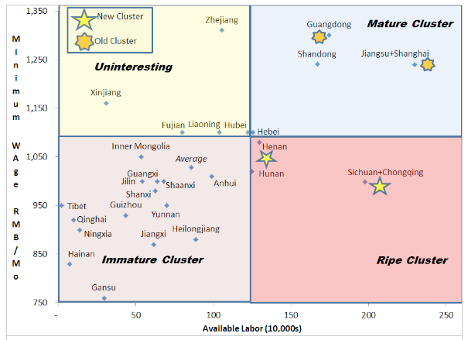

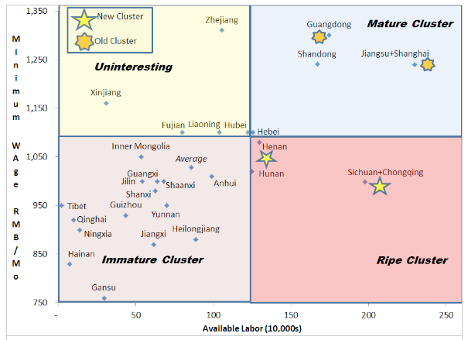

Increasingly, establishing or moving production to an inland location is being viewed as a cost-effective alternative in terms of labor cost, labor acquisition, taxes and to some extent even logistics cost. The below chart shows an analysis of the favorability of certain manufacturing locations based on the confluence or low wage levels and the availability of labor.

© Riverwood Solutions

The lower right quadrant represents conditions ripe for cluster development. Not surprisingly, the developing clusters in Sichuan, Chongqing and Henan fall in or near this quadrant. The clusters of the Pearl River Delta and eastern Jiangsu lie in the mature category, with their rising wages and tightening labor supply.

Provinces in the lower left quadrant, despite their low wages, lack the scale of worker availability and perhaps logistics and infrastructure development to spark an EMS cluster, which when fully developed can employ millions of workers.

Location, Logistics and Infrastructure

Clearly logistics and transportation are important to the manufacturing location decision.

Traditionally, most electronics products manufactured in China had to be transported to the ocean for export, necessitating a system of decent roads or railways. Until logistics costs fall to a certain level relative to other factors such as labor costs, relocating or expanding production to new areas is not economically viable.

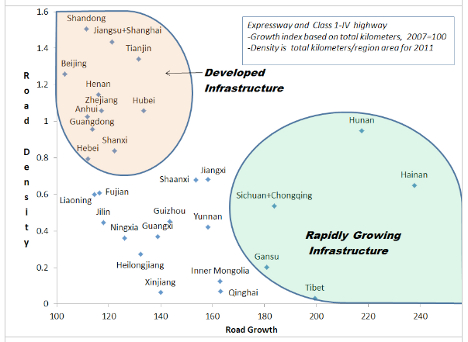

Infrastructure development is largely driven by the government and areas experiencing such development indicate possible government intervention, i.e. investment incentives. Using roads as a proxy for infrastructure development, we gain better insight in to trends of clusters develop.

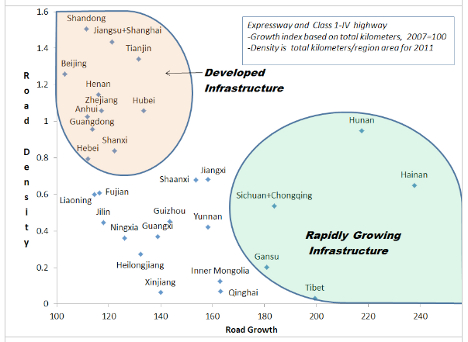

The below chart illustrates Expressway and Highway Class I-IV density and growth by province. As expected, the developed cluster areas of Jiangsu and Guangdong show more advanced infrastructure development. Sichuan, while relatively undeveloped, experienced rapid infrastructure growth in the last five years, hinting to the Chinese government’s focus on it as a center of manufacturing for tablets in Chengdu and laptops in Chongqing - take Foxconn and Cisco - both leading growth in these areas.

Zhengzhou, Henan, home to a large Foxconn Apple product operation since 2010, lands in the developed infrastructure category. Industry sources report that Foxconn chose this location partially in anticipation of a rapid manufacturing ramp-up due to release of new Apple products. Given Henan’s existing infrastructure, low wages and labor availability, the choice seems logical.

