© ic insights

Analysis |

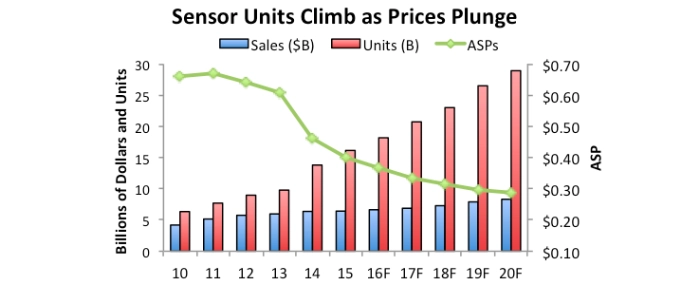

Sensor sales keep hitting new records but price erosion curbs growth

Double-digit unit shipment increases continue with demand being strong for low-cost sensors in wearable systems, Internet of Things, and automated embedded control.

Despite strong double-digit percentage increases in annual unit shipments, semiconductor sensor sales growth has become uncharacteristically lethargic because of steep price erosion in several major product categories. Strong unit demand is being fueled by new wearable systems, greater automation in vehicles, and the much-anticipated Internet of Things (IoT), but sharply falling average selling prices (ASPs) on accelerometers, gyroscope chips, and magnetic-field measuring devices are capping annual growth of total sensor revenues in the low- to mid-single digit range, based on data in IC Insights’ 2016 O-S-D Report—A Market Analysis and Forecast for Optoelectronics, Sensors/Actuators, and Discretes.

The 2016 O-S-D Report shows worldwide dollar-volume revenues for sensors rising by a compound annual growth rate (CAGR) of 5.3 percent between 2015 and 2020 compared to an 8.9 percent annual rate in the last five years. In contrast, total sensor unit shipments are expected to climb by a CAGR of 12.4 percent in the five-year forecast period compared to a blistering 20.5 percent rate of increase in the 2010-2015 period, when new sensing, navigation, and automated embedded control functions in smartphones drove up strong growth along with steady increases in automotive and industrial applications.

Despite recent years of weak sales growth—just one percent in 2015 to USD 6.4 billion—the sensor market is expected to end this decade with 10 consecutive years of record-high revenues and reach USD 8.3 billion in 2020. Unit shipments of sensors have reached record high levels each year since the beginning of the last decade—even in the 2009 downturn year, when worldwide unit volume grew 9 percent while sensor revenues dropped 3 percent. Record sensor shipments are expected to continue for another five years, reaching 28.9 billion units in 2020.

Competition between suppliers and requirements for low-cost sensors in new high-volume applications drove down ASPs from about USD 0.66 in 2010 to USD 0.40 in 2015. The need to squeeze more sensing solutions into wearable systems, far-flung IoT-connected applications, and multi-sensor packages for increased accuracy and multi-dimensional measurements is exerting more pricing pressure in the market. The report’s forecast shows sensor ASPs dropping by a CAGR of 6.3 percent in the next five years to only USD 0.29.

Total sensor sales are expected to grow by about 3 percent in 2016 to USD 6.6 billion with worldwide shipments rising 13 percent to nearly 18.2 billion units this year. Sales of sensors made with microelectromechanical systems (MEMS) technology (i.e., accelerometers, gyroscope devices, and pressure sensors, including microphone chips)—are expected to grow by four percent in 2016 to USD 4.8 billion with unit shipments increasing ten percent to 7.6 billion. IC Insights projects MEMS-based sensor sales rising by a CAGR of 5.5 percent in the next five years to USD 6.1 billion in 2020 with unit shipments growing by an annual rate of 11.9 percent to nearly 13.4 billion. ASPs for MEMS-based sensors are expected to decline by a CAGR of -5.7 percent to USD 0.45 in 2020 (from USD 0.61 in 2015).