A perfect storm slams the memory markets

Early in 2022, the near-term prospects for the memory markets, including both DRAM and NAND, were decidedly bright, despite the backdrop of tenuous geopolitical dynamics with the conflict in Ukraine and worsening China/US relations.

In the final weeks of Q2 2022, however, circumstances quickly began to change, and the hopes of banner years for the memory markets were dashed. A perfect storm of demand-side developments crashed into the memory markets, and not even the most rational production plans for 2022 could withstand the onslaught of bad news.

What went wrong?

There were, broadly speaking, three developments that began in the second quarter that brought about an abrupt change in near-term prospects for the memory markets, Firstly, the rapid deterioration in market sentiment; China’s persistent adherence to its “Zero COVID” policy also played its part; and thirdly, the further delay of Intel’s Sapphire Rapids server products.

What can suppliers do?

When the market is oversupplied, suppliers have only a few options available to them to help restore balance. They can reduce investments and thereby lower future production growth, build inventory and thereby limit the amount of memory entering the market, and idle capacity, reducing supply in the near term and counteracting ballooning inventories.

The uncertainties put memory makers in a challenging position. They are unable to look to 2023 and feel confident about demand. As such, they are unwilling to build inventory sufficiently high to stave off the precipitous pricing declines that have occurred over the last few months. Instead, memory makers, like their customers, are paying close attention to their own balance sheets and are reluctant to let inventory pile up.

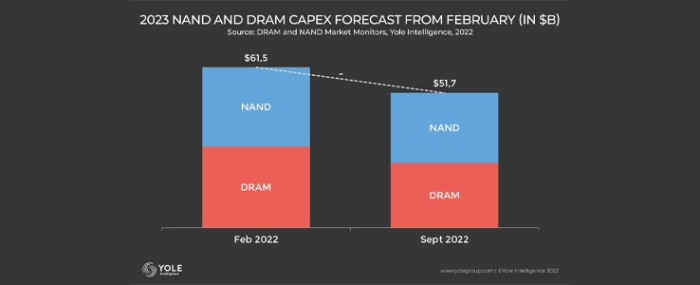

The next several quarters (or perhaps years) promise to be turbulent economic times and difficult waters for memory suppliers to navigate. Poor visibility of actual demand and little confidence about near-term forecasts have caused all memory suppliers to slash spending and move to a very conservative bias.

The complete article can be found on Yolé Group's website.