© Riverwood Solutions

The lower right quadrant represents conditions ripe for cluster development. Not surprisingly, the developing clusters in Sichuan, Chongqing and Henan fall in or near this quadrant. The clusters of the Pearl River Delta and eastern Jiangsu lie in the mature category, with their rising wages and tightening labor supply.

Provinces in the lower left quadrant, despite their low wages, lack the scale of worker availability and perhaps logistics and infrastructure development to spark an EMS cluster, which when fully developed can employ millions of workers.

Location, Logistics and Infrastructure

Clearly logistics and transportation are important to the manufacturing location decision.

Traditionally, most electronics products manufactured in China had to be transported to the ocean for export, necessitating a system of decent roads or railways. Until logistics costs fall to a certain level relative to other factors such as labor costs, relocating or expanding production to new areas is not economically viable.

Infrastructure development is largely driven by the government and areas experiencing such development indicate possible government intervention, i.e. investment incentives. Using roads as a proxy for infrastructure development, we gain better insight in to trends of clusters develop.

The below chart illustrates Expressway and Highway Class I-IV density and growth by province. As expected, the developed cluster areas of Jiangsu and Guangdong show more advanced infrastructure development. Sichuan, while relatively undeveloped, experienced rapid infrastructure growth in the last five years, hinting to the Chinese government’s focus on it as a center of manufacturing for tablets in Chengdu and laptops in Chongqing - take Foxconn and Cisco - both leading growth in these areas.

Zhengzhou, Henan, home to a large Foxconn Apple product operation since 2010, lands in the developed infrastructure category. Industry sources report that Foxconn chose this location partially in anticipation of a rapid manufacturing ramp-up due to release of new Apple products. Given Henan’s existing infrastructure, low wages and labor availability, the choice seems logical.

© Riverwood Solutions

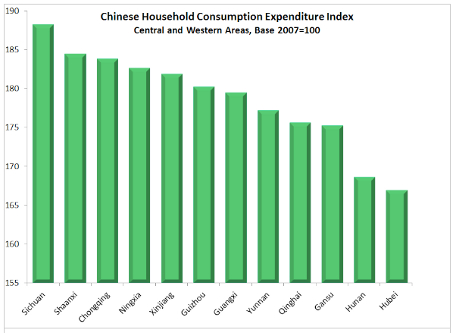

Electronics for China's Consumers

In addition to infrastructure development, proximity to markets also affects logistics costs. The traditional pattern of electronics manufacturing for export is slowly being displaced by an increasing focus on manufacturing for domestic consumption. Chinese consumption in the interior of China is rising rapidly, along with that of the developed coastal regions.

Transit times and costs from interiorly located Sichuan are significantly lower to many internal markets in China when compared with those from coastal locations. According to industry insiders, Foxconn established laptop manufacturing in Chongqing for domestic consumption after being convinced to do so by HP.

Furthermore, plans for a railway line from Chongqing that could supply Western Europe allegedly helped spur an agreement earlier this year for additional cooperation between HP and Foxconn to manufacture printers in Chongqing.

© Riverwood Solutions

Electronics for China's Consumers

In addition to infrastructure development, proximity to markets also affects logistics costs. The traditional pattern of electronics manufacturing for export is slowly being displaced by an increasing focus on manufacturing for domestic consumption. Chinese consumption in the interior of China is rising rapidly, along with that of the developed coastal regions.

Transit times and costs from interiorly located Sichuan are significantly lower to many internal markets in China when compared with those from coastal locations. According to industry insiders, Foxconn established laptop manufacturing in Chongqing for domestic consumption after being convinced to do so by HP.

Furthermore, plans for a railway line from Chongqing that could supply Western Europe allegedly helped spur an agreement earlier this year for additional cooperation between HP and Foxconn to manufacture printers in Chongqing.

© Riverwood Solutions

The Future

Many would agree that the sole presence of EMS industry giant Foxconn in a new area is sufficient catalyst to start the process of the development of a whole new cluster. As the world’s largest EMS provider and with factories of enormous scale (its Zhengzhou plant has 200,000 workers), Foxconn is one of the pioneers alluded to above whose new investment locations draw waves of new suppliers – Foxconn gets that snowball rolling and with it the capabilities of a new cluster grow exponentially.

For the purpose of this investigation we have focused on what factors influence the pioneers in China.

