© yole developpement

Components |

2Q/2019: Memory business is approaching bottom

“Combined DRAM and NAND revenue was USD 25.4 billion in 2Q/2019, down 5% from Q1 and down 39% year-over-year as sluggish demand and elevated inventory levels continued to plague the memory markets”, says Simone Bertolazzi, Memory Technology & Market Analyst at Yole Développement.

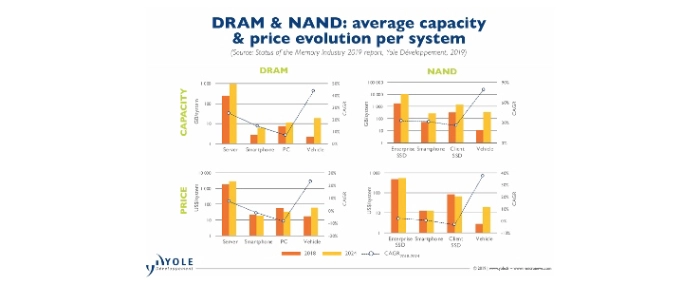

Megatrends are of course still present in this competitive landscape. The automotive sector is for example playing a key role. Even if the automotive memory business was still a relatively small market segment with less than 3% of the overall stand-alone memory market in 2018, companies are seriously considering investments and developments in this industry sector. Therefore, driven by important technology trends, automotive is expected to be the fastest growing memory-market segment over the next 5 years. Some memory analysts announce more than 20% CAGR between 2018 and 2024.

Autonomous vehicles are radically changing the memory requirements. By 2024, the average NAND content in cars is expected to increase dramatically, exceeding 300 GB/vehicle. Yole forecasts an impressive 79% CAGR between 2018 and 2024. Over the same period, DRAM should reach a 42% CAGR from 3.2GB per vehicle today to nearly 20GB per vehicle.

NAND market: the worst will soon be behind you

“NAND market conditions remained soft in 2Q/2019, with seasonally weak demand and abnormally high inventories keeping the pricing environment under downward pressure”, announces Walt Coon, VP of NAND and Memory Research and part of the Semiconductor & Software division at Yole.

Quarterly revenue stood at USD 10.1 billion in 2Q/2019, down slightly from Q1-19 and down 35% year-over-year. Blended NAND prices fell 13% from Q1-19, the sixth consecutive quarter of sequential price declines. Bit shipments were up 14% in the quarter.

NAND revenue-based market share rankings changed slightly in Q2 2019:

- Samsung increased its market share leadership position to 37% of the total revenue, up 5 points from Q1 2019

- Toshiba Memory held the second position with 19% of total revenue, followed by Western Digital at 14%

- SK hynix market share was 11%, overtaking Micron at 10% for the 3rd position; Micron at 10% for the 4th position