Nvidia sees strong cloud AI demand, but challenges in China

Nvidia's most recent FY3Q24 financial reports reveal record-high revenue coming from its data centre segment, driven by escalating demand for AI servers from major North American CSPs. However, TrendForce points out that recent US government sanctions targeting China have impacted Nvidia's business in the region.

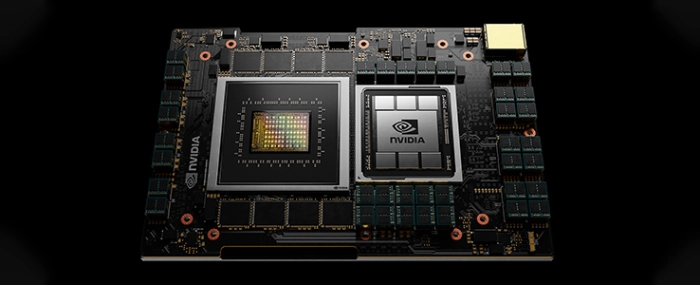

Despite strong shipments of Nvidia's high-end GPUs—and the rapid introduction of compliant products such as the H20, L20, and L2—Chinese cloud operators are still in the testing phase, making substantial revenue contributions to Nvidia unlikely in Q4. Gradual shipments increases are expected from the first quarter of 2024.

However, US sanctions continue to influence China’s foundry market as Chinese CSPs’ high-end AI server shipments potentially drop below 4% next year.

TrendForce reports that North American CSPs like Microsoft, Google, and AWS will remain key drivers of high-end AI servers (including those with Nvidia, AMD, or other high-end ASIC chips) from 2023 to 2024. Their estimated shipments are expected to be 24%, 18.6%, and 16.3%, respectively, for 2024. Chinese CSPs such as ByteDance, Baidu, Alibaba, and Tencent (BBAT) are projected to have a combined shipment share of approximately 6.3% in 2023. However, this could decrease to less than 4% in 2024, considering the current and potential future impacts of the ban.

China to expand investment in proprietary ASICs and develop general-purpose AI chips

Facing the risk of expanded restrictions arising from the US ban, TrendForce believes Chinese companies will continue to buy existing AI chips in the short term. Nvidia's GPU AI accelerator chips remain a top priority – including existing A800 or H800 inventories and new models like H20, L20, and L2 – designed specifically for the Chinese market following the ban. In the long term, Chinese CSPs are expected to accelerate, with Alibaba’s T-Head and Baidu being particularly active in this area, relying on foundries like TSMC and Samsung for production.

At the same time, major Chinese AI firms, such as Huawei and Biren, will continue to develop general-purpose AI chips to provide AI solutions for local businesses. Beyond developing AI chips, these companies aim to establish a domestic AI server ecosystem in China. TrendForce recognises that a key factor in achieving success will come from the support of the Chinese government through localised projects, such as those involving Chinese telecom operators, which encourage the adoption of domestic AI chips.

Edge AI servers: A potential opportunity for Chinese firms amid high-end AI chip development constraints

A notable challenge in developing high-end chips in China is the limited access to advanced manufacturing technology. This is particularly true for Huawei, which remains on the US Entity List and relies on domestic foundries like SMIC for production. Despite SMIC’s advancements, it faces similar issues created by the US ban—including difficulties in obtaining key advanced manufacturing equipment and potential yield issues. TrendForce believes that in trying to overcome these limitations, China may find opportunities in the mid to low-range edge AI server market. These servers, with lower AI computational demands, cater to applications like commercial ChatBOTs, video streaming, internet platforms, and automotive assistance systems. They might not be fully covered by US restrictions, presenting a possible growth direction for Chinese firms in the AI market.

For more information visit TrendForce.