© FBDi

Components |

German components distribution experiences massive surge in demand

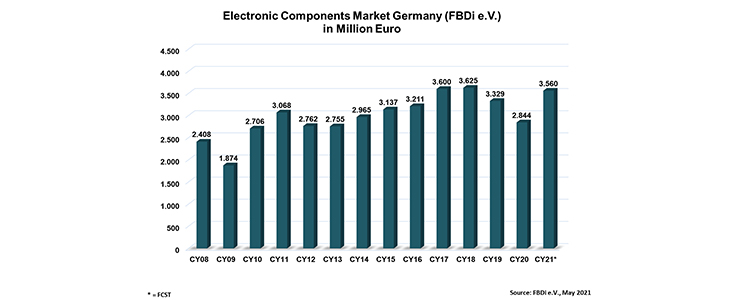

German components distribution (according to FBDi e.V.) records almost 50% increase in order intake in the first quarter of 2021. Sales still slightly down at -6.1%. Components shortage prevents better result.

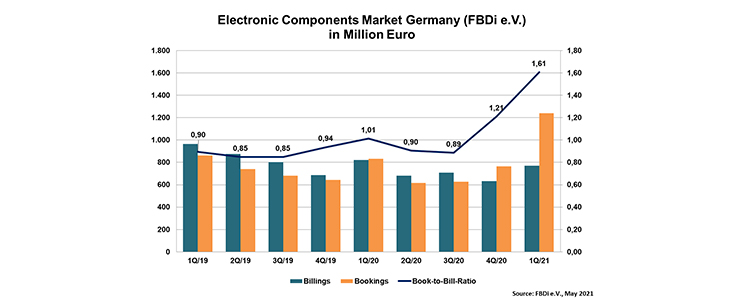

Sales in the European and German components distribution market is still decreasing compared to the pre-Corona quarter Q1/20, but as in the last quarter, order intake went through the roof in Q1/21. After 23% in the previous quarter, customer bookings went up by 48.8%, signifying a new all-time high of EUR 1.24 billion. Sales were slightly below expectations at EUR 771 million (-6.1%), held back by the lack of components availability. At 1.61, Q1 showed the highest book-to-bill rate ever registered at FBDi.

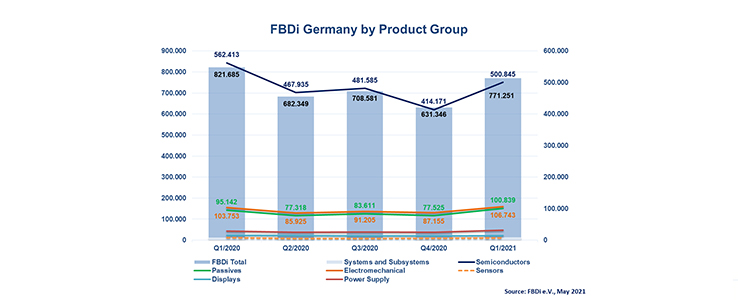

At product level, passive components, which were hit hardest in 2020, increased significantly by 6% to EUR 101 million of sales. Semiconductors saw a disproportionate decline in some product areas, resulting in an overall minus of -11% and sales of EUR 501 million. Revenue with electromechanics were 2.9% higher (EUR 107 million). Power supplies (+8.7% to EUR 32 million) and assemblies (10.4% to just under EUR 10 million) grew comparatively strongly. Displays and sensors remained in the red, as did semiconductors. Thus, at least for the first quarter, there was a slight shift in shares: semiconductors now account for "only" 65% of the cake, passives 13%, electromechanics 14% and power supplies 4%.

Georg Steinberger, FBDi Chairman of the board: "Sales development in the semiconductor sector is somewhat disappointing, but in view of a 52% increase in orders to almost 900 million Euros, a rather interesting 2021 is probably ahead, characterized by massive shortages and already foreseeable price increases by the manufacturers. It won't be much different for the other components."

Furthermore, the FBDi considers the general discussion about Europe's future role in the high-tech world with mixed feelings. Steinberger: "When billions of taxpayers' money are thrown around for a race to catch up with China, the USA or other countries, one should always ask oneself whether the money is being used correctly. As desirable as a highly subsidized 2-nm semiconductor factory may be for some politicians or large companies, the question arises as how it will benefit the small and medium-sized businesses that shape German and European industry and are defined by lower volume and higher complexity, when it comes to components consumption. From an employment perspective, industrial electronics (encompassing a huge variety of sectors such as automation, medical, energy etc.) are at least as systemically important as the automotive industry. Triple-digit billions must also be amortized, but where are the mass-market applications for this in Europe?"