Global notebook shipments drops to 195 million units in 2022

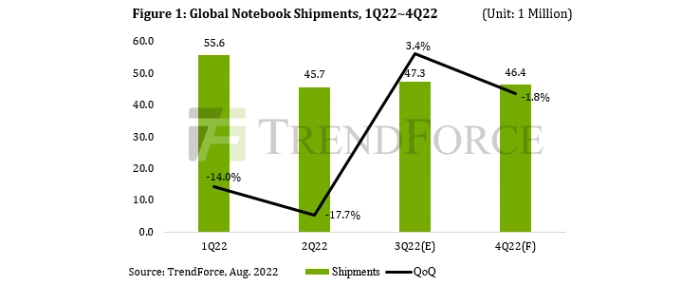

According to TrendForce research, global notebook shipments reached 45.74 million units in 2Q22, down 17.7% QoQ and 24.5% YoY, setting a single-quarter post-COVID19 outbreak low. In addition to the end of pandemic proceeds, Chromebook's educational outlook is no longer rosy.

Consumer demand has also been greatly reduced due to rising inflation in Europe and the United States and festering geopolitical issues. At the same time, repeated lockdown measures in Eastern China have not only seriously impacted the stability of the notebook supply chain, but also the huge Chinese consumer market as well as all three major world economies. Even though commercial demand in 1H22 seemed to have been backstopped by the return to the office, U.S. interest rate hikes, rising inflation and high inventory, and narrowing corporate profits and even losses have led to a reduction of capital expenditures and recession. The total number of notebook computers shipped worldwide in 1H22 was 100 million units, an annual decline of 14.7%. The forecast for notebook shipments for the entirety of 2022 is revised down to 195 million units.

Looking at notebook market trends in 3Q22, companies in various countries are not only facing declining revenue but a vicious circle brought about by a collapse of the overall economy. In addition, the frequency of interest rate hikes by central banks in various countries have also significantly increased the cost of running companies and they can only turn to reducing expenditures. As a result, commercial momentum has fallen and the effect of canceled orders has spread from downstream channels to ODMs, in turn impacting demand in the notebook market. With weak market conditions in the three major categories of business, consumer, and education, the traditional peak season 2H22 will be nonexistent. Global shipments of notebook computers in 2H22 is only estimated at 93.7 million units, a decrease of 7.5% compared with 1H22 and a decline of 26.4% YoY.

According to TrendForce, the notebook industry experienced a significant correction this year. In addition to the impact of the overall environment on terminal demand, previous orders had been repeatedly placed due to logistical constraints, material mismatch issues, and optimistic customer prospects, resulting in continued deterioration of the overall supply chain inventory problem. Notebook brands will prioritize destocking in 2H22 which will suppress purchasing momentum towards ODMs.

For more information visit TrendForce