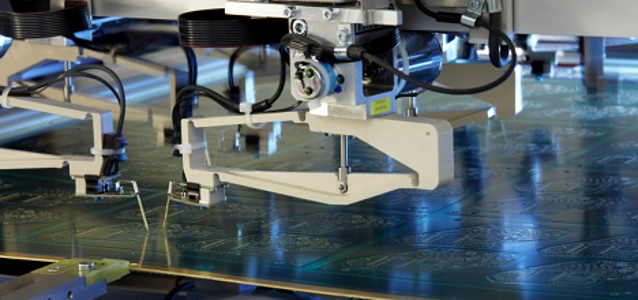

© Aspocomp

PCB |

Aspocomp: 2012 started reasonably well

Aspocomp CEO says the company's first quarter went reasonably well despite an unstable market.

Key figures 1-3/2012 in brief

- Net sales: EUR 6.4 million (EUR 4.9 million 1-3/2011)

- Operating result before depreciation (EBITDA): EUR 0.8 million (0.8)

- Operating profit (EBIT): EUR 0.4 million (0.4)

CEO Sami Holopainen commented:

“Year 2012 started reasonably well for Aspocomp in spite of the unstable market. Net sales grew to EUR 6.4 million following the acquisition of the Teuva plant, but profitability fell short of our target. Operating profit amounted to EUR 0.4 million, about seven percent of net sales.

Operational cash flow was slightly in the black. The acquisition of the Teuva plant increased tied-up working capital, thereby weakening cash flow. The effect of the acquisition is non-recurring and only impacts on the first quarter of the present year. In operational terms, the integration of Teuva into Aspocomp has proceeded according to plans".

Although the near-term market outlook remains murky, seasonal demand for quick-turn deliveries is expected to pick up. Our full-year outlook remains unchanged: we expect that net sales will rise clearly and that the operating result will be at a good level with respect to the industry sector, but to fall significantly short of 2011.”

Outlook

The company estimated that net sales will rise substantially in 2012 due to the acquisition of the business operations of Teuva, Finland. "The operating profit is expected to be at a good level with respect to the industry sector, but to fall significantly short of 2011," said a statement by the company.