© grzegorz wolczyk dreamstime.com

Analysis |

Chinese IC companies held only 3% of total IC sales in 2015

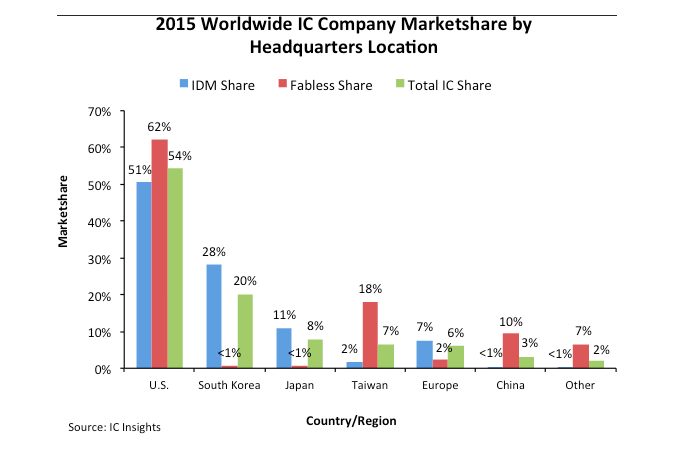

U.S. companies held a 54 percent share of the total worldwide IC market in 2015, which includes sales from IDMs and fabless IC companies. The total does not include foundry sales.

South Korean companies captured a 20 percent share of total IC sales and Japanese companies placed third with only an 8 percent share. Chinese companies accounted for just 3 percent of total IC sales last year.

The Taiwanese companies, on the strength of their fabless company IC sales, first surpassed the European companies in total IC sales share in 2013. However, although the European companies had about USD 1.4 billion less in total IC sales as compared to the Taiwanese companies last year, the European companies could surpass the Taiwanese companies in IC sales this year as Europe-headquartered NXP absorbs Freescale’s USD 3.7 billion in IC sales as a result of their merger in December 2015.

As depicted in Figure 1, the South Korean and Japanese companies are extremely weak in the fabless IC segment with the Taiwanese and Chinese companies displaying a noticeable lack of presence in the IDM (i.e., companies with IC fabrication facilities) portion of the IC market. Overall, U.S.-headquartered companies show the most balance with regard to IDM, fabless, and total IC industry marketshare.

© IC Insights

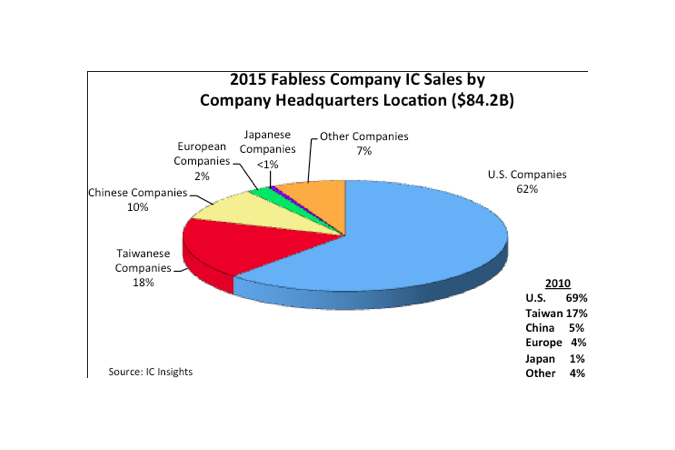

Figure 2 depicts the 2015 fabless company share of IC sales by company headquarters location. As shown, at 62 percent, the U.S. companies held the dominant share of fabless IC sales last year, although this share was down from 69 percent in 2010. Since 2010, the largest increase in fabless IC marketshare has come from the Chinese suppliers, which held a 10 percent share last year as compared to only 5 percent in 2010.

In contrast to the situation in the IDM segment, in which the European companies are expected to gain marketshare through acquisitions, the European fabless IC companies lost marketshare in 2015. The reason for this loss was the acquisition of U.K.-based CSR, the second largest European fabless IC supplier, by U.S.-based Qualcomm and the purchase of Germany-based Lantiq, the third largest European fabless IC supplier, by U.S.-based Intel in early 2015. These acquisitions left Dialog as the only Europe-headquartered fabless IC supplier in the top 50-company ranking and subtracted about USD 1.2 billion from the total European-headquartered fabless IC sales total, dropping their share to only 2 percent last year.