In the next article in this series we focus on the future and new trends in cluster development: Will pioneers focus their resources on existing clusters or move them to new locations? What are the new and potential clusters in other parts of Asia? Is there truly a migration in China from the coast to the interior, or is there a migration from China to other Asian locations in search of lower labor costs? Will China’s electronics manufacturing industry become dominated by domestic consumption?

Stay tuned.

-----

Author: Xander Kameny, Operations Consultant at Riverwood Solutions.

© Riverwood Solutions

The Future

Many would agree that the sole presence of EMS industry giant Foxconn in a new area is sufficient catalyst to start the process of the development of a whole new cluster. As the world’s largest EMS provider and with factories of enormous scale (its Zhengzhou plant has 200,000 workers), Foxconn is one of the pioneers alluded to above whose new investment locations draw waves of new suppliers – Foxconn gets that snowball rolling and with it the capabilities of a new cluster grow exponentially.

For the purpose of this investigation we have focused on what factors influence the pioneers in China.

In the next article in this series we focus on the future and new trends in cluster development: Will pioneers focus their resources on existing clusters or move them to new locations? What are the new and potential clusters in other parts of Asia? Is there truly a migration in China from the coast to the interior, or is there a migration from China to other Asian locations in search of lower labor costs? Will China’s electronics manufacturing industry become dominated by domestic consumption?

Stay tuned.

-----

Author: Xander Kameny, Operations Consultant at Riverwood Solutions.

© Riverwood Solutions

The lower right quadrant represents conditions ripe for cluster development. Not surprisingly, the developing clusters in Sichuan, Chongqing and Henan fall in or near this quadrant. The clusters of the Pearl River Delta and eastern Jiangsu lie in the mature category, with their rising wages and tightening labor supply.

Provinces in the lower left quadrant, despite their low wages, lack the scale of worker availability and perhaps logistics and infrastructure development to spark an EMS cluster, which when fully developed can employ millions of workers.

Location, Logistics and Infrastructure

Clearly logistics and transportation are important to the manufacturing location decision.

Traditionally, most electronics products manufactured in China had to be transported to the ocean for export, necessitating a system of decent roads or railways. Until logistics costs fall to a certain level relative to other factors such as labor costs, relocating or expanding production to new areas is not economically viable.

Infrastructure development is largely driven by the government and areas experiencing such development indicate possible government intervention, i.e. investment incentives. Using roads as a proxy for infrastructure development, we gain better insight in to trends of clusters develop.

The below chart illustrates Expressway and Highway Class I-IV density and growth by province. As expected, the developed cluster areas of Jiangsu and Guangdong show more advanced infrastructure development. Sichuan, while relatively undeveloped, experienced rapid infrastructure growth in the last five years, hinting to the Chinese government’s focus on it as a center of manufacturing for tablets in Chengdu and laptops in Chongqing - take Foxconn and Cisco - both leading growth in these areas.

Zhengzhou, Henan, home to a large Foxconn Apple product operation since 2010, lands in the developed infrastructure category. Industry sources report that Foxconn chose this location partially in anticipation of a rapid manufacturing ramp-up due to release of new Apple products. Given Henan’s existing infrastructure, low wages and labor availability, the choice seems logical.

© Riverwood Solutions

The lower right quadrant represents conditions ripe for cluster development. Not surprisingly, the developing clusters in Sichuan, Chongqing and Henan fall in or near this quadrant. The clusters of the Pearl River Delta and eastern Jiangsu lie in the mature category, with their rising wages and tightening labor supply.

Provinces in the lower left quadrant, despite their low wages, lack the scale of worker availability and perhaps logistics and infrastructure development to spark an EMS cluster, which when fully developed can employ millions of workers.

Location, Logistics and Infrastructure

Clearly logistics and transportation are important to the manufacturing location decision.

Traditionally, most electronics products manufactured in China had to be transported to the ocean for export, necessitating a system of decent roads or railways. Until logistics costs fall to a certain level relative to other factors such as labor costs, relocating or expanding production to new areas is not economically viable.

Infrastructure development is largely driven by the government and areas experiencing such development indicate possible government intervention, i.e. investment incentives. Using roads as a proxy for infrastructure development, we gain better insight in to trends of clusters develop.

The below chart illustrates Expressway and Highway Class I-IV density and growth by province. As expected, the developed cluster areas of Jiangsu and Guangdong show more advanced infrastructure development. Sichuan, while relatively undeveloped, experienced rapid infrastructure growth in the last five years, hinting to the Chinese government’s focus on it as a center of manufacturing for tablets in Chengdu and laptops in Chongqing - take Foxconn and Cisco - both leading growth in these areas.

Zhengzhou, Henan, home to a large Foxconn Apple product operation since 2010, lands in the developed infrastructure category. Industry sources report that Foxconn chose this location partially in anticipation of a rapid manufacturing ramp-up due to release of new Apple products. Given Henan’s existing infrastructure, low wages and labor availability, the choice seems logical.

© Riverwood Solutions

Electronics for China's Consumers

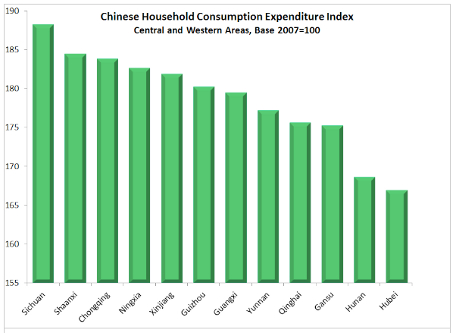

In addition to infrastructure development, proximity to markets also affects logistics costs. The traditional pattern of electronics manufacturing for export is slowly being displaced by an increasing focus on manufacturing for domestic consumption. Chinese consumption in the interior of China is rising rapidly, along with that of the developed coastal regions.

Transit times and costs from interiorly located Sichuan are significantly lower to many internal markets in China when compared with those from coastal locations. According to industry insiders, Foxconn established laptop manufacturing in Chongqing for domestic consumption after being convinced to do so by HP.

Furthermore, plans for a railway line from Chongqing that could supply Western Europe allegedly helped spur an agreement earlier this year for additional cooperation between HP and Foxconn to manufacture printers in Chongqing.

© Riverwood Solutions

Electronics for China's Consumers

In addition to infrastructure development, proximity to markets also affects logistics costs. The traditional pattern of electronics manufacturing for export is slowly being displaced by an increasing focus on manufacturing for domestic consumption. Chinese consumption in the interior of China is rising rapidly, along with that of the developed coastal regions.

Transit times and costs from interiorly located Sichuan are significantly lower to many internal markets in China when compared with those from coastal locations. According to industry insiders, Foxconn established laptop manufacturing in Chongqing for domestic consumption after being convinced to do so by HP.

Furthermore, plans for a railway line from Chongqing that could supply Western Europe allegedly helped spur an agreement earlier this year for additional cooperation between HP and Foxconn to manufacture printers in Chongqing.

© Riverwood Solutions

The Future

Many would agree that the sole presence of EMS industry giant Foxconn in a new area is sufficient catalyst to start the process of the development of a whole new cluster. As the world’s largest EMS provider and with factories of enormous scale (its Zhengzhou plant has 200,000 workers), Foxconn is one of the pioneers alluded to above whose new investment locations draw waves of new suppliers – Foxconn gets that snowball rolling and with it the capabilities of a new cluster grow exponentially.

For the purpose of this investigation we have focused on what factors influence the pioneers in China.

In the next article in this series we focus on the future and new trends in cluster development: Will pioneers focus their resources on existing clusters or move them to new locations? What are the new and potential clusters in other parts of Asia? Is there truly a migration in China from the coast to the interior, or is there a migration from China to other Asian locations in search of lower labor costs? Will China’s electronics manufacturing industry become dominated by domestic consumption?

Stay tuned.

-----

Author: Xander Kameny, Operations Consultant at Riverwood Solutions.

© Riverwood Solutions

The Future

Many would agree that the sole presence of EMS industry giant Foxconn in a new area is sufficient catalyst to start the process of the development of a whole new cluster. As the world’s largest EMS provider and with factories of enormous scale (its Zhengzhou plant has 200,000 workers), Foxconn is one of the pioneers alluded to above whose new investment locations draw waves of new suppliers – Foxconn gets that snowball rolling and with it the capabilities of a new cluster grow exponentially.

For the purpose of this investigation we have focused on what factors influence the pioneers in China.

In the next article in this series we focus on the future and new trends in cluster development: Will pioneers focus their resources on existing clusters or move them to new locations? What are the new and potential clusters in other parts of Asia? Is there truly a migration in China from the coast to the interior, or is there a migration from China to other Asian locations in search of lower labor costs? Will China’s electronics manufacturing industry become dominated by domestic consumption?

Stay tuned.

-----

Author: Xander Kameny, Operations Consultant at Riverwood Solutions.